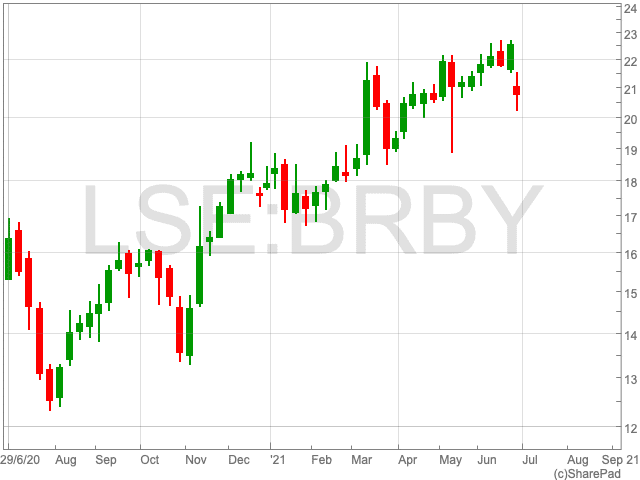

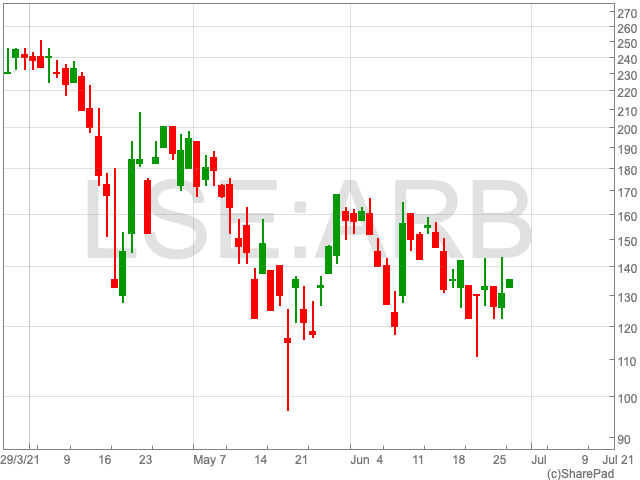

Argo Blockchain Share Price

The Argo Blockchain share price (LON:ARB) has been tumbling since it reached its high point in March. Having been as high as 360p, it now stands at 129.9p, after bitcoin plummeted in recent months. However, year-to-date, it remains up by 175.8%. Investors are still interested in the company as many see bitcoin as playing a pivotal role in the future of finance. While analysts, who have mixed views, continue to have their say on the cryptocurrency.

Update

In its last update, Argo confirmed it mined 166 bitcoin during May, up from 163 in April. This brings the total amount of bitcoin mined since the start of the year to 716, and its total holding to 1,108 bitcoin.

Peter Wall, Chief Executive of Argo said: “May has been a busy month. We have continued to deliver strong revenue and as a result, Argo’s Bitcoin holding has now surpassed 1,000 BTC. We are also delighted to have signed the Crypto Climate Accord and to have been involved in the creation of the Bitcoin Mining Council. These initiatives have the potential to enact systemic change within our sector and speed up the rate at which miners switch to renewable energy to power their operations. We are also pleased to announce Argo’s strategic investment into WonderFi. Access to this emerging sector needs to be democratised and we believe WonderFi is in an excellent position to achieve this.”

Analysts

The dive in the price of bitcoin caused analysts to cut their revenue forecasts for Argo Blockchain for the remainder of this year and the following. Analysts at FinnCap now believe that Argo Blockchain will make £60m in 2021 and £77.1m in 2022. FinnCap has set a price target for the Argo Blockchain share price of 220p.

Bitcoin

It goes without saying that the Argo Blockchain share price is intimately linked to the performance and adoption of bitcoin.

As bitcoin hovers above $30,000, analysts have mixed views on what could happen next. While some see further declines to below $30,000, others see the crypto heading north. “We believe that there is not much downside in the short term as we trade near the bottom end of the $30,000-$42,000 trading range,” Delta Exchange CEO Pankaj Balani told Coindesk.