Bay Capital has been set up by two highly experienced small company directors and they were both involved in building up AIM-quoted aggregates business Breedon Group (LON:BREE). Bay Capital chairman Peter Tom was executive chairman when Breedon floated as AIM shell Marwyn Materials in 2008 and he stepped down in 2019. Prior to that he was boss of Aggregate Industries.

The other Bay Capital director David Williams was a founder of Marwyn Capital and also an early director of Marwyn Materials/ Breedon. He is a director of cyber security company Shearwater Group (LON: SWG), as well as Acceler8 Ve...

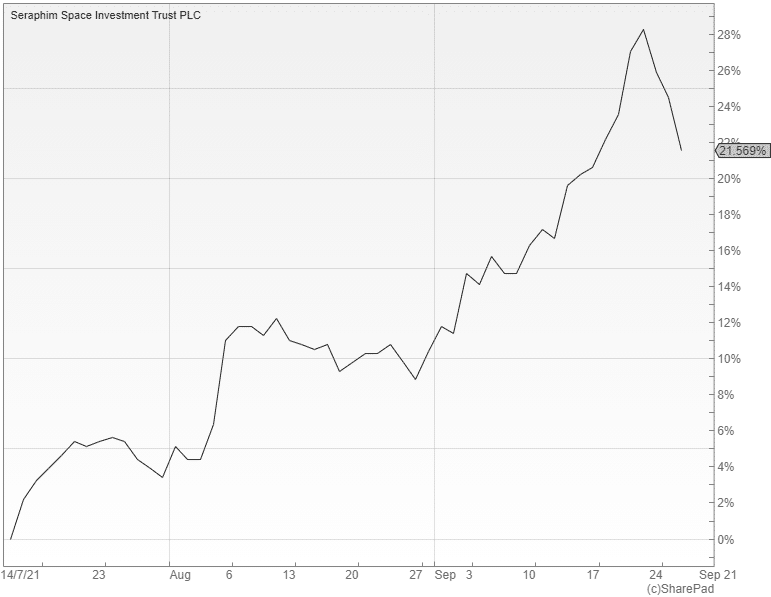

Lift-off for the first ‘space tech’ investment trust

The launch of the new vehicle in July marked the start of a new type of space race.

The Seraphim Space Investment Trust (LON: SSIT) invests in a portfolio of early and growth stage private space tech businesses. According to Morgan Stanley, this new and fast growing sector could be generating more than $1.1 trillion in annual revenue by 2040.

Demand for the new shares was so high that the applications had to be scaled back with the IPO raising £150m of fresh capital. There was also a further £28.4m invested via direct subscriptions in connection with the acquisition of the initial seed portfolio.

This consisted of stakes in 15 unlisted companies held in the Seraphim Space Fund. These included businesses such as: LeoLabs, which provides a visualisation of objects in low Earth orbit; AST SpaceMobile that fills in the gaps for existing mobile phone networks; and Altitude Angel, an aviation company that develops unmanned aircraft.

Four other stakes in unlisted companies worth around £70m were also due to be acquired from the same source by the end of the year. This process is now well underway with the investments in Spire Global, a pioneer of the nanosatellite market, and quantum encryption specialist Arqit now complete.

Once fully invested the new vehicle is expected to have a portfolio of 20-50 holdings spread across the US, UK and Europe. It will target NAV total returns of at least 20% per annum over the long-term.

Manager Seraphim Space has been operating in this area since 2016. It’s Seraphim Space Fund, the world’s first venture capital fund focused on new space technologies, is currently demonstrating an internal rate of return of 31%.

There is no doubt that the types of unlisted businesses that the investment trust is targeting have a lot of potential, but with such a concentrated portfolio the performance will depend entirely on whether the managers can identify which companies will go on and succeed.

Seraphim is currently trading on a massive estimated 28% premium to NAV, whereas many well-diversified global private equity investment trusts are available on wide double digit discounts and offer far better value.

