Palantir will also accept Bitcoin payments

Palantir (NYSE PLTR), the data mining company co-founded by technologist Peter Thiel, confirmed recently via a statement that it purchased $50m in gold bars.

The move by Palantir is in response to what is deems to be an uncertain economic outlook, combined with a lack of desire to keep money stored in cash.

Last year, as the pandemic got worse and the US government continued its efforts to stimulate the economy, the price of gold went past $2,000 per ounce.

Investors are increasingly voicing their concerns around inflation, while gold is historically seen as a hedge against it.

“During August 2021, the Company purchased $50.7 million in 100-ounce gold bars,” Palantir said in the Aug. 12 earnings statement for its fiscal second quarter. “Such purchase will initially be kept in a secure third-party facility located in the northeastern United States and the Company is able to take physical possession of the gold bars stored at the facility at any time with reasonable notice.”

Other companies see cryptocurrencies, namely Bitcoin, as the superior asset in which to hold reserves. In particular Tesla, which bought $1.5bn worth earlier in the year.

It turns out that Peter Thiel’s Palantir has plans in that area too.

The digital mining company has also invited its customers to pay for its data analytics software in Bitcoin.

The American company revealed it would be accepting Bitcoin as a form of payment and hedge against uncertainty.

A spokeswoman told Bloomberg that no one has paid the firm in Bitcoin yet. COO of Palantir Shyam Sankar said the decision to accept Bitcoin “reflects more of a worldview”.

“You have to be prepared for a future with more black swan events,” he added.

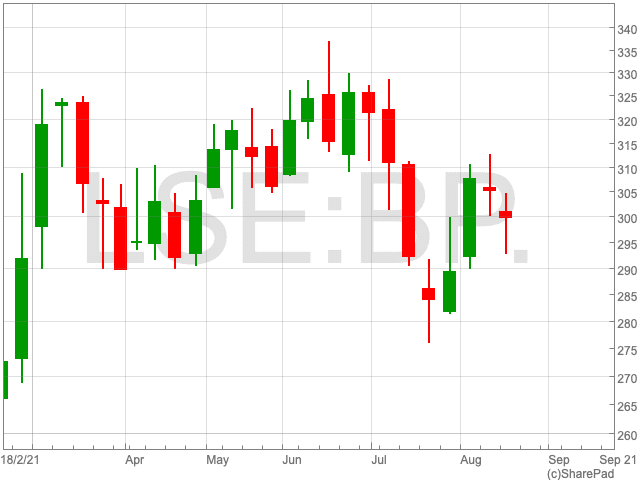

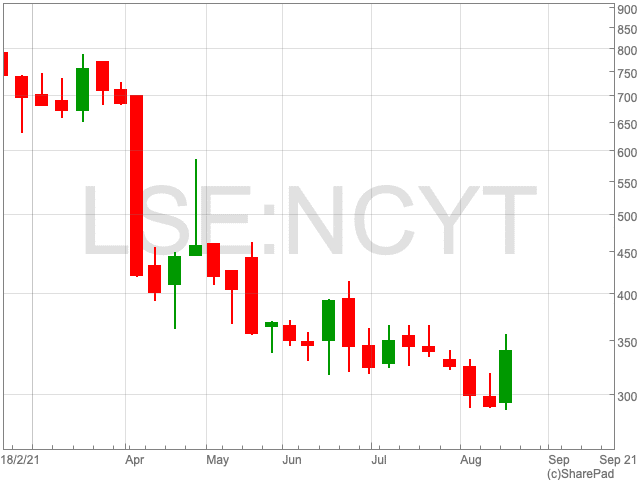

The Palantir share price closed up by 5.47% on Wednesday.