UK unemployment rate between January and March of 2021 fell to 4.8%

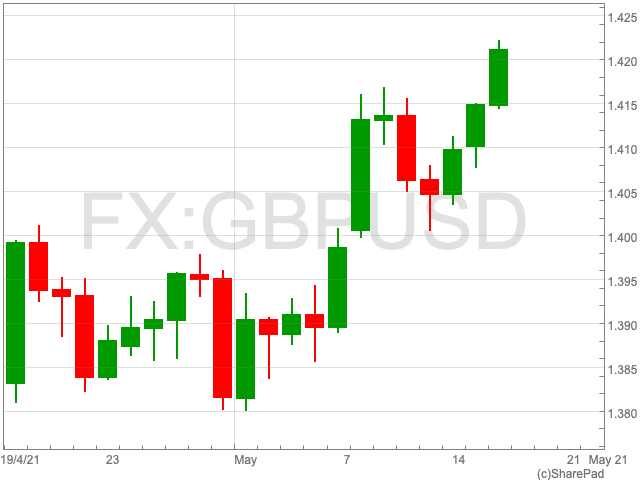

The Pound rose substantially on Tuesday, with Cable up 0.47% to 1.42, its highest level since February.

Until now the Pound has been somewhat rangebound, as England entered the third stage of easing lockdown rules.

The move comes as the UK jobs market showed signs of a recovery following the battering it took from the pandemic.

The UK unemployment rate between January and March of 2021 fell to 4.8%. The figure is roughly 0.8% higher than the same period in 2020.

The ONS announced that payrolls increased by 97,000 between March and April, in what was the fifth consecutive month of growth.

“With the latest lockdown restrictions being eased and further easing on the 21st of June, one can only presume this number will soon return to pre-covid rates or better,” says Hugh Shields, financial trader at Spreadex.

“However, the Pound’s surge today is not solely in connection with the UK’s job bliss. Cable’s surge is also down to a weak dollar,” Shields adds.

This is in light of rumours that, despite rising inflation rates, the Fed plans to keep its stimulus programme.

“This, in conjunction with US housing starts coming in below forecasts at 1.569M in April, suggest why the Dollar is struggling to match against the Pound,” says Shields.

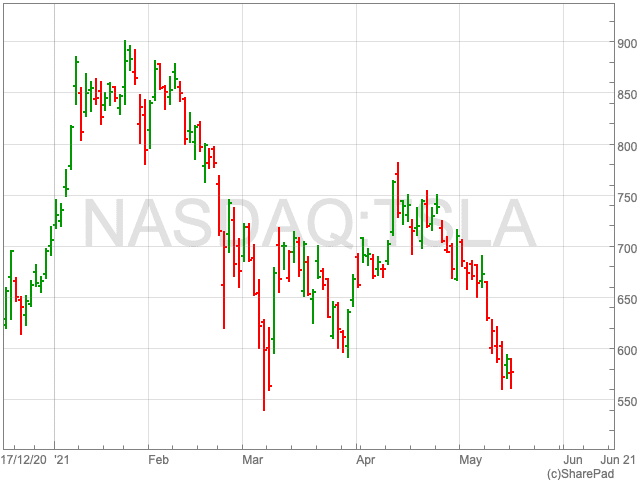

Even with a weaker Dollar, US markets haven’t been majorly affected on the open. The Dow is down only 3.68 points, and the S&P 500 down 3.87.

The Euro has also taken advantage of the weaker Dollar, with EUR/USD up 0.55% on the day to 1.2215.

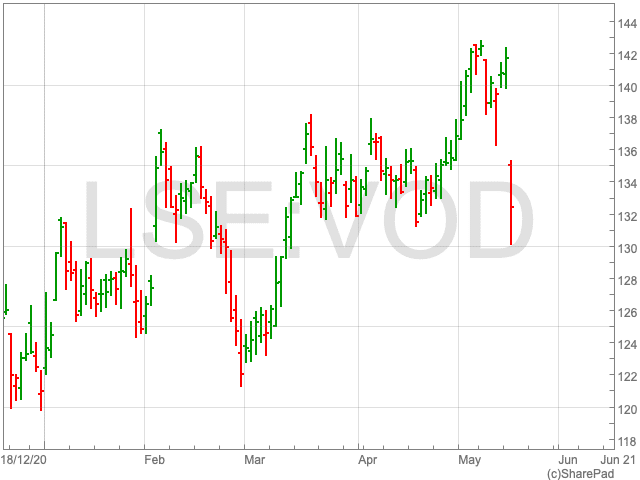

European markets have continued yesterday’s stability. The FTSE, having seen the Pound rise, is slightly up on the day, rising 11 points to 7044. On the other hand, the DAX and CAC are down 0.13% and 0.14% respectively.