Churchill China (LON: CHH) has demonstrated its resilience during the Covid-19 lockdowns and the recovery in the second quarter of 2021 was impressive. This has enabled the ceramics manufacturer to return to paying dividends.

Lockdowns were still in place during the first quarter, so there was limited demand from the hospitality sector. May and June revenues from hospitality were ahead of the same period in 2019. More than two-thirds of revenues came from exports. The average selling price increased by 13%. The momentum continued into the second half.

US interim sales were flat, but elsewhere ...

Gary Gensler right to say crypto needs regulation says deVere CEO

Chair of US Securities and Exchange Commission has called for the SEC to get power to oversee the crypto market

Gary Gensler, chair of the US Securities and Exchange Commission (SEC) is correct about the need to regulate cryptocurrency trading platforms according to Nigel Green, CEO of deVere Group.

In an interview with the Financial Times, Gentler said he was “technology neutral”, adding that cryptocurrencies are no different to other assets when it comes to public policy requirements, in terms of protecting against illicit activity and maintaining financial stability.

Green says: “It must be championed that the man at the top is taking a future-focused and pragmatic approach to cryptocurrencies – which have a market capitalization of more than $2trillion and which are becoming an increasingly dominant part of the mainstream global financial system.”

The deVere CEO believes cryptocurrencies, such as Bitcoin, Ethereum, Cardano, XRP, among others, are here to stay as financial assets and as mediums of exchange.

“Therefore, they must be brought into the regulatory tent and be held to the same rigorous standards as the rest of the financial system. The best way to do this is through the exchanges,” says Green.

Gensler’s interview with the Financial Times comes on the back of his recent calls to for Congress to grant the SEC more power to oversee the growing crypto market.

“The watchdog needs more powers over the market as there’s a clear direction of travel: both institutional and retail investors are taking Bitcoin and other cryptocurrencies more and more seriously. They are increasing their exposure to them at a faster rate than ever before,” said the deVere CEO at the time.

“The SEC seems aware that digital assets are the inevitable future of money, therefore they require more oversight.”

Nigel Green is both a long-term and high-profile advocate of cryptocurrencies, but also of regulation of the sector.

Over in El Salvador bitcoin will become legal tender as of September 7, alongside the US dollar.

Many countries across the world will be watching to see what happens when bitcoin becomes legal tender in the Central American nation.

A comparison of EIS Funds and Venture Capital Trusts (VCTs)

Venture capital trusts and EIS funds have been rising in popularity amongst high-income investors looking for tax-efficient strategies. Here’s the guide to understanding them:

What are VCTs?

Venture capital trusts are listed investment vehicles investing in younger companies in pursuit of high returns. VCTs have tax benefits, with the government keen to incentivise investment in companies that might boost the British economy.

These benefits include being able to deduct 30pc of your investment against your income tax bill (up to a maximum investment of £200,000 per annum), as well as tax-free dividends and capital gains. In order to qualify for this, investors must keep their money invested for a minimum of five years.

What are EIS funds?

EIS funds are specialist investments that make use of a similar scheme (the Enterprise Investment Scheme) incentivising investment in high-growth businesses by offering generous tax breaks.

The EIS scheme itself is newer than VCTs, and was originally designed to cover direct investments (e.g. into a single company). The scheme has adapted over the years to include EIS funds, which invest in a small portfolio of eligible companies, similar to a venture capital fund.

What are the main differences between the two?

VCTs are typically more diversified than EIS funds, often backing a portfolio of 30 or more companies. EIS funds rarely invest in more than ten companies (and sometimes only back a single business), thus magnifying the size of the potential gains and losses.

VCTs are generally considered more liquid than EIS funds, in that they are listed on the stock exchange. However, being a specialist investment, secondary trading is rare, and sellers will often receive less than they paid.

With both VCTs and EIS, it’s worth paying careful attention to exit strategies. Many VCTs are set up as time-limited investments, with the intention that managers will buy back the shares at the end of five years, or wind up the trust and pay back capital as a final dividend.

