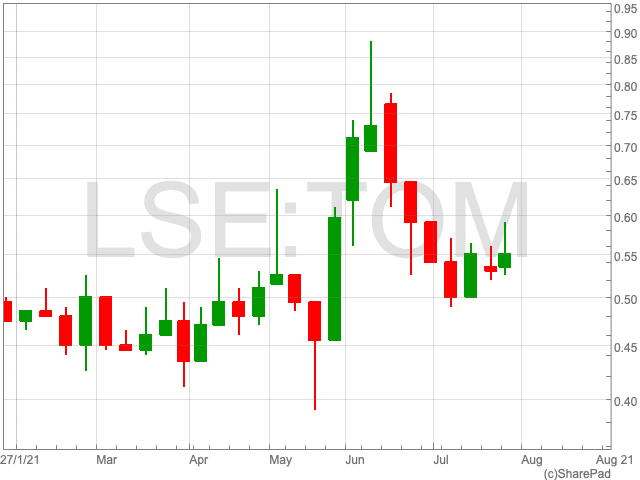

GENinCode has a significant addressable market in the risk assessment and diagnosis of cardiovascular disease. There are already initial sales for the diagnostic products, but the company needs to show that it can build up demand in other markets, particularly the US.

The autumn should bring news about progress with FDA approval. That could boost the share price.

The shares did not get off to a good start and the price has fallen to 36.7p (36.4p/37p). That is despite positive news about clinical results for Thrombo inCode, a diagnostic for inherited thrombophilia and venous thromboembolism ris...

UK house prices now 30% above pre-financial crisis peak

Zoopla says the average price of a property is now £230,700

UK house prices reached a new high last month, 30% above the peak prior to the 2008 financial crisis, according to property website Zoopla.

Zoopla also said that the average price of a property is now £230,700, 5.4% higher than June 2020.

The move comes as the volume of homes being placed up for sale is down by 25% during H1, compared to the first half of 2020.

Zoopla said it has seen can increase in the popularity of larger family-style homes, as demand for houses has more than doubled compared to the levels seen prior to the pandemic.

Supply and demand have been out of quilter since the beginning of the year, while there is no sign that supply levels will catch up soon, according to the property website.

“Demand for houses is twice as high as typically seen at this time of year between 2017 and 2019, accelerating away from demand for flats, creating a disparity in average price growth across the two property types,” Zoopla said.

“House prices are being supported in part by a severe shortage of homes for sale, with stock levels down some 25% in the first half of the year compared to 2020.”

Transaction levels are continuing apace, with agreed sales 22% up compared to the same point in 2020.

Additionally, the housing market in the capital is falling behind the rest of the country and looks set to carry on doing so.

The North East saw the highest level of growth at 7.3%, while Yorkshire and the Humber closely followed with 6.8%.

London’s market grew at a rate of 2.3%, 3.1% lower than the national average.

Grainne Gilmore, head of research at Zoopla, comments: “Demand is moderating from record high levels earlier in the year, but remains significantly up from typical levels, signalling that above average activity levels will continue in the coming months.

“Demand for houses is still outstripping demand for flats. To a certain extent this trend will have been augmented by the stamp duty holiday, with bigger savings on offer for larger properties – typically houses.”

FTSE 100 feels the pressure from all angles on Tuesday

The FTSE 100 is down by 0.92% during the morning session on Tuesday as Reckitt delivered a disappointing trading update, in addition to weakness among mining stocks.

“It’s no surprise to see Unilever fall in sympathy with Reckitt as investors are likely to be questioning the true defensive characteristics of these consumer goods companies. Yes, their products may be in demand during good and bad economic conditions, but that doesn’t mean profit margins can’t be squeezed,” says Danni Hewson, financial analyst at AJ Bell.

As reported yesterday, sentiment towards Chinese companies worsened as the government continues too come down on tech firms. Hong Kong’s Hang Seng index fell 4.5% with some of the big tech stocks weighing on the index including delivery platform Meituan down 15% and internet giants Alibaba and Tencent both declining by approximately 8%. “Those movements weighed on FTSE 100 investment trust Scottish Mortgage which has stakes in all three companies,” said Hewson.

“It’s been a difficult year for investors in Chinese stocks due to regulatory interference. This has been an underappreciated risk for companies where most of the attention has been on the fast levels of revenue growth.”

“Another bout of US companies will report earnings later today including Alphabet, Apple and Microsoft and a strong showing from them could encourage some investors to ditch Chinese tech names in favour of the more familiar US names. However, regulatory intervention also remains a big risk to this part of the market, as concerns grow over the largest players having too much power.”

FTSE 100 Top Movers

Croda International (4.24%), Just Eat (1.89%) and Segro (0.67%) are elating the way on the FTSE 100 on Tuesday out of the few companies to be in the green.

At the bottom end, Reckitt (-8.55%), Informa (-3.64%) and Intermediate Capital Group (-3.23%) are the biggest fallers during the morning session.

Moonpig sales and profits double thanks to pandemic

Moonpig made an adjusted profit before tax of £92m

Moonpig confirmed on Tuesday that both its annual sales and profits have doubled as the greetings cards company released its first set of results since its IPO in February.

