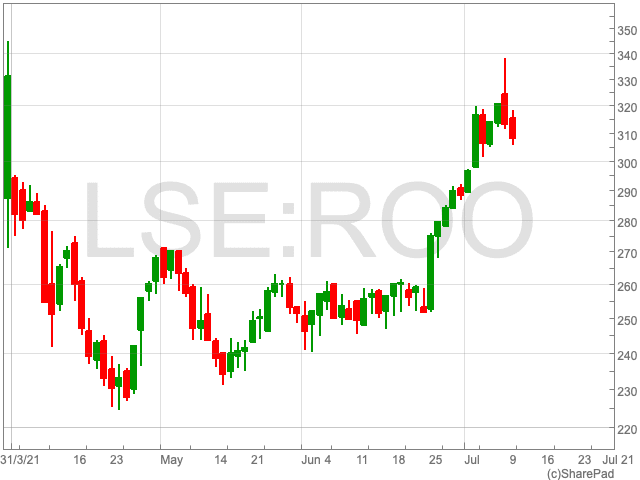

Plus 500 revenue for H2 to June 2021 recorded at $346m

Plus 500 (LON:PLUS) said its trading levels had fallen back since the early period of the pandemic, while the company reported ‘positive momentum’.

The fintech company’s revenue for H2 to June 2021 came in at $346m, compared to $564m over the same period of time in 2020, as Plus 500 reaped the benefits from surging demand during the pandemic. For the first six months of 2019, the company’s revenue was recorded at $148m.

Despite the fall in revenue, Plus 500 drew attention to a “very strong period of customer acquisition” during the first half of the year.

The firm said that 136,980 new customers came aboard, down from 198,176 people in 2020. This figure stood at 47,540 in 2019.

Overall, Plus 500 said its financial position remains robust, and cash balances remain healthy, driven by the strong EBITDA performance and continued high cash generation during the period.

David Zruia, Chief Executive Officer, commented: “Plus500’s excellent performance so far in 2021 was driven by the strength and agility of our technology and its ability to respond rapidly to market developments, news events and customer requirements.”

“We have multiple opportunities from which to access future growth through both continued organic investment and targeted acquisitions, by expanding our CFD offering, launching new trading products, introducing new financial products and deepening engagement with our customers,” Zruia said.

“Our long-term ambition is to enable simplified, universal access to financial markets as we continue to transition into a global multi-asset Fintech Group . We are thrilled to be already making significant progress in delivering this vision, with the recent launch of Plus500 Invest and the acquisition of Cunningham and CTS, both of which ensure that Plus500 can offer customers a diversified portfolio of products.”