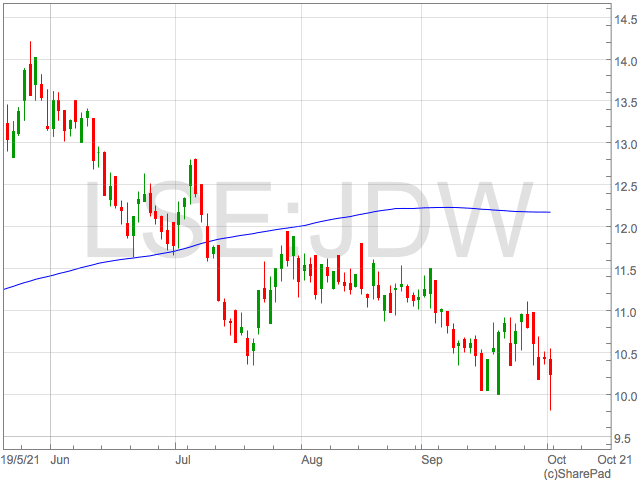

J D Wetherspoon pours record loss on investors

Pub group J D Wetherspoon posted a record loss on Friday as the impact of the pandemic sent revenue spiralling and operating profits down 274%.

Revenue declined from £1,262m in 2020 to £772.6m in 2021.

“How much sympathy Wetherspoons will get for its complaints about the backdrop for the pubs industry is open to question as it serves up a set of results which look so unappetising most investors would probably want to send them back to the kitchen,’ said Russ Mould of AJ Bell.

Coronavirus meant Wetherspoons had to close their pubs for a large proportion of 2021FY and offer a limited service for most of the remainder of the year.

Tim Martin, the Chairman of J D Wetherspoon plc, said:

“Like-for-like sales in the first nine weeks of the current financial year were 8.7% lower than the same weeks in August and September 2019, before the pandemic started. In the last four weeks of the period, like-for-like sales were minus 6.4%.

“Excluding airport pubs, where like-for-like sales declined by 47.3%, like-for-like sales declined by 7.1% in the first nine weeks, and by 4.9% in the last four.

“Total employee numbers averaged 39,025 in the financial year, which increased to 42,003 for the week ending 20 September 2021.

“On average, Wetherspoon has received a reasonable number of applications for vacancies, as indicated by the increase in employee numbers, but some areas of the country, especially “staycation” areas in the West Country and elsewhere, have found it hard to attract staff.”

Martin went on to outline the severe impact the pandemic had on the business:

“During the pandemic, the pressure on pub managers and staff has been particularly acute, with a number of nationwide and regional pub closures and reopenings, often with very little warning, each of which resulted in different regulations.

“In the last year, the country moved, in succession, from lockdown, to ‘Eat Out to Help Out’, to curfews, to firebreaks, to pints with a substantial meal only, to different tier systems and to further lockdowns.

“Pub management teams, and indeed the entire hospitality industry, had an almost impossible burden in trying to communicate often conflicting and arbitrary rules to customers.

“One of the most surprising statistics has been the apparent low level of transmission of the virus in pubs.”

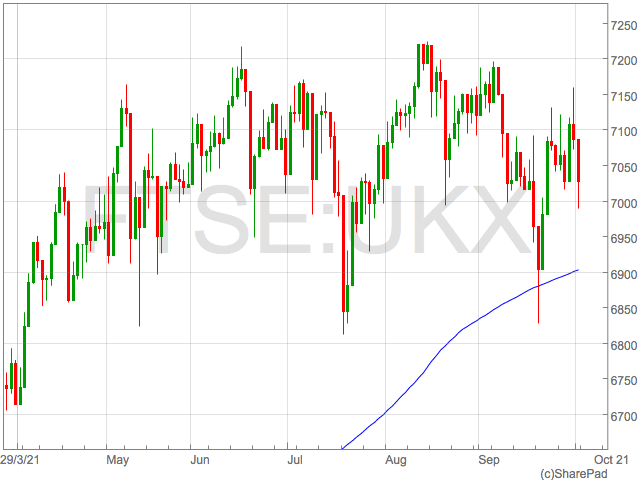

FTSE 100 sinks as business confidence collapses

The FTSE 100 starting the week on the back foot as poor Asian data sapped optimism from the market.

“On Friday they fell off the wire as the FTSE 100 started October down more than 1%. This followed a weak session on Wall Street overnight and new factory data from Asia which only added to concern that economic growth is slowing,” said AJ Bell investment director Russ Mould.

The FTSE 100 was trading at 7,028, down 0.58% in mid morning trade of Friday.

Business Confidence drops

Business confidence in the UK added to the dour mood on Friday as the fuel crisis destroyed confidence and the fear of stagflation began to become visible in market participants,

“In the UK there has been an alarming drop in business confidence in the space of a month with the optimism engendered by the vaccine roll-out feeling like a distant memory amid a fuel, supply chain and cost of living crisis,’ Mould said.

