Hottest areas on US stock market are showing signs of cooling

The S&P 500, the index tracking the performance of 500 large companies listed on US stock exchanges, is aiming to record gains for the eighth month in a row. It would be the index’s best run since January 2018, when it recorded a 10-month surge.

This time around “the FAANGM sextet continues to do a lot of the legwork,” says Russ Mould, investment director at AJ Bell.

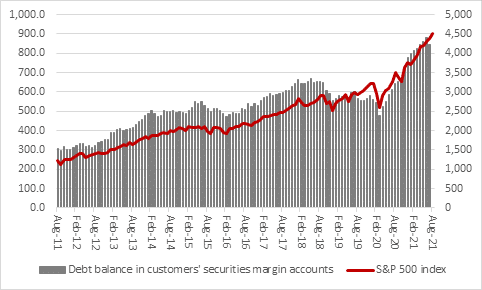

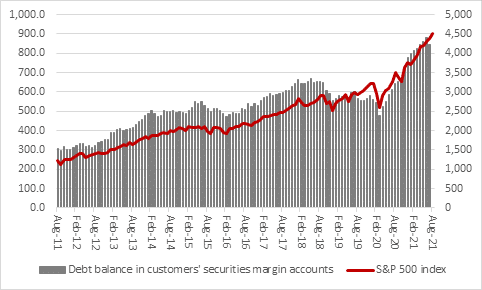

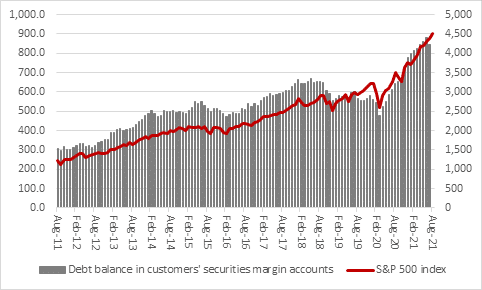

Mould also draws attention to the first dip in US margin debt since February 2020.

Margin debt is the amount of money an investor can borrow from their broker via a margin account to buy shares, or even short sell them.

“This looks smart and gears us returns when markets are rising (as the investor or trader can get more exposure) but looks less clever when markets are falling,” says Mould.

Falling asset prices can force so-called margin calls where the investor or trader must start repaying the loan – and sometimes they must sell other positions to fund that repayment, creating a negative feedback loop in markets.

The last time margin debt dropped was March 2020, just prior to the pandemic making its presence felt not just in Asia but Europe and America as well.

“This first dip in margin debt must be watched, especially in light of Securities and Exchange Commission (SEC) queries about regulatory filings from the investment platform Robinhood and questions about its business model and whether payment for order flow is appropriate. It remains to be seen whether this dampens some of the liquidity flow which has done so much to elevate certain sections of the US stock market, but it may be no coincidence that what looked like some of the frothier areas have started to flag.”

“Whether trading losses are sparking a slight decrease in risk appetite or whether a more cautionary approach (perhaps considering Federal Reserve reverse repo operations and talk of tapering) is lessening demand for initial public offerings (IPOs), Special Purpose Acquisition Companies (SPACs) and growth and tech stocks is hard to divine.”

Either way, it does appear that some of the hottest areas of the US market are showing some sign of cooling.