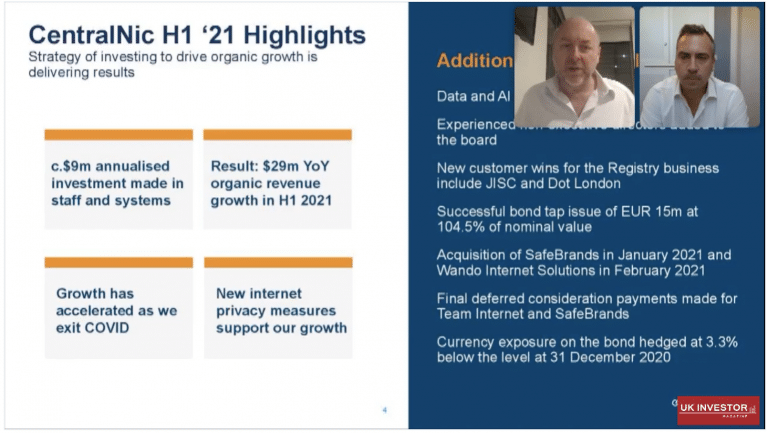

CentralNic (AIM: CNIC) is a London-based AIM-listed company that drives the growth of the global digital economy by developing and managing software platforms allowing businesses globally to buy subscriptions to domain names, used for their own websites and email, as well as for protecting their brands online. Its core growth strategy is identifying and acquiring cash-generative businesses in its industry with annuity revenue streams and exposure to growth markets and migrating them onto the CentralNic software and operating platforms.

Robinhood share price jumps after news of crypto wallet emerges

Robinhood Share Price

The Robinhood share price is up by 6.46% over the past five days as news emerged that the company is testing its own version of a crypto wallet. The move raises some questions over how the Nasdaq-listed company will fare by its move into the crypto space. While the app already allows users to buy and sell crypto, its latest move would enable them to store it all in one place.

The recent spike in its share price comes as welcomed news the Robinhood share price had been trading lower following its Q2 earnings. While the Reddit-induced retail frenzy was pumping up trading levels, the trend appears to have cooled down somewhat. Its pivot to offering crypto wallets could potentially give the company some momentum moving forward.

Crypto Wallet

Robinhood confirmed on Wednesday its intention to test crypto wallets, with a wider roll-out in early 2022. Users will be able to move supported cryptocurrencies in and out of their brokerage accounts.

Customers of Robinhood have demanded that the company provides the service, as crypto transactions exceeded equities for the first time during the last quarter.

“This is the natural next step for us when we think about democratizing finance for all, being able to have a lot more people from a lot of different contexts participate in this emerging market, and wallets are the key,” Aparna Chennapragada, Robinhood’s chief product officer, said in an interview.

The company intends to survey its current crypto-trading customers, around 60% of the app’s 21.3m active users, and pick small group of respondents to begin testing the new wallets and provide feedback, Chennapragada said.

By Robinhood increasing its exposure to crypto, it could also help to reduce risk of its current revenue streams, as other areas of its business have faced question marks recently.

Robinhood said it would receive 0% commissions for crypto trades once the wallets are launched.

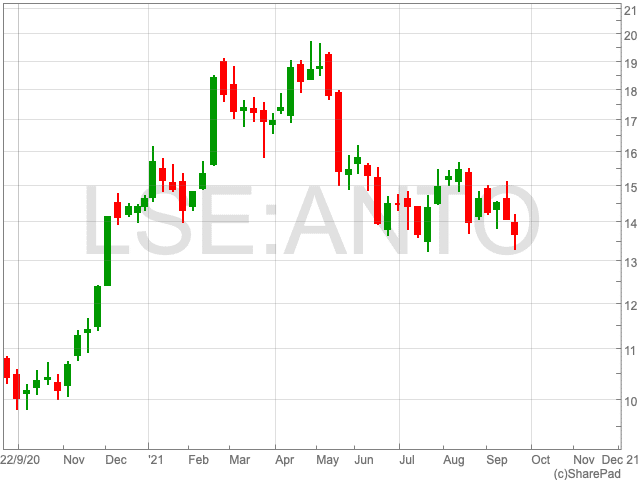

Antofagasta share price: low valuation could help to weather any storms

Antofagasta Share Price

The Antofagasta share price is up by 4.85% on Wednesday as the mining giant enjoyed a bounce back from recent woes on the stock market. Over recent weeks the FTSE 100 company saw its share price dip along with the price of copper and other commodities. The miner saw a resurgence today as there was a glimmer of hope that Evergrande could strike a deal over a bond interest payment that is due.

