Vietnam had the best performing stock market in the world in May, with its benchmark VN All Share Index up more than 32%. over the first five months of 2021. It is currently the world’s highest growth market, achieving nearly a 3% growth in GDP in 2020 while many other markets plummeted due to the pandemic. Despite recent outbreaks of new Covid-19 variants, Vietnam is also back on course to reach its 30-year track record of 6.5% growth.

Vietnam’s stock market ranks as the second most liquid in South-East Asia, recently recording more than $1bn of transactions a day, with almost 800,000 new stock market accounts opened in the last 12 months. There is now a total of 3.2m stock trading accounts in Vietnam compared with an estimated 2.2m in the UK. The new investors, who are also young consumers, are increasingly digitally connected, smartphone and app-enabled, and keen to embrace the new Industrial Revolution.

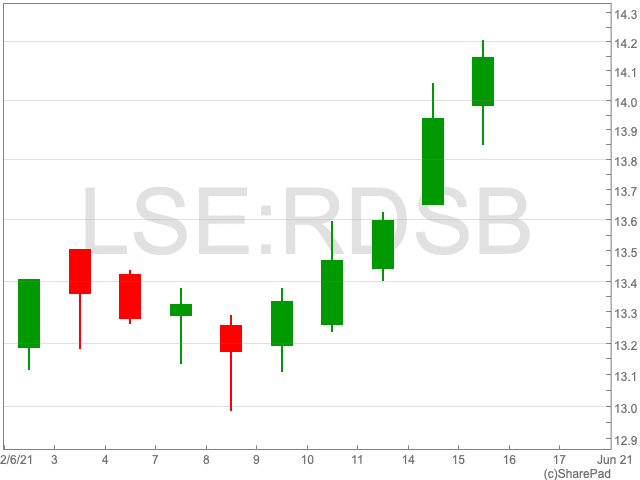

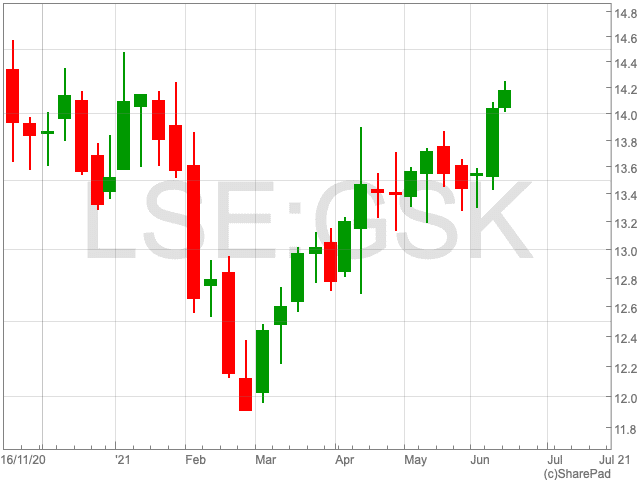

The strong rise in Vietnamese stocks selected by Vietnam Holding (LSE: VNH) made it the top performing investment trust in the UK in May by Net Asset Value increase, and the second highest by share price increase. This actively-managed high-conviction fund, is purely Vietnam focused, and up around 90% this financial year (June 30 year-end), strikingly with more than 28% outperformance against the VN Index benchmark. According to its manager, Dynam Capital, its portfolio is set for more than 40% growth in earnings per share and sits around 11x Price-to-earnings for 2021, which is in line with the investment strategy of ‘Growth at a Reasonable Price: GARP’. Notwithstanding this strength in performance and the future potential, the fund currently trades at a discount of 20% to its Net Asset Value on the London Stock Exchange, providing an attractive entry point for those looking to diversify their investments.

Dynam recently hosted a webinar to look under the bonnet of the VNH portfolio and in particular the fund’s largest holding, FPT, which is a key player in the digitalisation of Vietnam’s economy, and a leader in a sector that is estimated to grow to $52 billion in value by 2025. FPT has been the number one holding in VNH’s portfolio for over 18 months and has seen its stock price rally 60% this year alone. An on-demand recording of the webinar featuring a presentation made by FPT is available here.

Vietnam’s internet penetration reached 69% in 2020 and 70.3% in 2021. This is among the highest in Asia, though behind China (107%) and Japan (77%). Double digit growth, therefore, surely lies ahead. The cost of accessing broadband is low in Vietnam – the cheapest plan is equivalent to less than GBP 5.8 per month, compared to Thailand’s GBP 15, Korea’s GBP 20, Indonesia’s GBP 25, and according to BT’s website, GBP 28 in the UK. As we have seen, cheaper access to fast internet can contribute greatly to economic growth. For FPT, fast internet means customers can stream content over their rapidly growing Pay TV business. Pay TV has around 55% penetration in Vietnam, less than China’s 76% and South Korea’s 99%, so room to grow.

Vietnam’s digital development is uniquely benefited by geography. It is a 2000-mile-long country, and narrow in places, which favours long high-capacity fiber-optic backbones, with smaller spurs to the regions and rural areas. It also has smaller legacy copper networks than in the US and Europe, so fewer roads to dig up. The country currently has an estimated 100,000 telecom towers, one of the highest levels per capita in Asia, providing mobile voice and data coverage and accommodating the future roll-out of 5G.

In addition to being the top domestic IT services company in Vietnam, FPT is an emerging digital champion internationally with its provision of software and services to Fortune 500 companies. 20 years ago, Indian software companies, such as Infosys, Wipro, Satyam and TCS handled an increasing amount of outsourced IT work for the world’s multinationals. One catalyst for this was the infamous “millennium bug” or Y2K coding short-cut that was expected to cause global chaos with fears that aeroplanes would fall out of the sky and missiles fire by accident all simply by the hypothetical resetting of dates on computers at the stroke of midnight on the 1stof January 2000. The success of the software outsourcing model in India created an industry worth around US$150 billion, or 8% of the country’s GDP. Vietnam’s software engineers on average cost one third of the level of those in India and China, so the opportunity for a Vietnamese company such as FPT to be competitive is immense. Already FPT serves many Japanese and US companies, who are trying to move their activities to the cloud, and upgrade their technologies to adapt to new customer usage patterns.

The final pieces in the digital picture are education and government regulations. FPT trains around 40,000 software engineers a year at its campuses across Vietnam, creating a deepening pool of talent for domestic and foreign companies alike. Engineering jobs within growth areas, such as Artificial Intelligence, Blockchain, and Cloud computing, should be readily available. The government is also pushing hard for digital technologies as a way to scale Vietnam’s development as a modernising industrial nation. It is looking to promote e-payment and e-government. Soft infrastructure is as important as hard infrastructure, and both can have a multiplier effect on economic growth.

Visit www.vietnamholding.com for more information on the opportunities in Vietnam.