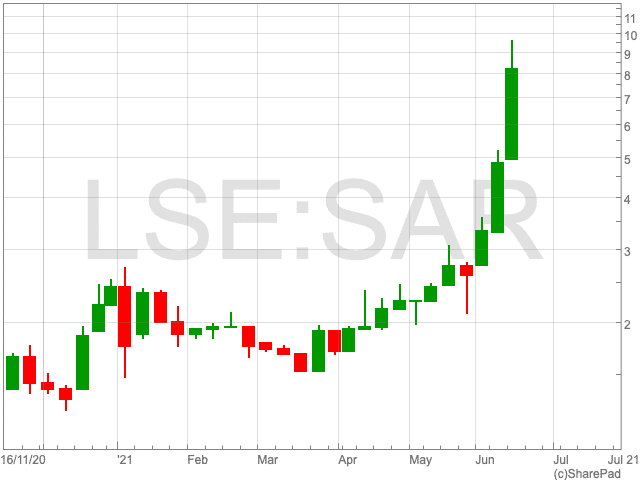

Sareum Holdings Share Price

The Sareum Holdings share price (LON:SAR) is flying in June as the drugs company made successive announcements over recent weeks. Today, in the aftermath of another announcement by the company, its share price is up by 9.43% to 7.66p. Over the past month it is up by an astonishing 157.05% causing the AIM-listed company to enter Hargreaves and Lansdown list of ‘most viewed shares’. Investors will be curious to know what is behind the recent surge and if there is more to come.

Bull-Run

There are a number of factors that can help to explain Sareum’s recent bull-run. Firstly, the pharmaceutical company confirmed that it raised £900,000 via a subscription by a high net worth individual at the end of May. The money, the company said, will be allocated to finding new coronavirus treatments. This is on top of funding received from the government months before. The Sareum Holdings share price rallied again on Tuesday as the company said it raised £1.47m before expenses via a subscription for 30m new ordinary shares priced at 4.9p each.

The drug developer also informed investors of encouraging results on its progress with a number of treatments. Included was small molecule therapeutics to improve cancer treatments and auto-immune diseases, in addition to is Covid treatment project. Sareum has previously stated that its project could bring “potentially ground-breaking Covid-19 treatments”.

Risks

While its ability to raise funds is impressive, as well as the potential upside of its coronavirus research, there are still risks to consider. Covid-19 research is highly competitive, especially when Sareum goes up against major pharmaceutical companies, including constituents of the FTSE 100. Nonetheless, the rise of the Sareum Holdings share price is noteworthy, and could be worth investors’ attention going forward.