Year-to-date the Antofagasta share price is down by 7.22%, after it surged in 2020 following the pandemic. Clearly, there is a lot going on, and copper prices can depend on demand in China. This article will take a look at the outlook for Antofagasta heading into the future.

Economic Uncertainty

A key question for the Antofagasta share price is the economic uncertainty that plagues the global economy. The miner’s ability to withstand economic shocks, wherever they may come from, could be vital.

One way to make this judgement is to examine the stock’s value. This can be done by looking at Antofagasta’s earnings yield, which is worked out by dividing its operating profit by its enterprise value. Generally speaking, the higher the Earnings Yield, the more valuable a share.

Antofagasta’s Earnings Yield is currently at 13.9%. This means, compared to the general rule, the company has a low valuation. This could be appealing to investors and reflects well on the company’s ability to withstand difficult economic conditions.

It must be added that while this measure of the FTSE 100 company’s ability to deal with turmoil bodes well, it by no means serves as a guarantee. Furthermore, economic shocks are impossible to predict.

DAX 30 to DAX 40 index: What does it mean for day trading?

Germany’s benchmark stock index the DAX is growing from 30 stocks to 40 with new stricter rules to govern the companies that qualify. See what’s happening and how it affects your index day trading.

————————–

What’s happening with the DAX index?

On Monday September 20th, STOXX a unit of Deutsche Borse, the German holding company of stock exchanges implemented what Reuters referred to as the biggest overhaul of the DAX index since it was created 33 years ago.

The biggest changes include:

- Growing from 30 companies to 40 companies

- Strict new index listing criteria

- New de-listing rules (to enable faster action in instances like the Wirecard scandal)

Reminder: What is the DAX index?

The DAX is the globally-known benchmark for the German stock market and contains the country’s biggest and best known blue-chip shares. The DAX index is Germany’s equivalent to the FTSE 100 in the UK or the S&P 500 and Dow Jones in the United States.

While many investors use it to track the overall performance of German stocks, it can also be directly day traded as an ETF on the Frankfurt Stock Exchange, as futures and options contracts and as a CFD.

Germany 30 CFD on the LCG Trader platform (3pm GMT 10/9/21)

Past Performance is not an indicator of future performance

LCG offers trading on the German 30 CFD(contract for difference) with one of the most completive spreads in the brokerage industry. The CFDs are currently named Germany 30 but will soon be updated to Germany 40, when the DAX changes take place (DAX® (TR) EUR – Qontigo (dax-indices.com).

The Dax index was created in 1988 and undergoes regular reshuffles whereby some new companies are added, and some are dropped but it has remained very close to its original form for over 30 years.

The DAX index family has expanded over the years. The new rules taking shape will affect all the DAX indices, including the MDAX, SDAX, TecDAX, DAX 50 ESG and DAX ex Financials 30.

DAX 40 Constituents (stocks)

The following table shows the companies and the sector they are in.