The company said it benefited from an increase in spending during the pandemic.

Moonpig‘s revenue climbed to £368m in the year to April, an increase of 113% compared to 12 months ago.

The firm made an adjusted profit before tax of £92m, up from £44m a year before.

Moonpig’s profit levels came in at the top end of its guidance which it established when it floated back in February.

However, the Moonpig share price is down by 6% on Tuesday to 399.1p per share.

The online retailer said will continue to scale as it is retaining customers acquired over the past year.

The group will make investing in marketing and market share capture over profit margin a priority, targeting annual revenue growth of around 15% and an adjusted underlying earnings (EBITDA) margin of 24-25% in the medium-term.

“Our customer proposition continues to improve, with enhancements to our card and gifting ranges, and more delivery options than ever before,” said Moonpig chief executive, Nickyl Raithatha.

“The long-term growth opportunity remains vast, with the majority of the card and gifting market still offline, and we have never been in a better position to capture this growth.”

In the next year, sales are expected to grow by half and reach between £250m and £260m.

Tesla profit soars as car sales boom despite chip shortages

Tesla delivers a record 200,000 cars to customers

Tesla (NASDAQ:TSLA) has revealed that its profits surged during the last quarter, despite supply problems caused by shortages of semiconductor chips among other issues.

During the previous quarter ending in June, its sales rose to £8.6bn, up from £4.3bn the year before.

Over the same time period the electric car manufacturer delivered a record 200,000 cars to customers.

Tesla confirmed that its profits improved thanks to the strong level of sales.

Profits during Q2 were £800m, up from £75.5m last year, thanks in part to sales of its Model 3 sedan and Model Y.

The results came as carmakers across the world found it difficult to deal with demand thanks to a shortage of semiconductors.

“Our biggest challenge is supply chain, especially microcontroller chips. Never seen anything like it,” said Elon Musk, Tesla’s chief executive. “Fear of running out is causing every company to over-order – like the toilet-paper shortage, but at epic scale.”

The company adapted, using other suppliers, while the supply issue has not discouraged customers from wanting Tesla cars.

“Public sentiment and support for electric vehicles seems to be at a never-before-seen inflection point,” the company said in a statement.

The Tesla share price closed on Monday up by 2.21%.

Tesla also revealed that losses from bitcoin offset some of the money it made from its car sales.

The carmaker stomached a loss of $23m on its bitcoin holdings over recent weeks.

Having purchased $1.5bn worth of the cryptocurrency during Q1 of this year, Tesla did not buy or sell any digital assets during Q2.

Reckitt feels the impact of rising commodity prices

Reckitt made £6.5bn in revenue over the past six months

Reckitt (LON:RKT), the FTSE 100 consumer goods group, confirmed the impact of inflation on its Q2 results as commodity costs rose sharply.

The manufacturer of Dettol and other such cleaning products said its sales slowed down as the high levels of demand seen at the beginning of the pandemic eased off.

Reckitt made £6.5bn in revenue over the past six months, which was just below analysts’ expectations.

The company’s balance sheet was buoyed by the sale of its Chinese infant formula business for approximately £1.5bn in June.

Reckitt confirmed a loss before tax during H1 of £1.94bn, a swing from a £1.44bn profit the year before.

Its operating profit margins narrowed 2.9% in H1 to 21.6%, down to rising commodity prices, Reckitt said.

“Cost inflation accelerated in the second quarter and it will take time to offset this headwind with productivity and pricing actions being implemented,” chief executive Laxman Narasimhan said.

Over the course of the past year Reckitt recorded record sales levels as demand for cleaning products and cold and flu brands soared.

As consumers tended to remain at home during the pandemic, cooking and washing more, demand for the related good increased.

“Overall demand in the disinfectant category remains significantly higher than pre-Covid levels and the two-year stacked growth of our hygiene portfolio is up 34.1 per cent, compared to a normal growth rate, pre-Covid, of around four per cent,” Narasimham said.

The company is expecting the coming quarter to be a bit slower in comparison with strong results from 2020 and the year before.

“We are encouraged by the progress we have made to strengthen the foundations of the business and reposition ourselves for sustainable growth. We expect to exit 2022 with a revenue growth run rate in the mid-single digits as we make our way towards our medium-term adjusted operating profit margin target in the mid-20s by the mid-20s,” Narasimham said.

The Reckitt share price is down by 9.28% during the morning session.

Mode PLC: Bitcoin and Open Banking with Jonathan Rowland

The UK Investor Magazine Podcast is joined by Jonathan Rowland, Chairman of Mode PLC.

Mode PLC provides Bitcoin and Open Banking services to it’s users and is a unique position here in the UK.

Mode have recently partnered with The Hut Group (THG), one of largest e-commerce groups in the UK, for Mode payments integration meaning 30+ THG brands will display Mode as a payment option at their online checkout.

Mode has also just launched their new payments solution in BETA so Mode app users will be able to utilise business payment solutions.

From a regulatory perspective, Mode became the fifth company to achieve AMLD5 registration with the FCA and Jonathan discusses how this demonstrates the strength of their business.