Test will analyse the ability of the UK’s major banks and insurers to adapt to the shift towards a net-zero emissions economy

The Bank of England outlined its stress test of the ability of the UK’s financial system to deal with the threat of climate change on Tuesday.

It added that the findings will not yet be used to determine capital requirements.

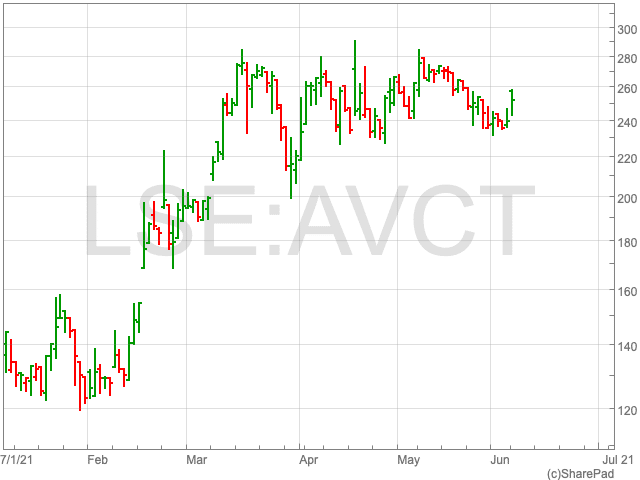

The central bank’s test will analyse the ability of the UK’s major banks and insurance companies, including HSBC, Barclays and Aviva, to adapt to the shift towards a net-zero emissions economy over the coming years, in addition to the impact of extreme weather conditions.

As the test is relatively new it will not compile results on individual firms at this stage and is set to publish its findings in May 2022. Although this date could be sooner.

The test involves three specific scenarios that cover 30 years. Firstly it will look at early action by governments across the world to reduce emissions, then action that is late, and finally the prospect of taking no additional action.

These scenarios will be judged using two criteria. Firstly, physical impacts, including fires and floods, and financial risks, such as a dramatic change in asset values or the price of carbon.

Responding to the publication of the Bank of England’s climate stress test scenarios this morning, Positive Money senior economist David Barmes said:

“The Bank’s climate scenario analysis may be a useful exploratory exercise, but it’s time to move from exploring to acting. Scenario analysis is incapable of accurately measuring highly complex climate-related financial risks, and we already know enough about the dangers of the climate crisis to justify regulatory action now,” Barmes said.

“It is concerning that the Bank of England appears to be ruling out using climate stress tests to help inform changes to capital requirements. Climate capital rules that reflect the high risk of fossil fuel investments are a necessary inevitability to ensure financial stability and alignment with the government’s climate plans, and the Bank needs to be introducing such policies without delay.”

“By delaying the implementation of climate capital rules, the Bank is undermining its duty to protect financial stability and support net-zero.”