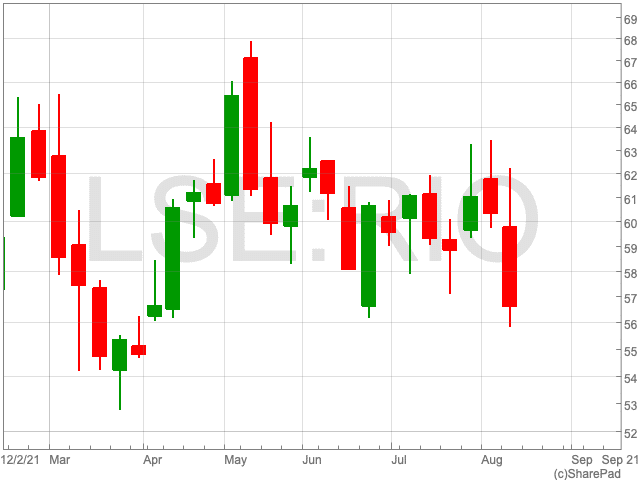

The BHP share price (LON:BHP) is trading close to an all-time high. This is because of hopes for “a post-pandemic economic recovery, commodity price strength and the company’s own capital discipline”, said AJ Bell investment director Russ Mould.

These factors have allowed the company to rein in capital investment and acquisitions, sell assets and pay down debt.

While the FTSE 100 company has six main product areas, iron ore and copper are the two that continue to contribute overwhelmingly to its profit levels.

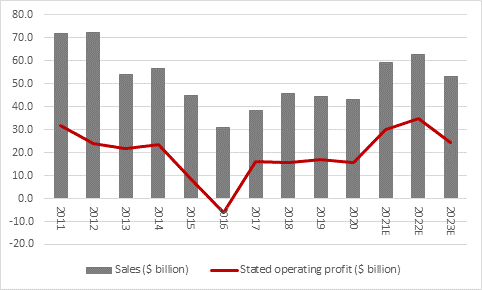

Analysts’ Consensus Forecasts

Analysts are expecting sales of $59bn for BHP‘s full-year results, compared to $43bn for the same period a year before. For the year beginning analysts have predicting sales of $63bn.

Operating profit for the full-year is expected to double to $30bn, along with an additional increase to $35bn in 2022.

Analysts are expecting a doubling of earnings per share (EPS) to $3.15, with a further one-third advance in the coming year to $4.41.

Finally, a dividend of $2.89 against $1.20 a year ago, with a further increment to $3.34 expected in the coming year.

“That means BHP is expected to show the greatest dividend growth in sterling terms of any firm in the FTSE 100 between 2020 and 2022 and is enough to leave the stock on a double-digit forward yield,” said Russ Mould.

A question mark remains over whether the current earnings and dividend success is sustainable. Analysts do not appear to think so.

“They have sales, profits, earnings per share and dividends falling in the year to June 2023, which is in keeping with central banks’ view that current price inflation is ‘transitory,’ and the result of a post-lockdown surge in demand, production bottlenecks and shipping shortages,” said Russ Mould.

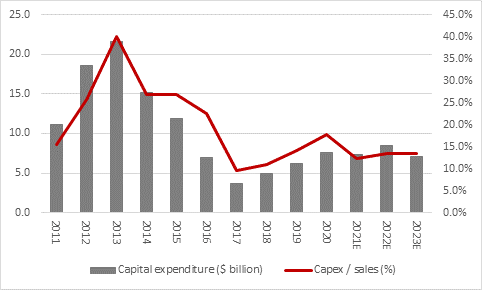

Capital Expenditure and Net Debt

Two final numbers to watch are capital expenditure and net debt. Net debt ended the first half at $11.8bn, the very bottom of the company’s $12 to $17bn target range. Capex was forecast to be $7.3bn in fiscal 2021, while the last published budget for 2022 was $8.5bn.