Sponsored by BitcoinPoint

- Bitcoin is still up 260% and its trajectory in the mid long-term won’t change

- Inflation is the impact of the recent correction but will paradoxically be good for Bitcoin

- Central Banks embracing blockchain with their own digital currencies and the DeFi sector will ultimately be good for Bitcoin

- BitcoinPoint’s vision is to accelerate the adoption by providing inclusive access

BITCOIN IS -NOT!- DEAD

Bitcoin has already died over 414 times in the media, and each time there’s a correction articles against it are flourishing, and last week was of course no exception.

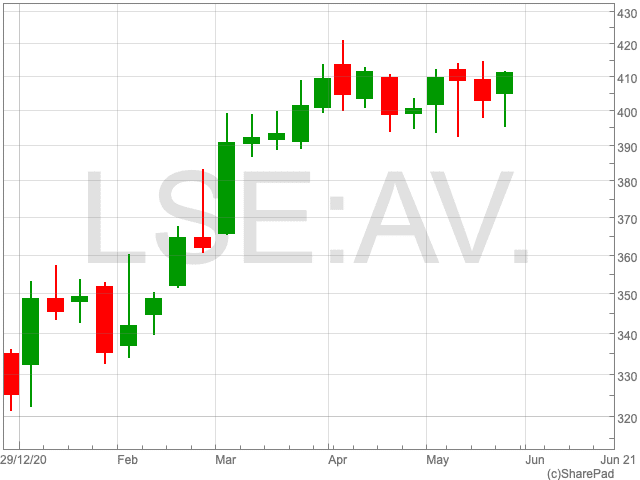

An asset trending upwards by 260% since May 2020 and that has increased by 200% per annum over the last 12 months is hardly a bubble or one that will fade into obscurity.

The truth is that it’s a classic FUD (Fear, Uncertainty and Doubt) in Bitcoin’s cycle, and long-term and experienced holders are not selling according to data from Coin Metrics compiled by Portfolio Insider.

DON’T BE DISTRACTED BY THE NOISE

While media are focusing on news about Elon Musk and China (reaffirming a statement from 2017), regulation is not presently a concern as it’s mostly trying to enforce taxation like other asset classes.

THE TRUE WORRIES ARE INFLATION

25% of existing US Dollar didn’t exist a year ago, what’s the impact on this excess of monetary stimulus?

Early this year, house prices have skyrocketed with the fastest year-on-year growth in the past two decades in wealthier countries (source OECD Analytical House Price Database). However, last month Commodity prices had increased by alarming rates, and two weeks ago the CPI (Consumer Price Index) had the sharpest rise since September 2008 in the US. This latest news took the market by surprise and led to a jump in the Long-Term Bond Yields and a fall in the Stock and Crypto market (which have been correlated for the past year). Then on May 13th the PPI (Production Price Index) was up by 6.2% which was the highest jump since tracking began in 2010.

The problem with inflation above target is that it can led to further inflation when companies start increasing their prices. Not only individuals are impacted, companies with cash on their balance sheets see a depreciation of their asset which is a destruction of shareholder value.

So, what’s a good hedge against inflation?

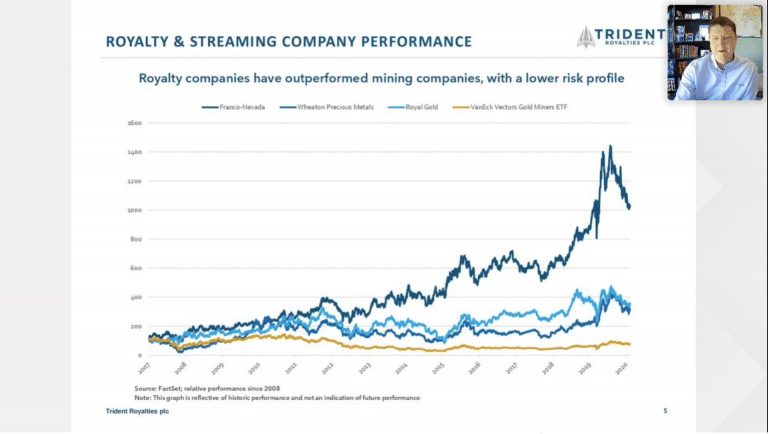

Gold is supposed to have limited supply but if we look at the performance over the past year it has increased by just 10% and we are currently not at an all-time-high level.

