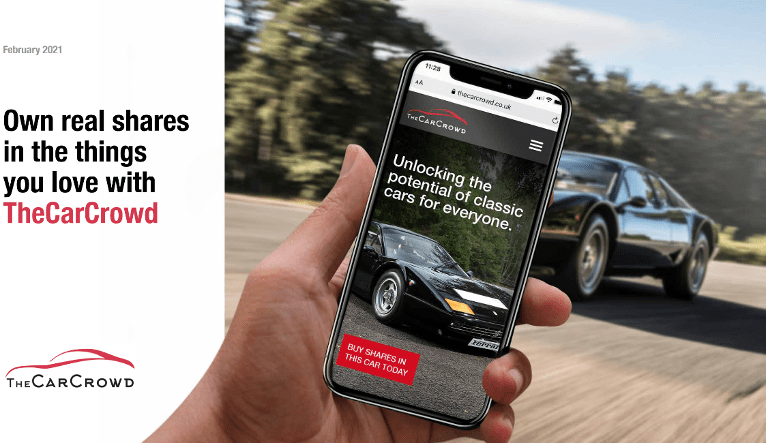

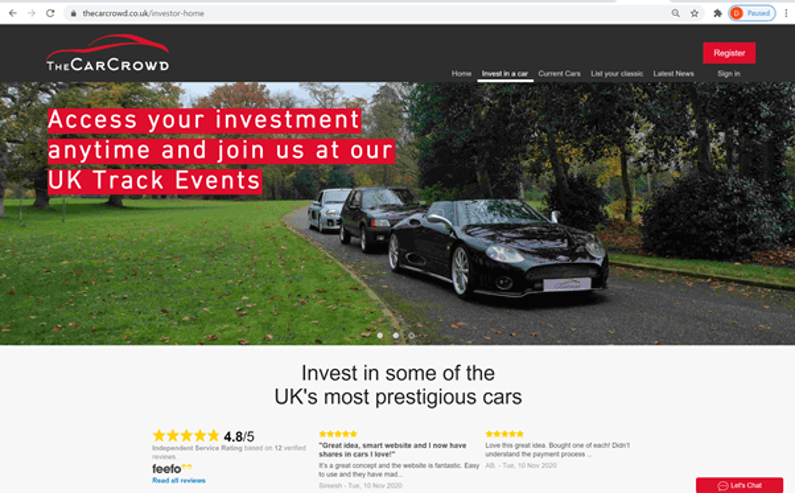

TheCarCrowd – A Passion Asset Investment Platform set to disrupt the investment market and address the lack of options for UK Millennial’s has launched on Seedrs.

TheCarCrowd are building a new way for people to invest in the assets they love. Starting with Classic Cars they are offering people everywhere the chance to take a real equity stake in a classic car and benefit from the potential appreciation. Having smashed through the original funding target on the Seedrs platform they are extending their campaign to allow more investors a chance to support their journey.

Using data sourced from the FCA financial lives survey, TheCarCrowd estimates that around 8 million UK millennials have no form of investments. A lack of choice and high minimum investments often cause barriers to entry.

TheCarCrowd are on a mission to unlock some strong returns for this large underserved market. Classic Cars have appreciated in value 194% over 10 years up to Q4 2019 (Source: Compiled by Knight Frank Research using data from Historic Automobile Group International. Please note that figures refer to the past and past performance is not a reliable indicator of future results).

However, these assets were largely reserved for those who can afford to buy, store and insure the car. TheCarCrowd is changing that with a real equity stake in a car starting at just £20 making is accessible to petrol heads everywhere.

Investors also gain piece of mind knowing that TheCarCrowd are an appointed representative of Kession Capital Limited who are regulated by the FCA.

Launched in Nov 2020, and now with over 620 registered investors demand has been strong. Their first vehicle; a Peugeot 205 GTI funded in just 67 days.

The platform has been purpose built and has a fully automated know your customer, anti money laundering and buy shares journeys meaning they are set up for scale.

The current raise on Seedrs has seen over 200 individuals invest in this exciting and innovative business. TheCarCrowd are also offering some great investor rewards with tickets to UK car shows and even a private track day on offer for qualifying investors, all detailed on their Seedrs page.

“With this fundraising round, we are looking to give people more options when it comes to investing. Helping them to diversify their portfolio and invest in something they really care about.

This Seedrs campaign is a great opportunity for us to supercharge our growth, and we want to bring some valued connections on board

It doesn’t matter how large or small your investment, we’d would love as many people to come on this journey as possible.” David Spickett – CEO

More information on TheCarCrowd can be found on the TheCarCrowd’s website and Seedrs Crowdfunding platform.

Please remember that when investing your capital is at risk