Next Tuesday morning, 29th July, will see the Morgan Sindall Group (LON:MGNS) report its Interim Results to end-June this year.

We have already been given strong guidance by the Partnerships, Fit Out and Construction Services group, that its Management is anticipating that its full-year results for 2025 will be significantly ahead of its previous expectations.

It is a group of specialist businesses, delivering housing and mixed-use partnership schemes, fit out and construction services across the UK for the public, commercial and regulated sectors.

The Business

Th...

FTSE 100 hits record highs as US/Japan trade deal fires up bulls

The FTSE 100 reached a record high on Wednesday after the US and Japan struck a trade deal, removing uncertainty surrounding one of the most significant US trade agreements for global growth and signalled a willingness for the US to make concessions to avoid the more damaging tariff rates.

London’s leading index touched a fresh record high of 9,080 and was trading very close to this level at the time of writing.

“News of a trade agreement between the US and Japan is fostering optimism among investors that further deals might be reached before punishing tariffs come into force,” explained AJ Bell investment director Russ Mould.

“The news helped drive the FTSE 100 to a new record high and saw gains in other markets across mainland Europe – with focus likely to now turn to the prospects of an agreement being forged between the Trump administration and EU.”

However, some analysts cautioned that while the markets reacted positively on Wednesday, the longer-term consequences of the trade deal may have ramifications for markets.

“At 15%, the US tariff on Japanese goods does not give much cause for long term celebration, despite the positive initial market reaction. Much higher product tariffs are not included in the deal,’ said George Lagarias, Chief Economist at Forvis Mazars.

“The number will still likely contribute to an increase of US inflation and put pressures on real growth for both countries. Why are the markets jubilant this morning? Because even a higher tariff is preferable to continued uncertainty. But this is hardly a catalyst for long term optimism. If the deal with Japan is the standard by which the negotiation with the EU will go, then investors and businesses should begin to price in a deterioration of the macroeconomic backdrop.”

Despite potential pitfalls down the line, most FTSE 100 shares were higher at the time of writing, with 73 of the 100 constituents trading in positive territory.

JD Sports was among the top risers as investors cheered the Japanese trade deal and what it could mean for other US trade deals more closely related to JD’s business model. JD Sport was one of the FTSE 100 stocks most heavily hit by Trump’s Liberation Day announcements.

The risk on tone to trade was underscored by weakness in defensive sectors. Centrica was the FTSE 100 top faller with a loss of 1.8% while SSE lost 1.7%.

Fresnillo fell around 1% after announcing silver production fell in Q2 due to the cessation of activities at a mine and lower ore grades.

“Fresnillo has made investors a lot of money this year thanks to soaring precious metal prices. Unfortunately, investors have now had a wake-up call that the day job still matters for the mining group,” Mould said.

“It has reported a big drop in second quarter silver production year-on-year, partially down to geological issues where the rock being mined contained lower grades of metal.

“Mining is high risk and often unpredictable, and anyone invested in this area needs to be aware of what could go wrong as well as what could go right.”

AIM movers: CPP disposal funds Blink business and Shield Therapeutics reduces cash

CPP Group (LON: CPP) is selling its business in India for £15.7m, of which £11.8m is payable on completion. The rest is dependent on performance. Tax could be £2m. This means that CPP can concentrate on the Blink InsurTech platform, focused on travel disruption and cybsersecurity. The cash will accelerate investment and fund the restructuring of the group to cut costs. Blink has annual recurring revenues of £1.6m. Net cash was £8.1m at the end of June 2025. The share price rebounded 21.7% to 157p.

Iron replacement treatment provider Shield Therapeutics (LON: STX) had a strong second quarter with revenues of $12.8m doubled the previous quarter. This means it is on track to reach cash flow positive by the end of the year. Cash was $10.8m at the end of June 2025. The share price recovered 15.5% to 4.1p.

Governance and compliance software provider Skillcast (LON: SKL) increased annual recurring revenues grew 22% to £12.7m. Interim revenues rose 18% to £7.5m and net cash has reached £11.5m. This could finance acquisitions activity. The share price improved 13.8% to 53.5p.

MyHealthChecked (LON: MHC) is partnering with Patients Know Best to give people the option to use its at-home blood and DNA tests and access results via the NHS app. The agreement lasts an initial three years. The share price rose 10.6% to 13p.

