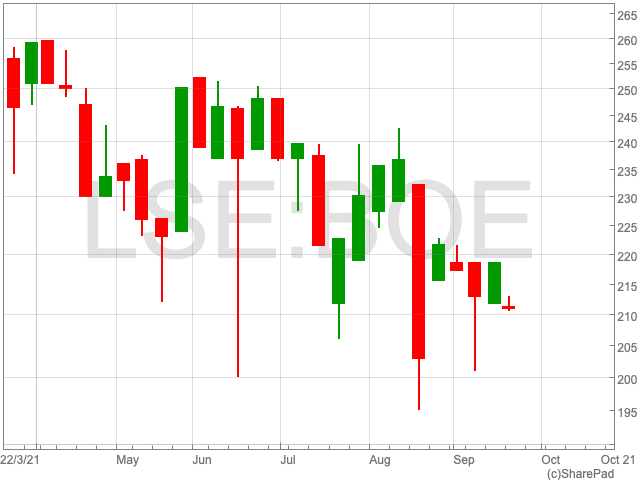

Delivered ready meals company Parsley Box (LON: MEAL) floated earlier this year and the share price has nearly halved. The non-executive chairman is still convinced by the prospects, though.

Chris van der Kuyl has bought 85,000 shares at 100p each via 4J Studios Ltd, a company where he has significant control. 4J Studios has a 5.16% stake in Parsley Box and Chris van der Kuyl has a direct stake of 5.56%.

The current share price is 101p, compared with the placing price of 200p at the end of March 2021. Previously during the summer, Chris van der Kuyl bought 440,000 shares at 120p each, 20,000 s...

High inflation causes interest payments on UK debt to rise

UK government borrowing higher than expected

The UK government had to borrow more than anticipated last month as rising inflation caused debt interest payments to increase.

The Office for National Statistics confirmed that the government’s budget deficit fell to £20.5bn in August from £26bn compared to the same month a year before, as the UK’s economy recovers from the pandemic.

However, the positive impact on national debt was offset by inflation causing interest payments on the country’s debt to go up by 84% year-on-year.

“August delivered another month when what the government raked in was far less than it spent and although the numbers are going the right way, borrowing figures overshot expectations. Tax receipts were up almost across the board with dips only in alcohol and tobacco duty and capital gains tax, the latter suggesting business is taking advantage of new incentives,” said Danni Hewson, AJ Bell financial analyst.

One of the big successes and one of the biggest costs has been the government’s furlough scheme which is now in its dying days.

“Spend on the scheme in August was just over a billion pounds, an almost 70% decrease compared to the same time last year as the jobs market bubbled and unemployment was kept in check,” Hewson added.

“All the support, all the restrictions have come with a substantial price tag and whilst the deficit might be lower than official forecasts, and the Chancellor might have a touch more wiggle room going into his autumn budget than had been expected, there are concerns.”

Inflation is not just something that’s making us wince when we get to the supermarket checkout, it’s also taking its toll on the public purse.

Hewson said: “Interest payments on all that debt shot up in August and September will be even more painful when you factor in the latest RPI figures. And the medicine for inflation, a rate rise from the Bank of England which is widely accepted to be on its way, will perversely also add to debt costs.”

JP Morgan Chase to launch digital bank to rival UK incumbents

JP Morgan Chase bank will expand into Europe and across the world if successful

JP Morgan Chase is set to launch a new digital bank as it seeks to become one of the largest lenders in the UK.

The ‘Chase’ bank will offer current accounts, in addition to savings, loans and other new products.

Sanoke Viswanathan, chief executive of the venture, said JP Morgan needs to have “millions of customers over time” to be viable.

JP Morgan is seeking to disrupt established institutions in its bid to be “in the top few” banks in the UK.

With a market cap of close to $500bn, JP Morgan is the biggest bank in America.

As of now, it employs just under 20,000 people in the UK, where its functions centre mainly around investment banking.

The bank has made a substantial but undisclosed investment in Chase UK, according to The Times.

Markets rebound from Evergrande sell-off

The FTSE 100 staged a mini-resurgence on Tuesday morning, climbing by just over 1%, but not quite back above the 7,000 mark.

