The leisure and hospitality sectors led the jobs recovery in June

Hiring was on the up again in June, as non-farm payrolls jumped by 850,000 jobs.

The increase was well above market expectations of 711,000, although unemployment increased by 0.1% in June to 5.9%.

The news comes as companies are pulling out the stops to match high levels of demand, by raising wages in order to bring Americans back into the workforce.

“Commenting on the US non-farm payrolls, Rupert Thompson, Chief Investment Officer at Kingswood, said: “Employment remains some 6.7mn below its pre-pandemic peak. The return to work is speeding up but far from complete, hindered by factors ranging from increased unemployment benefits, lack of child care facilities and fear of catching covid.”

“These obstacles, however, should fade over coming months, allowing the Fed to move closer to attaining its full employment objective. Only when it has made further substantial progress on this front, does it plan to start tapering its quantitative easing,” Thompson added.

The numbers show that leisure and hospitality led the recovery, increasing by 343,000, as states across the country eased their restrictions.

Average earnings also rose last month by 0.3%, or just over 10 cents an hour, and are now 3.6% higher than 12 months ago.

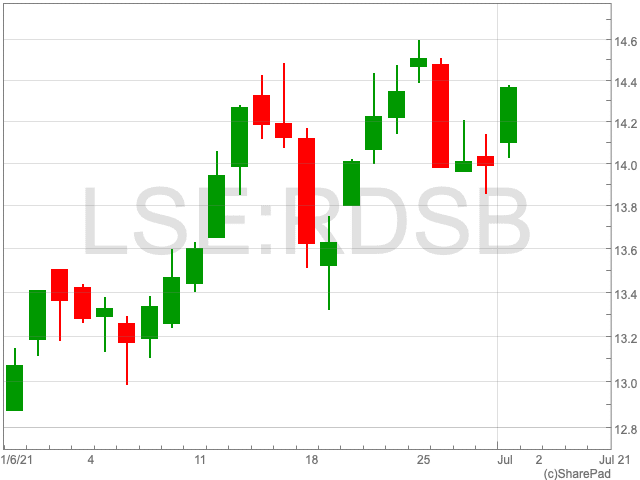

Stocks reached new highs on Friday as investors reacted positively to non-farm payroll numbers.

The S&P 500 is up by 14.4 points, or 0.33%, to 4,334 during the morning session, while the Nasdaq jumped by 54 points to a new high of 14,576.

Ali Jaffari, Head of North American Capital Markets for Validus Risk Management, said that the US Federal Reserve will likely hold off from hiking interest rates based on the numbers emerging on Friday.

“Employment data remains a key focus for the Fed and a continued convergence to pre-pandemic levels will certainly drive the thinking on tapering discussions and supports a build in US rate hike expectations. However, with two more job prints until the Sep FOMC, the Fed will likely hold off until there is a clear view on the return of labor force supply.”