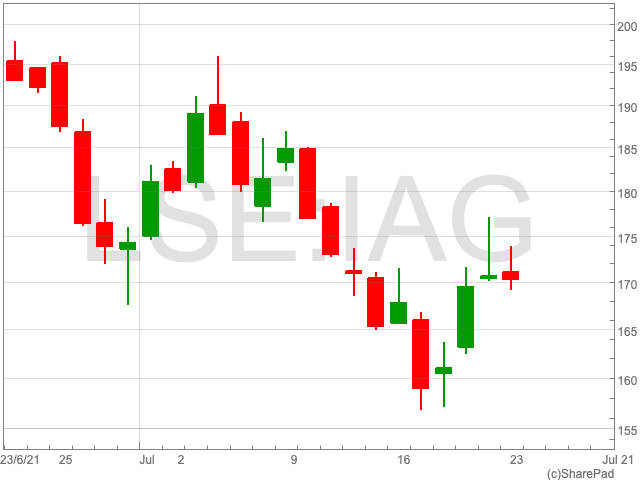

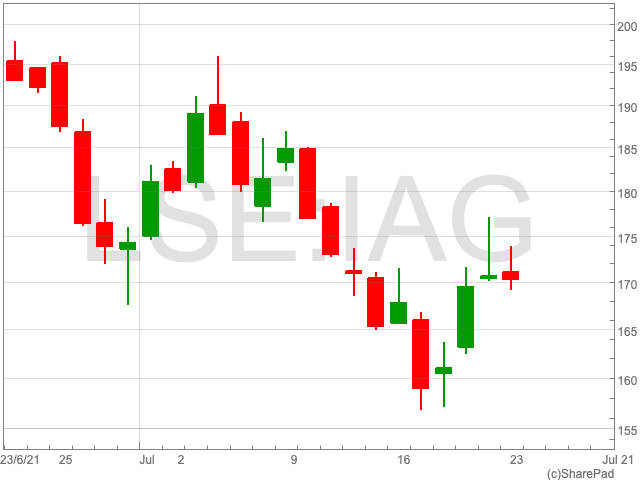

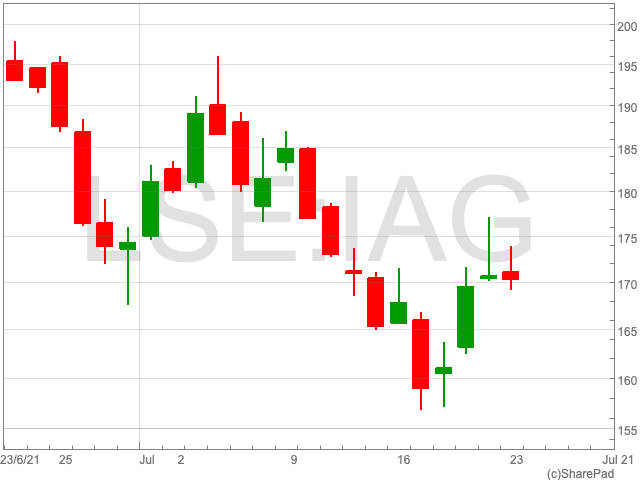

IAG Share Price

The IAG share price (LON:IAG) is down by 11.84% over the past month as ‘Freedom Day’ and the ongoing relaxing of restrictions failed to support the airline in a sustained way. IAG has struggled to gain any momentum since the middle of March, when its share price looked as though it might take off, amid what in hindsight proved to be blind optimism. Year-to-date the IAG share price is up by 13.59%, however, the uncertainty and lack of passenger numbers is cause for concern for the airline.

Covid-19

While the already delayed ‘Freedom Day’ was supposed to be the point at which things could return to normal, it has proved to be nothing of the sort. Especially for those with a desire to travel internationally.

With reports saying cases could rise to 100,000 a day in the UK without restrictions, many Brits are having to isolate. This is causing demand for flights to dive as more people are being told to self-isolate, while many are cancelling pre-booked vacations.

IAG is having to carry on paying its fixed costs and is subsequently losing out on revenue, which is becoming increasingly concerning to investors.

Finances

That leads on to the the company’s balance sheet and how it is effecting the IAG share price. Back in May, IAG posted a loss of £1.14 billion in Q1. At the time the company decided not to provide a guidance for the following quarter due to the uncertainty. They were proved right as uncertainty has persisted throughout the second quarter.

Investors could soon have a clearer indication of IAG’s current financial predicament. IAG’s half year results will be revealed in a week’s time and will provide a clearer indication of the company’s outlook. It is possible that investors are anticipating negative results which could already be factored into the IAG share price.