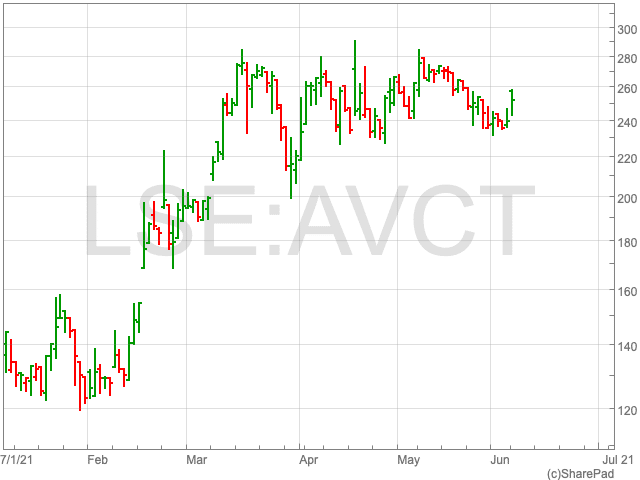

Avacta Group Share Price

The Avacta Group share price (LON:AVCT) is up by 6.21% on Monday to 253.84p per share. Going further back, over the last 12 months and more, the biotechnology company has performed well, as have many firms involved in the production of coronavirus tests. Before Covid-19 caught the world by storm, Avacta was focused on cancer therapies and diagnostics. Since then, Avacta found an additional purpose, which boosted its share price.

Over the last six months shares in Avacta Group are up by 105%. While over the last year and three years, shares in Avacta have risen by 60.5% and 641% respectively. The question that remains is how long will demand for Covid testing products support the Avacta Group share price and by how much.

Lateral Flow Test

Today’s move came as the diagnostics and cancer therapy developer revealed that the Medicines and Healthcare products Regulatory Agency (MHRA) has confirmed registration of its ‘AffiDX’ SARS-CoV-2 antigen lateral flow test for Covid-19. This allows the AIM-listed company to put the product on the market in the UK for it to be used professionally. Product registration from a recognised body in the European Union could soon follow.

Avacta said the purpose of its lateral flow test is to provide a cost-efficient and speedy way of identifying people who are most likely to infect others. This is also referred to as having a high viral load.

The company reported that its lateral flow test, when tested in April, found a 100% sensitivity for identifying infectious people with viral loads measured by PCR of Ct<27.

Avacta confirmed ongoing commercial discussions with distributors and end-user customers in nations that accept the CE-mark for in vitro diagnostic products.

“I am delighted to receive confirmation of the registration of the AffiDX SARS-CoV-2 antigen test from the MHRA,” said Avacta Group chief executive Dr Alastair Smith.

“It is a transformative milestone for Avacta’s Diagnostics Division being the first CE marked product powered by the Affimer platform that has been brought to market.”

The AIM-company will now turn its attention to focusing on the commercial roll-out, which could boost the Avacta share price, as well as playing a significant role in allowing economies around the world return to normal.