Caledonia Mining Corporation (LON: CMCL) says 2025 profit will be much higher than expected, helped by the strong gold price. The forecast was $86.7m, up from $51.6m last year. The second quarter was profitable, and 2025 production guidance was recently raised to 75,500-79,500 ounces of gold. The share price increased 8.59% to 1770p.

Plant-based detergent ingredients developer Itaconix (LON: ITX) reported record revenues of £4.8m in the first half of 2025. Panmure Gordon has reduced its 2025 forecast loss from $900,000 to $700,000. The share price is 7.45% to 137p.

FALLERS

K3 Business Technology (LON: KBT) bought back 34.1 million shares in a tender offer at 85p/share. Dealings on AIM end on 30 July. The share price fell 15.4% to 55p.

CyanConnode (LON: CYAN) reported full year results in line with expectations. Revenue fell from £18.7m to £14.2m due to delays in deployments of smart meters in India. Gross margins improved and operating costs were flat, so the loss fell from £4.2m to £3.7m. In the first quarter of the new financial year, there were 568,000 MESH modules shipped, compared with 1.26 million in the previous full year. The share price slipped 4.62% to 7.75p.

Higher yield UK stocks are outperforming as US sentiment wavers – is this just the beginning?

Thomas Moore, Manager, Aberdeen Equity Income Trust

- UK equities have outperformed US equities in the first half of 2025, led by higher yield stocks

- For many years, investor allocations to US equities have grown at the expense of UK equities

- Even a small rotation out of the US and into the UK could make a meaningful difference to returns

- Within UK equities, we observe that smaller cap stocks could be starting a resurgence, making this a rich hunting ground for investors who can invest across the UK market.

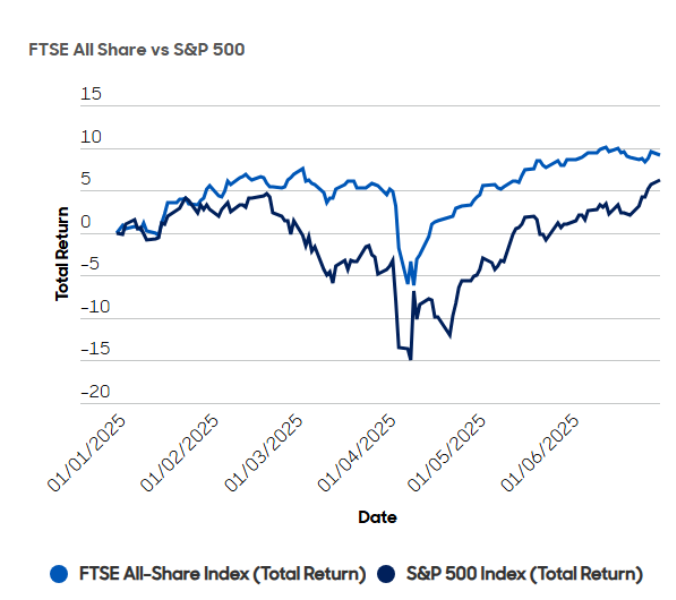

The resurgence in UK equities could come as quite a surprise for investors who have grown used to the dominance of US growth companies over the past decade. In the first 6 months of 2025, the FTSE All-Share index has delivered a total return of +9.1%, significantly outperforming the S&P 500 index delivered +6.2% in local currency terms. What’s even more surprising is that higher yield stocks have been leading the UK market. (Source: Bloomberg, 16 July 2025)

Our analysis shows that high dividend yield stocks have led the UK equity market over the first six months of the year, outperforming lower yield stocks and proving that dividends and capital growth can go hand in hand. Splitting the market into 5 equally weighted baskets, ranging from the highest yielding stocks to the lowest yielding stocks, a clear pattern emerges. The 2 highest yielding baskets, with an average yield of 5.9%, have generated a total return of +15.2%. In contrast, the 3 lower yielding baskets, with an average yield of 2.1%, have only managed to generate an average total return of +5.4%. (Source: Aberdeen, 1st July 2025)

Source: Bloomberg. For illustrative purposes only. No assumptions regarding future performance should be made.