What are the tax differences?

Both VCTs and EIS funds provide income tax relief of 30pc, as well as tax-free capital gains. In the case of VCTs, dividends are also tax-free.

Both investments have an upper-ceiling on the amount that can be used for income tax relief. For EIS funds, the maximum eligible investment is £1m per annum (or £2m for funds focusing on ‘knowledge intensive companies’). The ceiling for VCTs is lower, at £200,000 per annum.

EIS funds have some specific benefits, not available to VCT investors. These include:

- The ability to defer tax on capital gains from elsewhere (an investor can defer paying CGT on the proceeds of a secondary property, for example, if those funds were invested directly into an EIS investment);

- Exemption from inheritance tax (provided the investment has been held for two years prior); and

- The potential to claim additional tax relief (up to the value of 70pc of the original investment) if the investment is sold at an effective loss

All of these advantages depend on the investment being held for the minimum period (five years for VCTs; three years for EIS funds).

How have they performed?

The niche investment strategies pursued by VCTs and EIS funds mean that performance varies wildly across the sector. Some large VCTs have delivered returns of 60-80pc over the past five years (and over 200pc over ten years) whereas others have fallen by more than 10pc.

Of course, these returns don’t take account of the tax relief (both on the initial investment and, potentially, on reinvested dividends) which would have increased investors’ effective returns.

Both VCTs and EIS funds have been rising in popularity in recent years, as high-earning investors seek to maximise their tax relief. According to the AIC, the amount invested in VCTs in the most recent tax year (ending April 2021) was £658m – the third highest in ten years.

What are the most popular choices?

Popular VCTs include Octopus Titan, Baronsmead and Albion.

Tech-focused Octopus Titan has previously backed the likes of Zoopla, travel brand Secret Escapes and healthy snack company Graze. It currently maintains a portfolio of 80 early-stage companies.

Baronsmead launched its second VCT last year, and currently backs logistics specialist Carousel, AI customer service platform Netcall, and Vietnamese restaurant chain Pho.

Albion currently invests in large hydroelectric schemes in Scotland (Chonais and Gharagin), a Harley Street fertility clinic (Evewell), blockchain analytics firm Ellipsis, and AI-enabled digital marketing company Phrasee.

Popular EIS funds include Access, Downing Ventures, and West Hill Capital.

Access looks to invest alongside established angel investors, whose previous investments include geocode service What3Words, energy storage company HighView, and AI keyboard app Swiftkey (acquired by Microsoft in 2016).

Downing Ventures focuses on tech and life sciences, with investments including bionic limb manufacturer OpenBionics, genetics analytics company GENInCode, and make-up brand Trinny.

West Hill Capital’s past investments include diagnostics company Testcard, foreign exchange platform Freemarket, and hospitality app Onvi.

UK house prices see unexpected rise during August

The average price of a UK property is £248,857

UK house prices rose by around £5,000 last month as the property market continued its ascension as the government’s stamp duty holiday is wound down across England and Northern Ireland.

According to the Nationwide building society, the cost of the average property had risen by £4,628 to £248,857.

This represents a monthly rise of 2.1%.

Year-on-year property inflation increased by 11% in August, up by 0.5% compared to the month before. The move is despite expectations that house price increases would settle as the threshold for paying stamp duty was halved to £250,000 in July.

With interest rates at record lows, increased demand for space during lockdowns and support offered by the government, have caused the average price of a UK home to be 13% higher than 18 months ago.

Robert Gardner, Nationwide’s chief economist, said: “The bounceback in August is surprising because it seemed more likely that the tapering of stamp duty relief in England at the end of June would take some of the heat out of the market.”

Sam Mitchell, CEO of online estate agent Strike, added: “House prices in the summer usually see a dip as people’s attention turns to summer activities, but August has defied all odds with annual house price growth rising to 11%.

“Now the stamp duty holiday is starting to taper, many are wondering whether this demand can sustain. But let’s not forget that although the stamp duty holiday has ended, there is still a huge supply and demand imbalance issue in the UK, and the incentives that are still available – like the stamp duty savings still to be had for houses under £250,000 – are driving this imbalance further.