“Markets must hope that the current shortage of everything from energy and skilled staff to shipping containers and raw materials eases before stagflation becomes too entrenched and/or central banks are forced into drastic action to tackle rising prices.”

FTSE 100 Top Risers and Fallers

Lloyds share were the top faller early on Friday as investors dumped shares in the lender which is closely aligned to the strength of the UK economy.

Evraz and Hikma accelerated losses through the session and were down 4% and 3.3% respectively.

JD Sports felt the heat of potential stagflation eroding consumer spending power and were over 2% weaker.

Travel shares gained later in the session as they rebounded from recent losses. IAG was the top riser going into the close on Friday, up 4.5%. InterContinental Hotels was up 3.5%.

Two selections for the French economic recovery

As is evident in other Western European countries, the recovery in France is being driven by the consumer and the reopening of the hospitality industry and retail.

The French unemployment rate fell to 8% in the second quarter and judging by the number of people in Parisian bars and shops lining the Avenue des Champs-Élysées, this is likely to fall again through the rest of 2021.

Indeed, ING highlighted that one of the main issues impacting the French recovery is the lack of labour.

These selection focusing on growth in France take into consideration the consumer driven recovery from COVID-19, but also the wider implications of easy monetary policy.

The ECB are debating how, and more importantly when, to ease monetary policy and their choice of path forward will have a significant impact on French equities.

iShares MSCI France UCITS ETF

The first selection is a broad product in the MSCI France UCITS ETF that tracks French Large and Mid-Cap Equities.

The composition of the index plays nicely into the key themes we see driving the French economy higher in the consumer recovery and ongoing financial conditions.

The two top holdings in the ETF are LVMH and L’Oréal. Both are global companies that provide exposure to the French economy and risk appetite for European equities, but the global recovery.

Booming sales in the luxury sector make LVMH a particularly attractive prospect given the group recorded revenue of 28.7 billion euros in the first half of 2021, up 56% compared to the same period a year prior.

L’Oréal much the same saw a jump in revenue to the tune of 20.7% (LFL) driving a 21% increase in Earnings Per Share.

In addition to the draw of the top two constituents of the index, the ETF provides investors with holdings benefiting from the French economy.

The bank BNP Paribas, a facilitator and beneficiary of the growing French economy accounts for 3.7% of the index posted a 26% jump in Net Income in the second quarter.

Carrefour

Carrefour shares have dipped since the failed merger with Canadian Alimentation Couche-Tard Inc and the weakness raises eyes brows with shares changing hands under 16 Euros. The proposed merger was at 20 Euros.

The fierce fight over Morrison’s highlights the interest for Europe’s best supermarket brands and it’s likely interest could once more ignite in Carrefour.

Notwithstanding potential M&A activity, the group carved out a 34% EPS increase in the first half driven by strong growth across all geographies.

France, still by far Carrefour’s largest market, saw first half revenue excluding fuel rise by 4.7% (LFL) to €9.65bn.

Latin America was the displayed the strongest growth with a like-for-like 10.5% sales rise to €5.79bn.

With Adjusted Net Income of €337m in the first half, shares are attractively valued.

Assuming we see further growth through the second half, the earnings multiple could be in the range of 16x-18x which is more than reasonable given the dividend yield is 3%.

The company is also pouring over the possibility of disposing of international unit’s including that of Poland, a particularly tough market to crack. Tesco disposed of their Polish unit earlier this year.

