Meggitt shareholders will stand to earn 800p per share, a 71% premium on last week’s close

Meggitt, the British aerospace company, has agreed a takeover deal from Parker Hannifin, its American rival.

It is the latest in a string of approaches for UK-listed companies from buyers based overseas.

If the deal goes ahead, Meggitt shareholders will stand to earn 800p per share, amounting to a premium of 71% on last week’s close.

The board of the FTSE 250 engineering company has unanimously recommended that shareholders accept the 800p-per-share deal.

“Meggitt is one of the world’s foremost aerospace, defence and energy businesses, leading the market with a strong portfolio of technology and manufacturing capabilities, and holding a significant amount of intellectual property,” said the Meggitt chairman, Sir Nigel Rudd.

“While Meggitt is currently pursuing a strong, standalone strategy which will deliver value to shareholders over the long term, Parker’s offer provides the opportunity to significantly accelerate and de-risk those plans, while continuing to deliver for shareholders.”

The bid comes amid a flurry of bids for UK companies by US buyers, specifically in the defence sector.

Recently, the UK government has been keeping a close eye on Cobham’s private-equity backed takeover of Ultra Electronics.

In addition, Senior, the FTSE 250 aerospace and defence group, rejected an approach by Lone Star, the US investment firm.

Parker would nearly double its aerospace operation with the acquisition of Meggitt, the company that supplies the UK government.

Parker has made a series of legally binding pledges to the government to guard Meggitt’s operations.

Following the downturn caused by the pandemic, Meggitt was forced to cut 1,800 jobs as Covid-19 ravaged the travel sector.

The company has also confirmed that it swung to a profit for H1 2021 as it continued on its path to recovery.

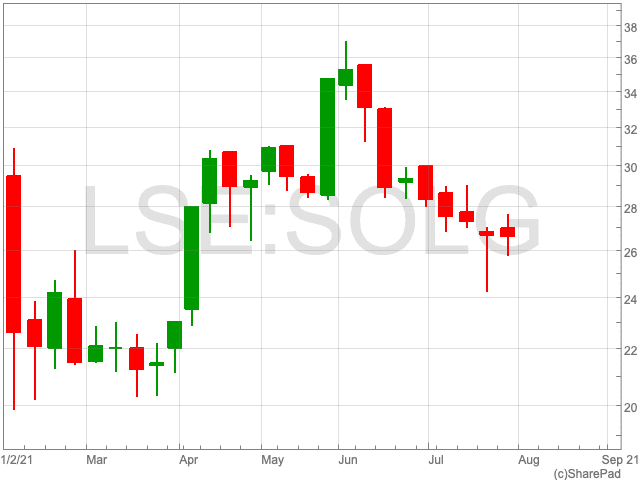

The Meggitt share price is up by 56.85% on Monday to 735.80p, blowing past the previous record high of just under 700p.