“The other incentives on offer will no doubt contribute to this too, with increased availability of 95% mortgages and low interest rates just some of the things that buyers can take advantage of. And who knows, the government might also have something planned to keep the market moving, but only time will tell!”

Blackfinch bolsters Ventures team by appointing new director

Brookner has over 13 years’ worth of experience

Blackfinch, the investment platform, has made an addition to its investment division’s senior management team by appointing James Brookner as Ventures Director.

Brookner was previously a consultant at Accenture, where he worked on projects in mergers and acquisitions (M&A), fast moving consumer goods (FMCG) and digital innovation. He also co-founded three companies including one operating in the enterprise software space.

He has over 13 years’ worth of experience having previously been employed by Station 12 Ventures where he played a role in a number of early-stage transactions.

Brookner later joined Velos Growth Capital Partners where he led multiple transactions – including raising

funds and taking on board roles – and most recently worked at Barclays Ventures where he sought

out investments aligned to the bank’s growth strategy in FinTech and cybersecurity.

Brookner expressed his excitement at the prospect of joining Blackfinch, bringing attention to his desire to build its Commenting on his appointment, James says he is ‘looking forward’ to building Blackfinch’s

investment portfolio and backing innovative technology driven companies that reflect the firm’s

environment, social and governance (ESG) values.

Blackfinch revealed earlier this year that it raised £10.4m via its Ventures Portfolios in the tax year ending April 2021. The investment firm said this money has been invested in innovative start-up and early-stage technology companies across the UK in a variety of industry sectors.

A further £5.8m was raised through its Spring Venture Capital Trust (VCT) which invests

primarily in companies at the start of their growth journey.

Dr Reuben Wilcock, who leads the Blackfinch Ventures team, said: “James has an impressive amount of experience working with fast growth tech-enabled companies that are indicative of the sort of businesses that form our own ventures portfolio.”

“His hands-on approach will add further value to those businesses that choose us as their investment partner, and we are delighted to have him onboard.”

Blackfinch is an investment specialist and trusted provider working in partnership with advisers. Based in Gloucester and employing more than 100 full-time members of staff, it has a heritage dating back 25 years.

The insurtech making big splash in retail

Seamless insurance distribution for any business, anywhere

Quotall is unlocking a £51bn UK market

Sponsored by Quotall

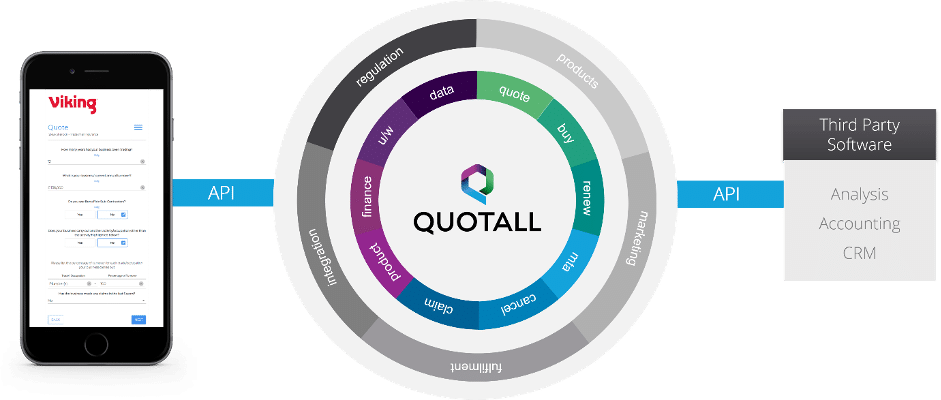

Quotall is a specialist insurtech software house helping large, high-profile enterprises to enter the insurance market.

Up to now brands have struggled to extend into insurance due to significant up-front costs, regulatory concerns, legacy insurance technology and a lack of in-house expertise.

