VSA Capital Group (LON: VSA) wants to show its support for the Aquis Stock Exchange by refloating itself on that market having left AIM in 2013. VSA Capital is keen to become increasingly involved with Aquis, but it also has expertise in other markets.

Management believes AIM is over regulated and costly and that Aquis Stock Exchange is an attractive alternative. They also want to attract more individual investors to help to finance transactions.

In the first three days of trading, the VSA Capital share price has risen to 23.5p (23p/24p), which values the company at £4.57m. There have been sev...

FTSE 100 rises despite Chinese tech concerns

The FTSE 100 shrugged off concerns around Chinese and Asian shares on Monday as Londons-leading index moved back towards the 7,100 level.

The FTSE 10O was trading at 7,083 shortly before midday on Monday, up 54 points or 0.7%.

The gains were broad with Royal Mail leading the gains. UK-focused financials and house builders among the top risers.

“There was a dose of Monday motivation for the FTSE 100, which opened up 0.6% with house builders leading the upwards drift, as the red hot housing market shows little sign of cooling,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

Chinese Tech

The FTSE 100 gained despite volatility in Asia markets following a report by the Financial Times that Chinese authorities were planning to dismantle Ant group’s Alipay.

“The FTSE 100 started the week with solid gains despite fresh turmoil in Asia as the Chinese crackdown on the tech sector showed little sign of ending,” said AJ Bell investment director Russ Mould.

“News that Beijing is looking to break up Ant Group’s Alipay hit the wider Hang Seng index which was down more than 2% but UK investors seem to have decided this news has little relevance to them for now.

“It’s hard to read the end-game as the regulatory pressure on Chinese firms continues to mount and this uncertainty is proving extremely damaging to the valuation of the likes of Alibaba and Tencent.

“Further setbacks could see sentiment towards this part of the market turn decidedly toxic.”

AB Foods

Associated British Foods was the FTSE 100’s biggest faller after the group unveiled the impact of a summer of uncertainty related to COVID-19.

AB Foods owns retailer Primark and had previously been upbeat on the economic reopening and potential demand for fast fashion.

“It’s not easy being a retail business and the impact of Covid-19 is still being felt as events continue to disrupt trading,” said Mould.

“Even though lockdown measures are now (hopefully) a thing of the past, Associated British Foods-owned Primark still saw volatile trading over the summer because of people being told to self-isolate. There remains a real risk of further disruption if there is an autumn flare-up of Covid as more people interact in society and the Delta variant still rages.

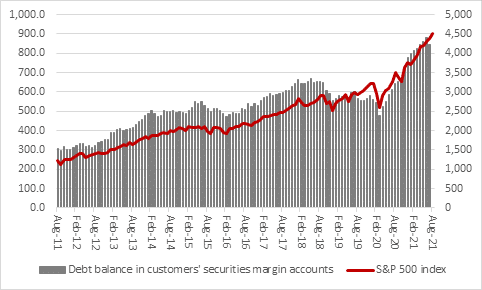

Keep an eye on margin debt as FAANGM sextet supports S&P 500

Hottest areas on US stock market are showing signs of cooling

The S&P 500, the index tracking the performance of 500 large companies listed on US stock exchanges, is aiming to record gains for the eighth month in a row. It would be the index’s best run since January 2018, when it recorded a 10-month surge.

This time around “the FAANGM sextet continues to do a lot of the legwork,” says Russ Mould, investment director at AJ Bell.

Mould also draws attention to the first dip in US margin debt since February 2020.

Margin debt is the amount of money an investor can borrow from their broker via a margin account to buy shares, or even short sell them.

“This looks smart and gears us returns when markets are rising (as the investor or trader can get more exposure) but looks less clever when markets are falling,” says Mould.

Falling asset prices can force so-called margin calls where the investor or trader must start repaying the loan – and sometimes they must sell other positions to fund that repayment, creating a negative feedback loop in markets.

The last time margin debt dropped was March 2020, just prior to the pandemic making its presence felt not just in Asia but Europe and America as well.

“This first dip in margin debt must be watched, especially in light of Securities and Exchange Commission (SEC) queries about regulatory filings from the investment platform Robinhood and questions about its business model and whether payment for order flow is appropriate. It remains to be seen whether this dampens some of the liquidity flow which has done so much to elevate certain sections of the US stock market, but it may be no coincidence that what looked like some of the frothier areas have started to flag.”

“Whether trading losses are sparking a slight decrease in risk appetite or whether a more cautionary approach (perhaps considering Federal Reserve reverse repo operations and talk of tapering) is lessening demand for initial public offerings (IPOs), Special Purpose Acquisition Companies (SPACs) and growth and tech stocks is hard to divine.”

Either way, it does appear that some of the hottest areas of the US market are showing some sign of cooling.

