Young investors drawn to ‘businesses of the future’

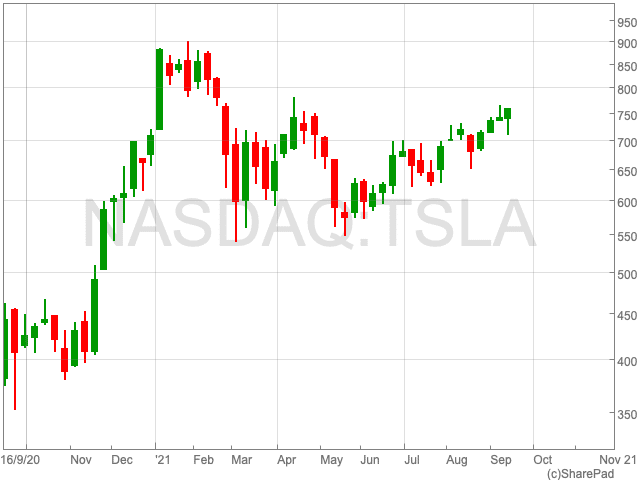

Tesla is a unique company, not only from an innovation perspective, but because of its ability to attract non-traditional investors.

On of the key reasons for this phenomenon is the personality of its CEO Elon MusK.

That is the view of Peter Garnry, Head of Equity Strategy at Saxo, who spoke about the powerful appeal of electric vehicle stocks – in particular Tesla – on investors.

“In many ways, Elon Musk is a great showman. He captivates his audience and he’s telling a narrative that many young people can relate to, which are both the new buyers of electrical vehicles and the new class of retail investors,” said Garnry.

In addition, Tesla, and other electric vehicle companies, are seen as the companies of the future, and there is a reason for people’s desire to invest, beyond Musk’s ability to do marketing.

When it comes it electric vehicles, Tesla is the standout operator, while year-to-date, the Tesla share price is up by a mere 3.73%.

However, Tesla is not the only electric vehicle manufacturer that interests young future-oriented investors.

Garnry says Nio, the Chinese EV manufacturer, is another popular choice among investors, “but if you want to expose yourself to the industry and not be focused on which of the manufacturers win the arms race, you could look at battery producers”.

“Traditionally car manufacturers have owned the intellectual property on which a car has been built upon. But this is bound to change with electric vehicles gaining ground, because the battery technology will be owned by the battery producers and not the car makers.”