As a result, only 5% of the UK’s £51bn insurance market is sold via retailers, utilities or affinity groups.

Quotall’s insurance ecosystem service aims to remove these barriers to enable rapid market entry.

Business Highlights

- Established in 2010 by a highly experienced management team

- Raised £4m to date

- Targeting clients with a potential £500k+ ARR

- Office Depot insurance service launched January 2021

- WHSmith insurance service launch in Q4 2021

A unique insurance ecosystem for rapid market entry

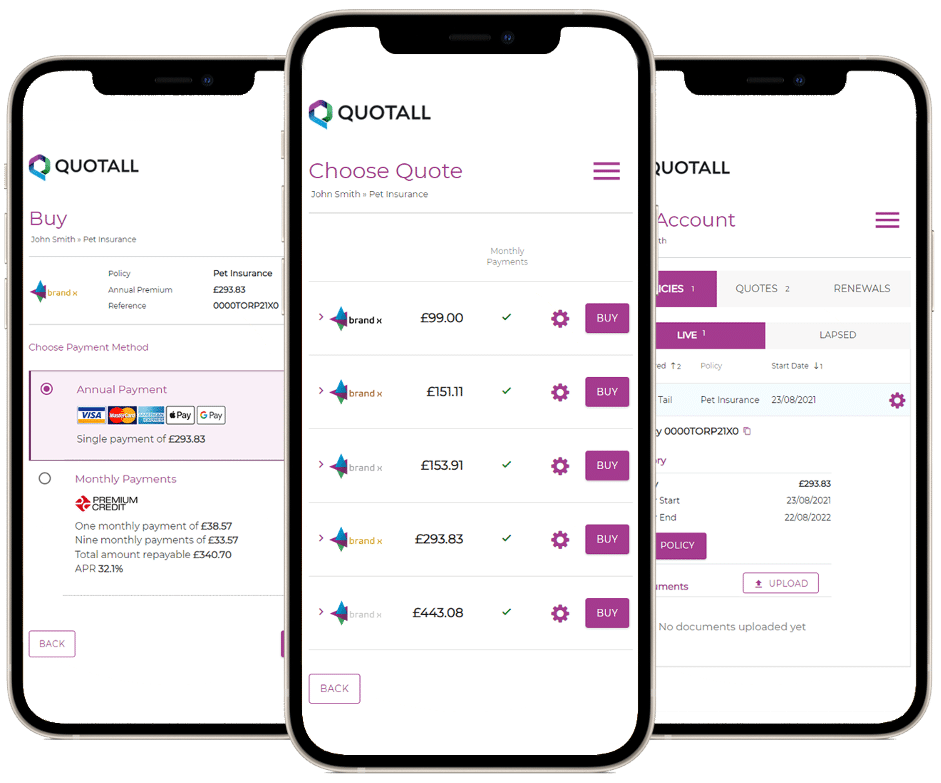

Our ecosystem service is built to be a simple, fast, and efficient way for brands to extend into insurance.

At its heart our cloud-hosted SaaS platform is designed to support multi-channel insurance distribution anywhere in the world. It enables our clients to offer a comparative quote, buy and self-service insurance proposition out of the box.

Around this we’ve built a network of services and partners to provide everything from regulatory cover and product sourcing through to marketing and analytics.

A highly scalable revenue stream

Quotall generates its revenue from multiple streams including:

- Commission shares for the provision of our system and supporting services

- Transaction (work transfer) fees – paid by insurance partners for the automation of insurance transactions on the Quotall platform

- Underwriting profit shares paid by insurers and MGAs subject to product performance.

- Premium finance – a percentage of the finance charge on monthly premium instalments

Our revenue scales with each client engagement and will benefit from the insurance renewal cycle and the underlying profitability of the insurance arrangements.

Want to find out more?

To find out more about our business or to get in touch please visit our website at quotall.com or watch our video.

Investing in Sustainable Digital Infrastructure with Triple Point’s Thor Johnsen

The UK Investor Magazine Podcast is joined by Thor Johnsen, Triple Point’s Head of Digital Infrastructure, for a deep dive into the Digital 9 Infrastructure Investment Trust.