UK GDP figure shows government cannot rely on consumer spending

Figures may be ‘bumpy for a while longer’

UK GDP growth fell to just 0.1% in July, well below City expectations, according to official data, raising question marks over the possibility of the UK economy going into reverse.

The slowdown marks the end of a strong period of growth that started at the beginning of the year.

Factors including the easing of restrictions, pent-up demand and the furlough scheme helped to prop up the economy earlier this year.

However, global supply chain issues and labour shortages have led to the outlook worsening.

The furlough scheme will come to an end this month with 1.6m people still relying on government support.

This is creating fears over a potential rise in unemployment, while ongoing supply chain issues could take some time to be resolved as well.

Paul Craig, portfolio manager at Quilter Investors, commented on the data: “Given July’s stat includes ‘freedom day’, a 0.1% GDP growth figure for July is fairly disappointing. Leisure and entertainment saw good growth, reflecting the easing of restrictions, but this was not enough to offset falls within construction and retail.”

“It was hoped household consumption would help drive the economic recovery, but given concerns around Covid cases and the pingdemic that caused many to self-isolate, it shows the economy cannot solely rely on consumers and instead needs other areas of the economy to start delivering once more.”

“The UK economy is showing some sign of strain with the shortage in HGV drivers and supply chain issues. This is going to take some time to resolve itself, so the figures may be a bit bumpy for a while longer. Inflation remains a concern and this could be enough to spook Andrew Bailey and the MPC into not joining the ECB and withholding its tapering plans,” Craig said.

GDP miss fails to negatively impact UK stock markets

The FTSE 250, which is more focused on UK domestic businesses, nudged 0.26% ahead to 23,860 while the more international-focused FTSE 100 advanced 0.4% to 7,052.

“A big miss on UK GDP expectations didn’t do any harm to the pound, with the currency rising 0.2% against the US dollar to $1.3862. In turn, the main indices on the UK shrugged off the news,” says Russ Mould, investment director at AJ Bell.

“Helping to steady the ship was a conversation between US President Joe Biden and Chinese President Xi Jinping where they discussed the need to ensure competition doesn’t veer into conflict. The fact the two parties are engaging is a positive and perhaps long overdue, given this was only Biden’s second call with Xi since coming into power.”

Markets will want to see a rebuilding of relationships after damage has been done in the past.

“The latest engagement between the leaders certainly helped to lift Asian markets, with the Hang Seng rising 1.4% and the Nikkei up 1.3%. Investors are clearly hoping that better relationships between the US and China will be good for trade.”

“Add in the fact that the European Central Bank didn’t spook investors too much with its latest policy update – reassurance that it will only slowly withdraw stimulus measures – meant that markets are ending the week on a much brighter note.”

“There are still the headwinds of inflation, supply chain issues and Covid Delta variant to contend with, but on balance markets are still finding plenty of reasons to keep buying equities.”

FTSE 100 Top Movers

Antofagasta (2.72%), Lloyds (2.16%) and Burberry (1.8%) are leading the way on the FTSE 100 which is in a defiant mood on Friday.

While IAG (-2.06%), Coca-Cola (-0.9%) and Melrose Industries (-0.74%) make up the bottom three on the blue-chip index.

Argo Blockchain secures loan backed by Bitcoin

Loan allows Argo to retain its current Bitcoin holding

Argo Blockchain (LON:ARB) confirmed on Friday that it has secured a £18.05m loan agreement with Galaxy Digital by using some of its Bitcoin as collateral.

The loan will mature on 29 October 2021.

The blockchain mining company’s outstanding loan with Galaxy is valued at £14m, meaning the new loan agreement will come to a total of £32.05m.

The money will be allocated, in addition to the funds raised by the company previously, to continue the build-out of the West Texas data centre and to meet the firm’s operating cash flow requirements.

The loan will enable Argo to retain its current Bitcoin holding, whilst further expanding its mining operations.

“Argo is delighted to continue working with Galaxy as its financing partner,” the company added.

Argo Blockchain made £6.83m in mining revenue last month, an increase of £2.23m, as the price of bitcoin rose.

The bitcoin mining company mined a total of 206 bitcoins in August, down from 225 in July, bringing the overall amount mined for the year-to-date to 1,314.

Argo sold 61 bitcoins last month, and kept a total of 1,659 bitcoins on its balance sheet, priced at a market value of $82m as of Friday morning.

Peter Wall, Chief Executive of Argo and interim Chairman said: “I am pleased that we have been able to deliver these results at an improved margin this month and continue to deliver value to our shareholders. We are also delighted to have released our Climate Strategy and remain committed in our efforts to enact positive change within the crypto mining sector.”

Argo Blockhain, listed on the London Stock Exchange (LSE) at present, is weighing up a secondary listing on Nasdaq.