| Original DAX 30 | Adidas | Footwear |

| Allianz | Financial services | |

| BASF | Basic Materials | |

| Bayer | Healthcare | |

| BMW | Automaker | |

| Continental | Automotive | |

| Covestro | Basic Materials | |

| Daimler | Automaker | |

| Delivery Hero | Online food ordering | |

| Deutsche Bank | Financial services | |

| Deutsche Borse | Financial services | |

| Deutsche Post | Industrial | |

| Deutsche Telekom | Communications | |

| Deutsche Wohnen | Real Estate | |

| E.ON | Utilities | |

| Fresenius | Healthcare | |

| Fresenius Medical Care | Healthcare | |

| Heidelberg Cement | Basic Materials | |

| Henkel | Consumer goods | |

| Infineon Technologies | Technology | |

| Linde | Basic Materials | |

| Merck | Healthcare | |

| MTU Aero Engines | Industrial | |

| Munich Re | Financial services | |

| RWE | Utilities | |

| SAP | Technology | |

| Siemens | Industrial | |

| Siemens Energy | Technology | |

| Volkswagen Group | Automaker | |

| Vonovia | Real Estate | |

| New DAX 40: | Airbus | Plane-maker / defence |

| Porsche | Automaker | |

| Puma | Shoes & sportswear | |

| Siemens Healthineers | Health technology | |

| Symrise | flavour and fragrances | |

| Sartorius | Lab equipment | |

| Brenntag | Chemicals distributor | |

| Hello Fresh | Home meal kits | |

| Qiagen | Genetic testing | |

| Zalando | Fashion retailer |

The new rules for the DAX index

The aim of the rule changes is to raise the bar on what’s required of companies in the DAX index. The major new rules for the DAXas reported by Qontigo are the following:

- Companies must be profitable for 2 years before inclusion

- Must publish quarterly financial statements and have audited accounts

- Companies must appoint an independent audit committee

- DAX composition to be reviewed every 6 months (instead of 12)

- Turnover requirement replaced by liquidity requirements (trading VOLUME)

Why is the DAX changing?

In a word, Wirecard. The accounting scandal involving the German company that had been escalated to the DAX index only 2 years priorto going insolvent was a major black eye. As of Wirecard’s insolvency in July 2020, a massive €2 billion is unaccounted for in what appears to be massive fraud at one of Germany’s most prized companies and a member of the DAX index.

The hope is that these changes will do two things:

- Raise the requirements to qualify for the DAX index

- Diversify the index so one stock will have less impact

Will the DAX 40 be better for day trading?

Despite the furore over Wirecard and the wild trading in German markets the weeks surrounding its collapse, the DAX index remains one of the most popular indices to trade at LCG.

As always, there are reasons for both hope and scepticism about the changes.

Pros for DAX 40

A larger number of stockswill bring higher trading volumes, which in turn is good for liquidity. Day traders want as much liquidity as possible to make sure bid ask spreads are low and there are more traders to match your order against.

The Diversificationthat comes with the index becoming 25% larger means the DAX will be less influenced by moves in one or two stocks. This means news from Siemens will have less impact on the price of the DAX than it once did but means news affecting the other smaller companies like Continental AG will have a bigger effect, potentially creating more trading opportunities.

Growth focusednewly added stocks can change the dynamic of the index away from traditional heavy industry to more digital areas of the German economy.

Cons for the DAX 40

The big companies still matter the mostin what is still a relatively concentrated index. With 40 companies the DAX is now more diversified than the Dow Jones Industrial Average but significantly less diversified than the S&P 500.

Germany’s economy is more concentratedthan the United States – in both the number of companies and the industries those companies operate in. From that standpoint, there is only so much that the DAX index can change.

Volatilitycould decrease. Having more constituents in this index will decrease volatility, which could either encourage or discourage day traders who normally would have liked this index due to its aggressive swings

How to trade the DAX 40

To practise trading on the DAX index or over 10,000 other financial instruments including CFDs on forex, shares, indices, spot metals, futures, bonds, options, and ETFs –

Register for a free LCG demo trading account

Spread betting and CFD trading carry a high level of risk to your capital and can result in loss of your deposits. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 68% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

The information provided within this communication has been prepared by London Capital Group Limited (LCG) and is intended for informative purposes only. It is not intended for investment, or commercial advice or an offer or solicitation for the purchase or sale of any financial instrument. Any opinions, news, research, analysis, prices, other information or links to third-party contained within this communication is provided as general market commentary and does not constitute investment advice and is not intended for any form of commercial use. LCG shall not accept liability for any loss, damager including, but without limitation, to any loss or profit which may arise directly or indirectly from use of or reliance on such information.