While Bitcoin has a limited supply of 21 million units it also has a decreasing emission schedule, and its inflation rate is falling to reach nearly zero by 2035 where 99% of Bitcoin will be mined. The billionaire Paul Tudor Jones, one of the most successful macro Hedge Fund managers, sees Bitcoin as “the firstcrypto, first-mover… it has that historical integrity within digital currencies that it will always have … and because of its finite supply, that might be the precious crypto” he added.

One thing Jones is certain of is the digitization of money in the future, especially as more central banks move toward their own digital currencies.

CBDCs

Indeed, Central Banks are now actively looking at CBDCs (central bank digital currency), a concept is inspired by Bitcoin with blockchain based technology.

UK Chancellor Rishi Sunak made the announcement of its potential benefit. While a digital transformation could make payment more resilient and avoid a situation where 90% of payments are controlled by US companies (Mastercard also owns the company running Faster Payments and BACS). CBDCs also hope to compete with existing cryptocurrencies.

However, whilst at the macro-level CBDCs could serve as a powerful tool to monitor flows and inject cash faster without the needs of commercial banks, the ultimate benefit of consumers using contactless payment or similar approaches is questionable.

Likewise, any digital currency created a by a state or issued by private companies replicating fiat currencies like the US Dollar (commonly called ‘stablecoin’), would simplify the access to Bitcoin as commercial banks – still the main ‘on-ramp’ access for Bitcoin – would no longer be required.

Moreover, ‘state’ cryptocurrencies would be easier to convert with the interoperability of blockchains. As an example, USDC, the second largest stablecoin replicating the US dollar, is now available on four blockchain rails.

But while Central Banks could succeed their digital transformation. These CBDCs are an antithesis of Bitcoin if they lead to mass surveillance by implementing digital identity. Bitcoin was created to become a digital version of cash to keep transactions private.

SUPERIORITY OF BITCOIN

Bitcoin is a scarce asset and its momentum will not be reproduced: it’s not controlled by any central entity, a state or a company like Facebook, and has no identified founding team or leader, like Vitalik Buterin the man behind Ethereum.

Bitcoin, with its global presence and encouraging adoption, is the gate for the DeFi (Decentralised Finance) sector.

BitcoinPoint a service to accelerate the adoption

The story began early 2017 when its cofounder struggled to open an account on a cryptocurrency exchange and found Bitcoin ATMs too expensive. A few months later, the company released an app with an online Bitcoin wallet that charged zero network fees for purchases in-store to buy at a network of agents, and BitcoinPoint became two years later a platform supported by 25 agents ranking in the top bitcoin ATM services in London. By mid-2020, the app also allowed the customers to instantly buy through Open Banking technology from anywhere, creating a unique bitcoin exchange with non-custodial solutions on both cryptocurrency and fiat, removing the credit risk for the users.

Six months ago, the company began allowing users to sell bitcoin and withdraw cash through 16,000 ATMs across the U.K., making the largest ATM network in the country an off-ramp service for Bitcoin. And last month, it signed an agreement to connect to 320,000 in 20 countries. Starting with the UK with 20,000 Point of Sale (POS)!

FUTURE PLANS

This new partner, bringing in POS locations in Europe, Latin America, Asia and Africa, will be a game changer by allowing us to scale-up their activities faster. The company is also in discussions with banking and retail partners in different countries to build a remittance service to allow cross-border instant transfers.

After a successful integration into U.K. Faster Payment Service, the company wants to become a fiat gateway to Bitcoin and DeFi by connecting to global payment service providers and facilitate online payment processing solutions in emerging countries for people who don’t have access to the financial system.

FUNDRAISING

While, the company has successfully hit a fundraising goal to expand its services a few hours after being live, the campaign will last for another two weeks as the more funding they can gather, the quicker they can realize their global expansion.

Visit BitcoinPoint’s crowdfunding page on Crowdcube.

Find out more about their services on their website here.