“Bargain hunters appeared to be out in force on Tuesday as the FTSE 100 bounced back from a torrid start to the week,” says AJ Bell investment director Russ Mould.

“The miners, scarred by heavy selling on Monday, eked out a recovery while British Airways owner International Consolidated Airlines continued the ascent which begin yesterday afternoon when the US lifted travel restrictions on fully vaccinated UK and EU visitors.”

A major factor in market volatility of late has been fears about the fall-out from a potential collapse of Chinese property developer Evergrande, and the concerns have not gone away.

“Evergrande is due to make a debt repayment on Thursday and this event could be the next major test of investors’ resolve.”

“The challenge for the markets is trying to guess how Beijing might react, particularly after its notably strident approach in recent months when it comes to the technology industry. Will it be similarly strict with the property sector?

Before Thursday there is also the latest US Federal Reserve meeting and the question of whether recent events will lead chair Jay Powell and his colleagues to rethink their plans for tapering financial stimulus.

FTSE 100 Top Risers

IAG (5.04%), Pershing Square Holdings (4.14%) and Shell (4.03%) are leading the way on Tuesday, each with sizeable gains.

At the other end, Kingfisher (-4.71%), Compass Group (-1.93%) and Polymetal International (-0.95%), were all in the red.

Kingfisher to raise dividend and buy back shares after profit jump

Kingfisher has been a winner from the coronavirus crisis

Kingfisher, the DIY chain, has raised its interim dividend by nearly 40% and is set to buy back £300m of its shares as its profits rose throughout the pandemic.

The British company has been successful on the back of the coronavirus crisis as the lockdowns, in addition to the move to people working from home, led to people spending more doing up their homes and gardens.

While this trend is expected to somewhat reverse as the economy reopens, Kingfisher is expecting its sales in H2 are expected to fall by less than initially expected.

The company is predicting its fall-year sales will fall by at most 7% compared to a previous forecast of between 5% and 15%.

Kingfisher added that adjusted pre-tax profit for the year would be between £910m and £950m, compared to analysts’ forecasts of around £912m.

Ross Hindle, retail sector Analyst at Third Bridge, commented on Kingfisher’s results:

“Kingfisher experienced strong sales growth yet again, with H2 LFL sales up 22.8% y/y driven by a strong demand for home improvement across both retail and trade channels. What is further-more impressive is that both transaction volume and average basket size is up on a 1-year and 2-year basis,” said Hindle.

“Before Covid-19 double-digit growth in the DIY space was something of an anomaly, however a few months on and growth remains stronger than ever.”

“Lockdowns were a boon for the group but with online sales still low it looks like more needs to be invested into digital and data,” Hindle added.

“A structural change towards working-from-home have made people look at their homes differently. Many families have spent months redirecting money into home improvements, especially home offices, outdoor spaces, and garden sheds.”

The Kingfisher share price is down by 4.75% on Tuesday morning.

Shell agrees to $9.5bn sale of Permian basin assets

Shell produces 175,000 bpd in the region

Shell has vowed to return over £5bn to its shareholders having sold out of one of the biggest oil fields in America.

The FTSE 100 oil giant agreed to offload its operations in the Permian Basin to ConocoPhillips for $9.5bn.

The move comes after Shell has deliberated over its strategy having mad promises to reduce its emissions on pressure from campaign groups.

The Permian basin produces in the region of 175,000 barrels per day, which means the decision represents a fork in the road for Shell.

The company confirmed it will use $7bn for “additional shareholder distributions”, while the rest will be used to prop up its balance sheet.

The deal remains subject to approval by regulators.

Shell remains one of the largest energy companies in the world and produced approximately 3.4m barrels of oil per day last year.

Wael Sawan, Shell’s upstream director, commented: “After reviewing multiple strategies and portfolio options for our Permian assets, this transaction with ConocoPhillips emerged as a very compelling value proposition.

“This decision once again reflects our focus on value over volumes as well as disciplined stewardship of capital. This transaction, made possible by the Permian team’s outstanding operational performance, provides excellent value to our shareholders through accelerating cash delivery and additional distributions.”

The Shell share price is up by 3.65% during the morning session on Tuesday.