Wavering sentiment towards US assets can be seen across a range of asset classes. The DXY index, which measures the performance of the US Dollar against a basket of other currencies, is down 10.7% in the first 6 months of 2025, breaking a long run of Dollar appreciation. Within the US equity market, the flagship ‘Magnificent 7’ technology companies are seeing their status questioned, removing one of the key pillars of support. Meanwhile US bond markets are also experiencing significant volatility on concerns over unsustainable pro-cyclical fiscal policies. Most recently, the “One Big Beautiful Bill” is creating a fiscal firestorm in the US, given concerns that it could add between $3 trillion and $5 trillion to the national debt over the next decade. In addition, investors are concerned by unpredictable policy making, in particular tariff policies, as well as institutional decay. All of this sits uneasily with the high valuations and heavy allocations to US equities.

The US has attracted a huge amount of investment from overseas investors in the past two decades. The US Bureau of Economic Analysis states that foreign ownership of US assets totals $62 trillion, far higher than the $36 trillion of overseas assets held by US owners. This makes the US the largest net debtor country in the world. To put these numbers into perspective, the FTSE All- Share (over 500 companies) totals $3.5 trillion. Another way of contextualising it is to consider that the market capitalisation of Apple, at $3.1 trillion (As at 16/07/25), is approximately the same as the whole UK market. What is clear is that it would not require a large shift out of US assets into the UK equity market for there to be a pronounced impact on share prices. UK stocks are cheap after years of weakness caused by macro concerns, but all the while, UK companies have been diligently taking action to improve their efficiency and grow their profits.

So, it’s against this backdrop that we believe that the current rotation out of US equities could have legs. Human beings tend to wait to see a trend develop before they start to feel the urgency to act on it. Investors have grown used to the US market delivering reliable, outsized returns. The weakness of the US Dollar also changes the calculation for non-US investors, exerting a further drag on returns. The trepidation starting to be felt by investors who are overly concentrated in US assets could become a catalyst for action.

There is also a strong case for increased diversification, particularly as some passive portfolios may have as much as 70% in the US. In the past, diversification meant selling UK equities to buy overseas equities, but investor allocations to UK equities have slumped over the past decade. As the reliability of US growth stocks fades, international and domestic investors could turn their attention to the UK.

The follow-on question for investors is what asset class they should consider rotating into. The strong performance of UK equities in the first half of 2025 might represent early evidence of a shift into UK equities. In a slow-growth world, every country has its fair share of challenges, but we see some emerging positives for the UK including the Government’s intention to make economic growth its number one priority, investing in infrastructure and defence, reforming planning controls and pushing through de-regulation of the Financial Services sector.

Within the UK equity market, we observe some interesting shifts going on beneath the surface:

First, income stocks are now doing all the running, with higher yield stocks outperforming lower yield stocks. High yield stocks have a natural appeal at a time of uncertainty. Rather than relying on unpredictable capital growth, investors can enjoy greater visibility of returns if they find stocks that offer dividend yields in excess of 6%, plus buybacks on top. The UK market has an abundance of companies that fulfil this brief.

Second, we are now seeing a shift in performance by size of company. Large cap stocks were first out of the blocks, as so often happens in early stages of a turnaround. Yet something interesting happened in April 2025 – smaller cap stocks started to outperform larger cap stocks.

Putting all of this together, we believe that this makes the UK a potentially rich hunting ground for income investors, particularly those who are willing to look all the way down the market cap spectrum. Our index-agnostic approach to income investing allows the Aberdeen Equity Income Trust to go anywhere, seeking out the best valuation opportunities across the market. This makes us poised and ready for this new era, as investors look to broaden out their allocations into small and mid-cap stocks.

Investors have always looked to the UK for dividend yield, but an improving corporate earnings backdrop can now enable dividend growth and capital growth to become a reality. This is why we see no compromise between the pursuit of income and capital.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- The Company invests in smaller companies which are likely to carry a higher degree of risk than larger companies.

- Movements in exchange rates will impact on both the level of income received and the capital value of your investment.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- Specialist funds which invest in small markets or sectors of industry are likely to be more volatile than more diversified trusts.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Other important information:

The details contained here are for information purposes only and should not be considered as an offer, investment recommendation, or solicitation to deal in any investments or funds and does not constitute investment research, investment recommendation or investment advice in any jurisdiction. Any data contained herein which is attributed to a third party (“Third Party Data”) is the property of (a) third party supplier(s) (the “Owner”) and is licensed for use with Aberdeen. Third Party Data may not be copied or distributed. Third Party Data is provided “as is” and is not warranted to be accurate, complete or timely. To the extent permitted by applicable law, none of the Owner, Aberdeen, or any other third party (including any third party involved in providing and/or compiling Third Party Data) shall have any liability for Third Party Data or for any use made of Third Party Data. Neither the Owner nor any other third party sponsors, endorses or promotes the fund or product to which Third Party Data relates.