The information in this article is not directed at residents of EU as well as Australia, Belgium, Canada, New Zealand, Singapore or the United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

London Capital Group (LCG) is a company registered in England and Wales under registered number: 3218125. LCG is authorised and regulated by the Financial Conduct Authority (FCA) under the firm reference number of: 182110. The registered address for LCG is: 80 Cheapside, London EC2V 6EE.

Entain, UK buy outs and mineral company selection with Alan Green

Alan Green joins the UK Investor Magazine Podcast to discuss the key themes in UK markets and explore individual equities.

This week we look at the takeover offers for Entain and the wave of cash being deployed in the takeover and buy outs of UK companies. We then look at junior explorer Caerus Minerals.

Entain is the latest UK company to be subject to takeover interest from a US entity. In this case it’s mergers and acquisitions activity as the interested party is DraftKings. DraftKings has made a £16.4bn offer for the owner of Ladbrokes which saw Entain shares soar and pulled up the prices of other gambling shares on hopes of more interest in sector.

William Hill was acquired by US-based Caesars in a near £3bn deal and Entain would be the latest UK gambling company snapped as the US gambling market develops.

We look at the wider trend of US interest in UK companies and question the ramifications for Uk equity in the rest of 2021.

Caerus Minerals has avoided the downturn in mining shares and we look at the merits of the company and their operations in Cyprus.

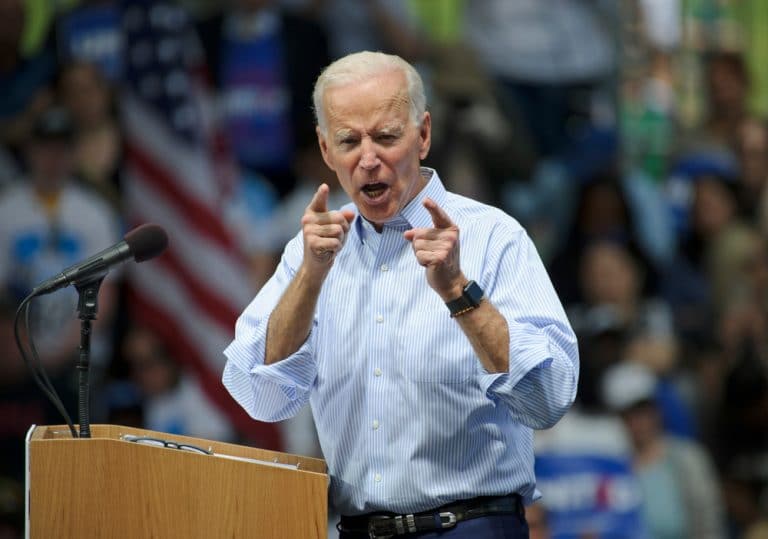

Biden delivers blow to UK’s hopes of US trade deal

UK could now seek alternative arrangement

Britain’s hopes of a post-Brexit trade agreement with America seem to have disappeared after news emerged that Joe Biden and Boris Johnson held talks on the matter.

It is an issue which has been highlighted as a key selling-point of Brexit by Johnson, as it would have represented Britain’s new found freedom from the EU.

However, sources close to talks now seem to think there is little prospect of a deal, especially as Biden has other priorities.

Having been asked for un update on the matter, Johnson said, “we’re going as fast as we can”, although he did not confirm whether a deal would be in place or not before 2024.

Reports now suggest that the UK is looking at alternative options, including joining the US-Canada-Mexico trade deal instead of striking a bilateral agreement with Washington.

A senior government source said: “There are a variety of different ways to do this. The question is whether the US administration is ready. The ball is in the US’s court. It takes two to tango.”

Biden also made his views clear on ensuring peace in Northern Ireland is not in doubt as a result of post-Brexit tensions.

“I feel very strongly,” he said. “We spent an enormous amount of time and effort in the United States. It was a major partisan effort, and I would not like to see – nor would many of my Republican colleagues – a change in the Irish accord”.

