The FTSE 100 received an early helping hand thanks to a better than forecast Q1 GDP reading, showing the UK contracted by 1.5% in the lockdown-hit opening months to the year, compared to the -1.6% forecast.

“A stronger sign of recovery was news that the economy actually grew by 2.1% in March, instead of the 1.5% expected, as the country cautiously started to open up. That’ll only boost hopes of a robust rebound in the second and third quarters,” said Connor Campbell, financial analyst at Spreadex.

The GDP news shot the FTSE 100 to the top of the table after the bell, leaving the UK index 0.46% higher and around 20 points short of 7,000.

The DAX, meanwhile, added 0.4%, lurking just below 15,150, with the CAC up 0.3%, sticking a pinkie beyond 6,260.

“These European gains should be caveated, however, as they all come before this afternoon’s US inflation reading for April has been unveiled. And given that Monday and Tuesday’s losses can in large part be explained by fears of surging inflationary pressures, the trading landscape could look very different once the figure has been released,” Campbell said.

FTSE 100 Top Movers

Spirex-Sarco Engineering (3.07%), Diageo (3.05%) and Glencore (2.74%) are the top three risers on the FTSE 100 90 minutes into the morning session on Wednesday.

At the other end, Just Eat (-3.92%), Flutter Entertainment (-1.95%) and Renishaw (-1.07%) lost the most ground.

The UK economy grew by 2.1% in March, at better than expected levels, in what was the fastest month of growth since last August.

The Office for National Statistics (ONS) said on Wednesday that economists previously predicted growth of 1.3%.

The UK economy also showed resilience during the second wave of the pandemic, as it contracted by 1.5% during Q1 of 2021, seeing strong growth in March. Again, expectations were surpassed, as a contraction of 1.7% was initially forecast.

During Q1 the economy was supported by government spending, as the government increased spending on vaccinations and testing, while consumer spending and business investment dropped as the third lockdown came into effect.

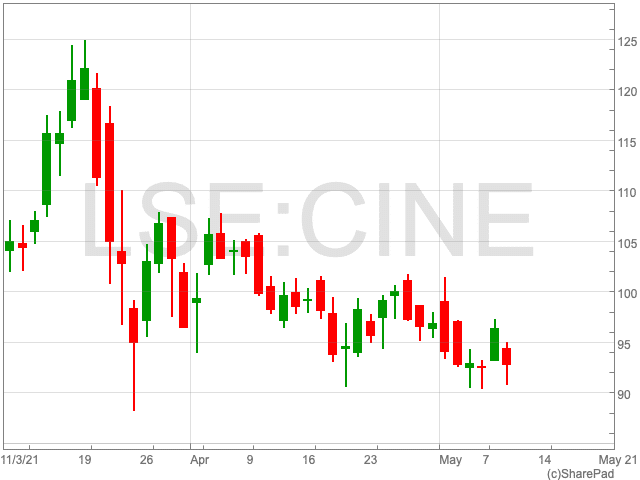

Diageo

The Diageo share price jumped during the morning session on Wednesday, up by 3.8% at the time of writing, as the drinks company made a pledge to buy back shares or provide a special dividend.

The FTSE 100 company’s share price reached 3,317p per share, now less than 10% below its all-time-high of 3,640p, as it looks to be closing in on the marker last reached in September 2019.