Two investment trust bargains

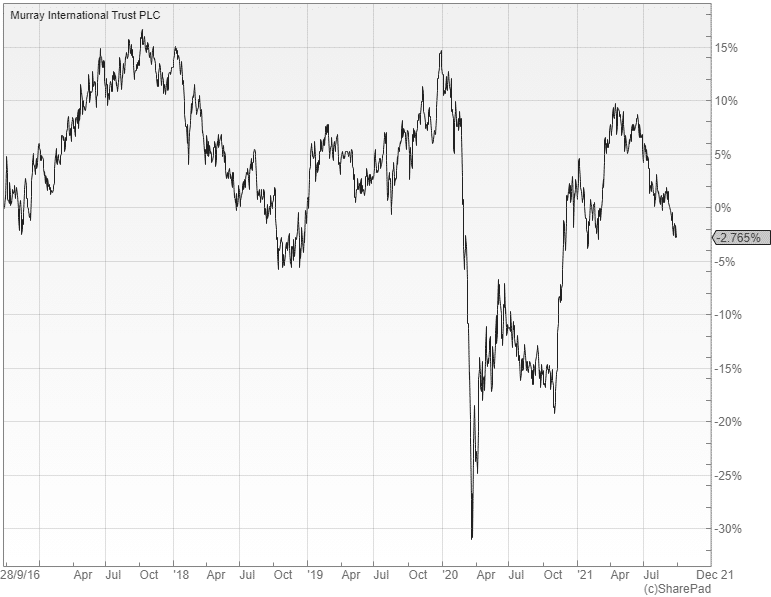

The £1.7bn Murray International (LON: MYI) is a global investment trust that aims to achieve an above average dividend yield, with long-term growth in dividends and capital ahead of inflation. It is currently yielding an attractive five percent with the shares available on a wider than normal discount to NAV of seven percent.

Manager Bruce Stout has been in place since June 2004 and has achieved 16 consecutive years of dividend growth. He has delivered decent overall returns since his appointment, although the relative performance has been disappointing in recent years because of the portfolio’s tilt towards dividend-paying stocks in emerging markets that have been out-of-favour with investors.

Murray International has the highest yield in its Global Equity Income peer group and has substantial revenue reserves that should enable it to continue to increase the dividend in future years. The Board is committed to limiting the discount through the use of share buybacks, so there is real scope for the rating to recover, especially if revenue returns from Asia improve in the coming months.

At £164m, Middlefield Canadian Income (LON: MCT) is a lot smaller, but it is paying a similarly attractive yield of 4.8% with the shares available on a wide 16% discount to NAV. It aims to provide investors with a high level of income, as well as capital growth over the longer-term, from a portfolio of US and Canadian dividend-paying stocks.

Since its inception in July 2006 the fund has generated a NAV total return of 200%, which is well ahead of the increase in the benchmark of 158.7%. Canadian companies currently trade at a discount to their US peers, hence the reason the manager has reduced his US weighting to just eight percent of the portfolio.

The largest sector exposures are financials and real estate that account for a massive 60% of the assets. If inflation takes hold and interest rates are kept low, as looks likely, the fund could do extremely well with the broker Investec having a buy recommendation on it.

Evergrande misses offshore payment again

Investors remain concerned over lack of communication and potential losses

Evergrande has missed paying a bond interest payment again according to two bondholders.

It is the second time the property developer has missed its offshore debt obligations in seven days.

However, the firm did make a partial payment to some of its onshore investors.

The firm, facing the pressure of its more than $300bn debt, was obligated to pay $47.5m in a bond interest payment.

The total amount of the liabilities are the same as 2% of China‘s GDP, as concerns remain over the fallout and its potential impact on the world financial system.

Investors are concerned by Evergrande’s lack of communication as they face the potential of having to take big losses.

“I can’t see there being much willingness to give a fairer outcome to offshore bondholders rather than onshore banks, let alone house buyers and people who have lent onshore through the personal loan structures,” said Alexander Aitken, a partner at Herbert Smith Freehills in Hong Kong.

“Of course legally there is also structural subordination from being offshore, which means lenders to Evergrande’s onshore subsidiaries get paid before lenders to the parent company or any offshore debt issuer.”

What will the end of furlough mean for the UK job market?

Over the past 18 months, as many as 11.6m jobs have at some point been on furlough.

Figures from HMRC revealed that at the end of July 1.6m people were still on furlough.

As of 19 September, the Jobs Recovery Tracker showed there were 1.9m active job adverts in the UK.

Danni Hewson, AJ Bell financial analyst, comments on the end of the Coronavirus Job Retention Scheme:

“There will be plenty of employers hoping that Friday does finally deliver the anticipated flood of labour back into the market but in reality, nobody really knows for sure how many of those listed as still on furlough at last count have been welcomed back into their old jobs.”

“We can surmise that certain sectors like travel won’t be able to keep paying every staff member that’s been kept on the books but now those traffic lights have finally been switched off, even travel will be considering whether winter sun might provide a bonanza.”

Many recovering businesses won’t want to lose skilled workers from the fold and for them the timing of furlough’s end might provide a solution.

“Christmas is rapidly approaching and names like Amazon, John Lewis and Next are already jostling to pull in the temporary staff they’ll need to keep deliveries flowing over the all-important golden quarter.”

“It might not be the solution furloughed staff had been hoping for but taking a cut in hours would at least give them hope that their career path is still heading in the right direction, even if it has to take a little detour. And with sign-on bonuses or perks like free food being dangled like carrots, a cut in hours does open up opportunities at least in the short term.”