The name D9 is derived from the UN’s Sustainable Development Goal 9 which is: Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation.

D9 Infrastructure are doing just that through their investment strategy to provide investors with a target yield of 6% by allocating funds to assets providing critical infrastructure facilitating the digital world.

Digital 9 Infrastructure plc will look to invest in:

- Subsea fibre-optic networks

- Data centres

- Terrestrial fibre-optic networks

- Wireless via macro cell towers and small cell networks

Find more information on the D9 Infrastructure website:

Red Rock Resources given 1.6p price target by First Equity

London-based broker, First Equity, has analysed each of Red Rock Resources‘ (RRR) (LON:RRR) investments and projects, calculating a sum-of-the-parts valuation and a share price target.

First Equity has calculated a total sum of the parts value of £19.5m, which is significantly more than Red Rock’s current market cap (£7.3m), equating to 1.60p per share.

The broker argues that the market has not priced in the very near-term potential of Red Rock Australasia (RRAL) and Elephant Oil attaining a market listing within the next few months and realisable asset value which would then be added to the balance sheet, a figure that is very likely to surpass Red Rock’s current market cap.

First Equity estimates the probability of RRAL and Elephant Oil listing on a recognised stock market within the next 6-months is 70% and 80% respectively.

Along with these IPO valuation catalysts, investors can benefit from further exploration news and developments on the Mikei gold and Luanshimba copper-cobalt projects, where active exploration campaigns are in motion, the broker said in a research note.

On the Mikei Gold Project in Kenya, an initial 2,000-metre drill programme is underway. The results from this could help improve the JORC resource of 723,000 ounces at 1.49 g/t, which forms the basis for First Equity’s project-based valuation estimate.

- The greatest potential enhancement to project value in the next 12-months could come from the battery metals focused Luanshimba copper-cobalt DRC project, where a 2,000-metre drill programme is in progress.

- The entrepreneurial culture at Red Rock has resulted in the creation of RRAL and its progression to IPO since 2020. The company currently aims to create two significant listable JVs in other major gold provinces, thereby creating further potential upside.

| Investment/Asset | Value | Valuation Method |

| Power Metal Resources plc | £0.86m | actual listed market |

| Jupiter Mines Limited | £1.70m | actual listed market |

| Red Rock Australasia Pty Ltd | £5.10m | est. risked IPO |

| Elephant Oil Limited | £0.96m | est. risked IPO |

| Mikei Gold Project | £9.69m | est. gold JORC value |

| DRC Projects | £0.75m | partial cost |

| El Limon Royalty | £0.58m | NPV10 |

| Cash & Other Liquid Assets | £0.50m | actual listed market |

| Debt | (£0.65m) | |

| TOTAL | £19.5m |

RRR is an AIM-listed mining company which manages a diverse and international portfolio of projects and investments and seeks to add value through development throughout all phases of the commodity cycle across both the mining and minerals and oil and gas sectors.

First day of September brings a pick-up in European equity markets

There was an upturn in equity markets across Europe on the first day in September. The FTSE 100 is up by 0.94% to 7,187, while in France the CAC 40 added 1%, and in Spain the IBEX 35 grew by 1.6%.

“Summer holidays are over; children are returning to school and we’re now only weeks away from the start of autumn. This shift in mindset also applies to investors as they sharpen their focus on market opportunities in the final section of the year,” says Russ Mould, investment director at AJ Bell.

“On the UK market, mining was the only sector to struggle after metal prices took a hit. Investors instead showed more interest in the oil and gas sector where commodities prices were stronger,” Mould added.

FTSE 100 Top Movers

Just Eat (2.97%), Informalities (2.94%) and JD Sports (2.92%) are leading the way on the FTSE 100 on Wednesday morning.

At the other end, miners Fresnillo (-1.55%), Antofagsta (-1.34%) and Rio Tinto (-1.09%), have seen the sharpest falls in the values of their shares.