The Key Information Document for Aberdeen Equity Income Trust can be obtained here.

Issued by abrdn Fund Managers Limited, registered in England and Wales (740118) at 280 Bishopsgate, London EC2M 4AG. abrdn Investments Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Both companies are authorised and regulated by the Financial Conduct Authority in the UK.

Find out more at www.aberdeeninvestments.com/aei or by registering for updates. You can also follow us on Facebook, LinkedIn , YouTube and X.

Yen steady after Japan-US trade deal announcement

The Japanese Yen was slightly weaker against the dollar on Wednesday after the announcement of a 15% trade tariff on Japanese imports to the US.

The Yen had rallied against the dollar in the initial market reaction to the trade deal, but was quickly sold into by traders.

15% tariffs are significantly better than the previously touted 25% rate, but the muted reaction reflects the damage to trade between the US and Japan.

Stocks displayed the most enthusiasm for the trade deal, the Nikkei rallying around 3% overnight.

“Asian markets have rallied overnight, after the announcement of a trade deal between the US and Japan. The deal sees a 15% tariff imposed on all Japanese exports to the US. Traders reacted positively to the news, because President Trump had previously been threatening a 25% tariff,” said Steve Clayton, head of equity funds, Hargreaves Lansdown.

USD/JPY was 0.1% higher at the time of writing after the Yen strengthened against the dollar in the run-up to the deal.

The trade deal comes amid political uncertainties in Japan, with Prime Minister Ishiba suffering an election loss but vowing to remain in post.