Markets pick up on Wednesday

The FTSE 100 was up 0.9% to 7,042 and China’s SSE index jumped back to life after markets were closed for a few days’ holiday. The SSE advanced 0.4%.

“A lot can change in a week on the markets,” says Russ Mould, investment director at AJ Bell. “Having seen some very bad days for equities in recent sessions, Europe and parts of Asia were more upbeat on Wednesday.”

So, what’s changed to make investors more confident?

“One key event is China’s troubled property developer Evergrande striking a deal over a bond repayment, thereby bringing a sense of relief to markets we might not see the business collapse – something that could cause ripples in multiple markets,” says Mould.

“Evergrande still has plenty of problems to fix including more bond payments later this week, but today’s deal would suggest catastrophe is not immediately around the corner.”

“We also have the Federal Reserve issuing a policy statement later today and speculation is growing that we won’t get the dreaded tapering announcement at this event. That would be a massive relief to investors and could give further support to markets.”

FTSE 1OO Top Movers

The top risers on the FTSE 100 on Wednesday, each making sizeable gains, are Entain (6.08%), Antofagasta (5.68%) and Anglo American (4.54%).

At the other end of the UK index is Hikma Pharmaceuticals (-1.71%), AstraZeneca (-1.33%) and Severn Trent (-1.19%).

DAZN in advance talks over takeover of BT Sport

BT Sport jumps on the news

The BT share price rose on Tuesday after news emerged that DAZN, the sports streaming service, had made a bid for the telecommunications company’s sports channels.

DAZN has entered advanced talks to buy BT Sports in a deal that could be confirmed in the coming weeks, leading the BT share price to climb by 2.7%.

A spokesperson for BT Sport said all options were on the table as the company continues to explore its options.

The deal would be a huge step for DAZN in its efforts to take-over sports broadcasting.

Despite being founded in London, the company has gained a lot of traction in North America and other regions.

This specific deal would give DAZN access to the coveted rights to Premier League football.

DAZN’s chair Kevin Mayer, a former Disney and TikTok executive, has previously stated his desire to get Premier League football on the platform.

“I would love to see the Premier League on DAZN in the future,” Mayer told a conference. “It’s a huge market, incredibly popular sport, high quality experience, of course we’d want that.”

Uber share price surges as company expects profitable quarter for the first time ever

Uber share price closed 11.49% higher yesterday

Uber is set to embark on a profitable quarter for the first time ever, on an adjusted basis, after over ten years of going through its billions of dollars cash piles.

The ride-hailing firm has seen its stock fall by nearly 40% since it reached an all-time-high in early February this year.

It is projecting gross bookings for July to September of between $22.8bn and $23.2bn, while its adjusted earnings before interest, tax, depreciation and amortisation is between ($25m) and $25m.

Uber’s chief financial officer Nelson Chai said a result less than break-even would need a substantial fall in business activity during the remainder of this month.

“With positive adjusted ebitda in July and August, we believe Uber is now tracking towards adjusted ebitda break-even in Q3, well ahead of our prior guidance,” said Chai, in a filing released before markets’ opening on Tuesday.

The Uber share price ended up closing 11.49% higher.

Chai said Uber is now expecting a strong Q4, and the filing projected that adjusted EBITDA would be between $0 and $100m.

Uber has previously told investors it was hoping for a loss “better” than $100m for Q3.

National Express and Stagecoach share prices rise on merger talks

New larger company would have a market cap of £2bn

The share prices of both National Express and Stagecoach jumped up yesterday as investors got behind a possible merger between the two.

It followed National Express and Stagecoach confirming yesterday that they were holding talks.

As part of the deal, Stagecoach shareholders would own around 25% of National Express as they would receive 0.36 shares for each one they own in Stagecoach.

National Express added 7.6% on the news while Stagecoach soared by 27%.

“National Express’ plans to snap up rival Stagecoach have been met with a warm welcome all round; there’s just the little issue of the competition watchdog to deal with before any ink can meet paper,” said Danni Hewson, AJ Bell financial analyst.

The new company would become the largest bus operator in the country and would have a market cap of £2bn.