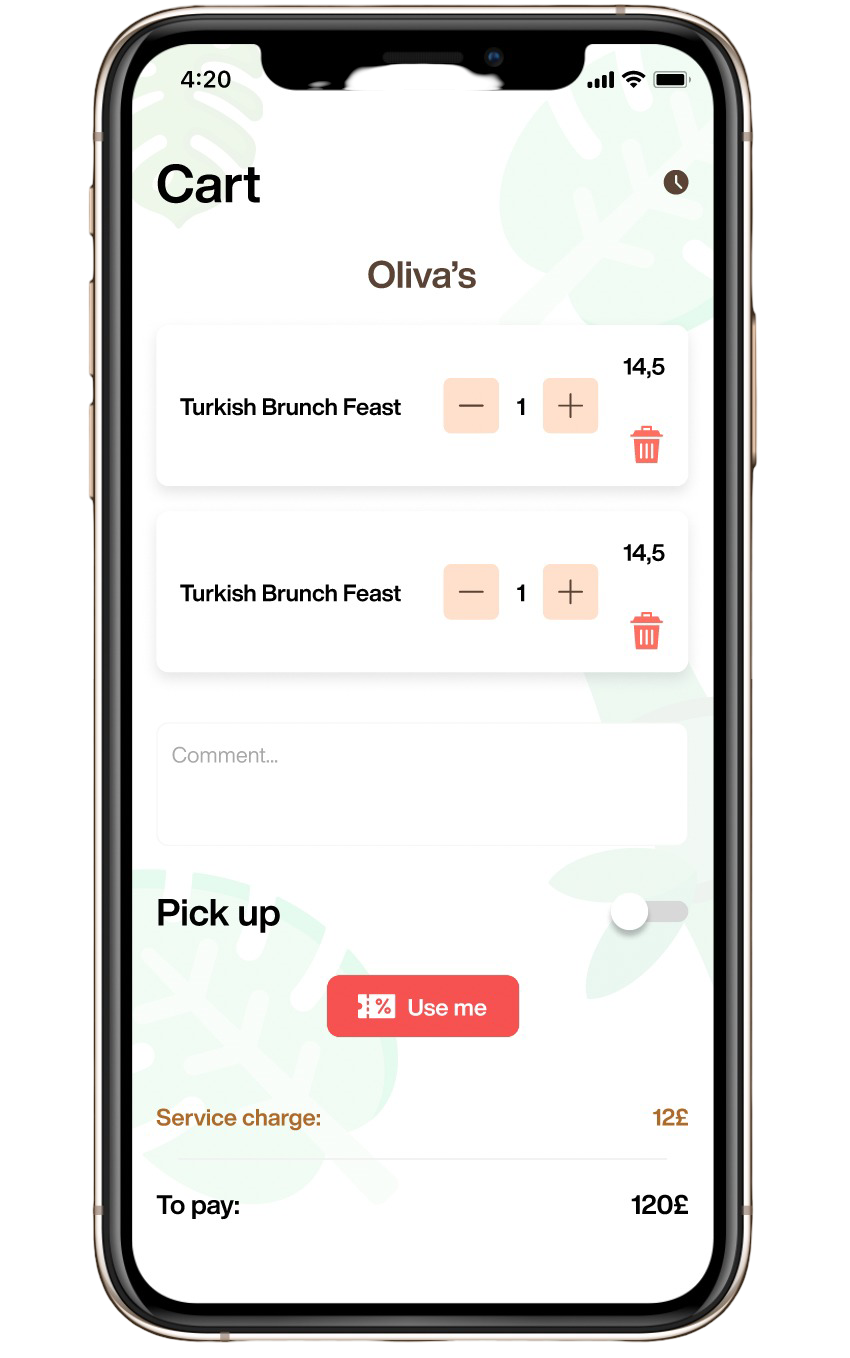

Panda: The Groundbreaking Fintech Disrupting Hospitality and Student Spending

In today’s fast-evolving fintech landscape, few ventures manage to simultaneously tackle deep-rooted sector challenges while capturing the imagination of investors. Panda, the UK startup registered in 2024, is one such company — reshaping how students and young professionals manage social spending, all while empowering independent hospitality venues to thrive amid a transforming high street.

At the helm is Duncan Nyanzi, a serial entrepreneur whose track record includes launching a premium events company and a highly successful Provence rosé brand now distributed nationally. With Panda, he’s bridging two vast markets — fintech and hospitality — delivering a product both culturally relevant and commercially sound.

A Fresh Take on Credit — Transparent, Responsible, and Socially Smart

Unlike many BNPL products that have faced regulatory scrutiny and reputational risks, Panda’s approach is fundamentally different. It offers a branded, embedded credit solution specifically tailored for social occasions — think dining out, nights at the pub, and events — with three simple, fixed instalments, no interest, and no risk of compounding debt.

Critically, Panda offloads all credit risk and compliance to its FCA-authorised partner SteadyPay, which uses robust Open Banking checks to safeguard affordability. This means Panda can focus on creating a seamless experience for users and venues, without being exposed to credit defaults or collections headaches.

Empowering Hospitality — A New Revenue Stream for Independent Venues

Independent pubs, bars, and restaurants in the UK face unprecedented challenges from inflation, reduced footfall, and the rise of large chains with aggressive discounting. Panda’s embedded credit platform offers these venues a unique growth lever — enabling flexible payment options that encourage repeat visits and higher spend without exposing venues to financial risk.

Unlike many fintechs that rely heavily on consumer fees, Panda’s revenue model is anchored in transaction fees paid by venues, supplemented by revenue share with the credit provider. This creates a sustainable, scalable ecosystem aligning the interests of all parties.

Early Traction and Unmatched Market Access

With over 2,000 targeted venues lined up in its first 12 months and more than 40 hospitality businesses onboarded or committed to trial, Panda is rapidly building momentum in key regional markets like Bristol and Bath.

On the consumer side, Panda has secured a waitlist of thousands of students and millennials through strategic partnerships with UCAS, Unidays, and Dig-In — platforms representing some of the most engaged youth audiences in the UK.

This dual-sided traction validates Panda’s position as the only fintech and hospitality tech company globally offering such a focused, embedded credit solution — a true category pioneer.

The Investment Opportunity

Panda is currently raising £500,000 via Crowdcube at a £3M pre-money valuation, with funds earmarked for final product development, go-to-market execution, venue onboarding, and credit scaling.

Investors stepping in now have the opportunity to back a product already live, with operational credit infrastructure and commercial partnerships in place, led by a founder whose entrepreneurial pedigree is proven.

Why Investors Should Take Notice

In a world where fintech startups often promise growth without clear revenue or risk frameworks, Panda stands apart with a lean, capital-efficient model and no lending risk. Its deep hospitality expertise combined with cutting-edge fintech innovation positions it uniquely to capture and grow a large underserved market segment.

For investors seeking a differentiated, high-potential fintech with tangible early traction and a founder-driven culture, Panda represents a compelling proposition — one that could redefine how a generation spends socially, and how hospitality survives and thrives.

To learn more and secure your investment, visit: www.crowdcube.com/companies/panda.

Guardian Metal Resources secures $6.2M US government award and raises $21M for Nevada Tungsten projects

Guardian Metal Resources has received a significant boost for its Nevada tungsten operations, securing a $6.2 million award from the U.S. Department of Defense alongside a successful $21 million equity fundraising round.

The award and fundraising are a major vote of confidence in Guardian’s ambitions in the US and pay testament to the firm’s execution of its strategy. In many respects, Guardian has achieved what the board of every junior miner dreams of, but few pull off.

The Defense Department funding, awarded to Guardian Metal’s wholly-owned subsidiary Golden Metal Resources, will accelerate development of the company’s flagship Pilot Mountain tungsten project in Nevada.

The award specifically supports the pre-feasibility study for the project as the U.S. pursues national security objectives to onshore critical metals production.

“I firstly want to extend my thanks to the U.S. Department of Defense and Defense Production Act Purchases team for their tireless effort to support the domestic critical minerals industry and the Pilot Mountain Project, in particular,” said Oliver Friesen, CEO of Guardian Metal.

“This Award is a step-change in our business, as we work towards our goal of supporting the U.S. industrial base with Mined in America tungsten.”

Guardian Metal has successfully raised approximately £15.6 million ($21 million) at 60p per shares. The fundraising was led by the company’s largest shareholder, UCAM Limited, which made a £10 million subscription, increasing its stake to around 28.7% of the company

The combined funding will be strategically deployed across Guardian Metal’s two flagship Nevada tungsten projects during the first half of 2026.

Fundraise proceeds will support ongoing Pilot Mountain Project drilling operations, metallurgical test work, engineering studies, and permitting activities. The Defense Department funding will enable an advanced pre-feasibility study incorporating both the Desert Scheelite deposit and recently completed drilling at the Garnet Zone.

The Tempiute Project will also be advanced through a drilling program to define an open pit resource, advance engineering work leveraging existing mine infrastructure, progress project permitting, and evaluate surface stockpiles from previous mining operations.

“Securing approximately US$27.2 million in total funding – through a combination of a U.S. government award and new equity subscriptions – represents a major milestone for Guardian Metal Resources,” Oliver Friesen said.

“This financing positions us to rapidly advance our co-flagship tungsten projects in Nevada , Pilot Mountain and Tempiute, and is a strong endorsement of our mission to establish a secure, Mined-in-America supply of Tungsten – a critically important defense metal.”

Guardian Metal Resources shares were 10% higher at 67p at the time of writing and have gained 130% so far in 2025.

Wetherspoon sales rise as Guinness drives volumes higher

JD Wetherspoon has released a customary concise trading update reporting like-for-like sales growth of 5.1% for the 12 weeks to 20 July 2025, maintaining the same growth rate year-to-date.

The group is benefitting from strong sales of wine, and Guinness is driving draught sales higher. Food sales have also picked up with Chicken-based meals proving popular.

The pub chain currently operates 794 outlets after opening three new pubs but selling nine others during the year. Additionally, five new franchised locations have launched, bringing the total number of franchised Wetherspoon pubs to eight.

The company has also acquired eight freehold reversions for £19 million, purchasing properties where it was previously a tenant.

The firm expects year-end net debt of approximately £720 million, with £220 million of headroom under existing facilities. This gives the pub chain plenty of breathing room and marks an improvement in its financial health compared to recent periods.

Full preliminary results are scheduled for release on 3 October 2025.

“The company has benefitted from favourable weather in the fourth quarter, so that profits are anticipated to be in line with market expectations, notwithstanding the high tax and labour increases for the hospitality industry, which have been widely reported,” said chairman of JD Wetherspoon, Tim Martin.

“In the next financial year, as well as investing in areas such as staff rooms, glass racks for “branded” glasses, and gardens, the company plans to open approximately 15 new managed pubs and about the same number of franchised pubs.”

“Sales volumes, which were very slow post-pandemic, have recently overtaken pre-pandemic levels. Wine, for example, has shown strong growth, with Villa Maria from New Zealand and Prosecco from Italy both shooting the lights out. Spirits have improved in recent months and whisky volumes are significantly above pre-pandemic levels.

“Draught volumes are performing strongly with Guinness being the standout performer. On the food front, breakfasts, terribly slow post-pandemic, have recovered their lustre and are now well ahead. Chicken, also, has put in a clucking good performance and volumes in recent weeks are up by about 50% compared to pre-pandemic levels.”

JD Wetherspoon shares were flat at the time of writing and are 28% higher year-to-date.

Gold closes in on record highs

Gold was closing in on another fresh record high on Wednesday after breaking back through the $3,400 mark.

The combination of geopolitical risks and central bank buying is driving prices higher with technicals supporting further gains in the near term.

“Since bottoming out around $3,245/oz, gold has experienced an impressive rally, supported by several long-term structural factors. Chief among them are escalating geopolitical risks, expectations of a shift in monetary policy, and sustained accumulation by central banks,” explained Linh Tran, Market Analyst at XS.com.

“These three pillars are converging to create a favorable environment for gold to continue asserting its role as a safe-haven and store of value asset.”

Central banks globally are ramping up their purchases of gold and are opting to hold the yellow metal over dollars in some circumstances, providing further upside pressure on the gold price.

Global conflicts are keeping the safe haven trade alive and well. Although the safe-haven trade may not be the primary driver of gold prices currently, the ongoing tensions in the Middle East and Asia keep gold at the forefront of many traders’ minds.

“Geopolitical risks remain a key catalyst driving defensive demand in global markets,” Linh explained.

“The situation in Eastern Europe remains at an impasse, with Russia and Ukraine unable to establish a viable diplomatic roadmap toward lasting peace. The prolonged conflict not only puts pressure on Europe’s energy security but also triggers widespread instability across global supply chains—factors that historically prompt investors to increase their exposure to gold.”

FTSE 100 trades sideways amid UK public borrowing concerns

The FTSE 100 was gently undulating between positive and negative territory on Tuesday as investors weighed a raft of solid updates from UK companies with a worrying development for the UK’s spending deficit.

London’s leading index was 5 points higher at 9,015 at the time of writing after touching a fresh intraday record high early in the session.

“Investors are weighing up fresh company results alongside the latest public borrowing figures,” said Matt Britzman, senior equity analyst, Hargreaves Lansdown.

“Despite an overshoot in June, borrowing is clinging to the OBR’s forecasts, but storm clouds are gathering as weaker tax receipts and soaring debt interest payments signal tougher times ahead. With economic growth faltering and spending cuts unravelling, the Chancellor faces a £15-25bn Budget shortfall, likely forcing higher taxes to preserve fiscal discipline.”

While the state of the UK public finances will be a concern for investors, there were reasons to be optimistic in several company updates on Tuesday.

Compass Group was the FTSE 100’s top riser as investors cheered an 8.6% increase in Q3 sales and strong guidance driven by growth in North America and the integration of recent acquisitions. Shares were over 6% at the time of writing.

“For the full year, organic growth is expected at over 8% with underlying operating profit to expand faster at close to 11%,” explained Derren Nathan, head of equity research, Hargreaves Lansdown.

“The group’s also leaping on the opportunity to consolidate this fragmented market, announcing another 1.5 billion Euro acquisition today for Vermaat Group, which operates at the premium end of the market and comes with an impressive growth and margin profile.”

Centrica shares were 4% higher on news that the group would take a 15% stake in the Sizewell C nuclear plant.

“Sizewell C is a compelling investment for our shareholders and the country as a whole, and I look forward to working with our world-class partners, EDF, La Caisse, Amber Infrastructure Group and the UK government, to make the project a great success,” said Chris O’Shea, Group Chief Executive, Centrica.

Housebuilders were among the losers as trader reacted to rising gilt yields in the wake of the public spending figures. Barratt Redrow lost 2.6% and Taylor Wimpey dipped 1.6%.

“Housebuilders were knocked by the public sector finance figures as the rise in gilt yields suggests the market believes interest rates could stay higher for longer,” said Russ Mould, investment director at AJ Bell.

“Housebuilders are desperately waiting for rates to come down as that could make mortgages more affordable and help more people get on the property ladder.’