Darktrace was cautious with its pricing and in conditional dealings the share price went to a significant premium, but it was still trading far short of the £3bn at which the management had hoped it would be valued.

One of the main shareholders is Mike Lynch and there are other shareholders under the banner of his venture capital firm Invoke Capital. Mike Lynch is the former boss of software company Autonomy, which was acquired by Hewlett-Packard for $11bn in 2011. There have been subsequent legal actions against Mike Lynch because of the takeover and the claim that figures were inflated. The ...

Dark Horse Investments – Classic Motorcycles that offer unrealised Investment Potential

Alan Green provides his latest instalment of insight into motorcycle investment

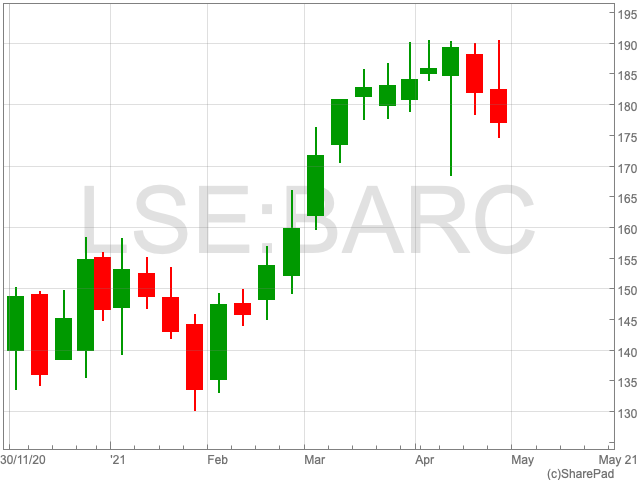

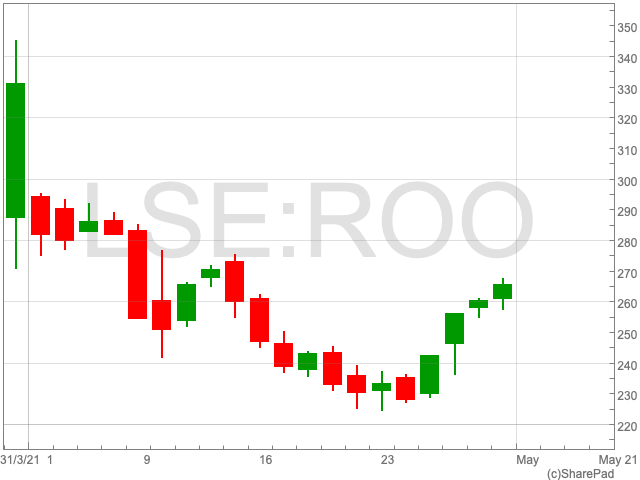

Deliveroo Share Price: Waitrose deal provides welcome boost

Deliveroo Share Price

Deliveroo suffered one of the worst debuts in London history as its shares fell by 26% when the food delivery company came to the market at the end of March. According to data from Refinitiv, Deliveroo was trading as low as 271p within the first 20 minutes of trading, way lower than the offering price of 390p. The UK-headquartered company priced 384.6m shares at 390p each, the bottom of its target range, meaning Deliveroo was valued at £7.6bn, which is the highest in London since Glencore in 2011.

Since that day it has been more of the same. On 26 April Deliveroo shares were valued at 228p. However, over the past few days the company has regained some ground, moving up for four consecutive days. This follows Deliveroo entering a two-year partnership with Waitrose to deliver groceries. The question now is whether or not Deliveroo can sustain this investment and entice investors.

Waitrose

After a successful trial of the service, Waitrose and Deliveroo came to an agreement over a two-year partnership for rapid home deliveries. The British supermarket confirmed it would be growing Deliveroo’s service from 40 to 150 stores across the country before the end of summer.

The new partnership comes on the back of an overall increase in the number of home deliveries of groceries during the pandemic, as such orders now make up 14% of the market, up by double since the beginning of 2020. Waitrose customers will be able to order from an increased range of 750 to 1,000 products and have them delivered in 20 minutes to addresses from London to Scotland.

Outlook

In mid-April Deliveroo posted healthy Q1 results, including a fourth consecutive quarter of growth. While its orders were up by 114%, compared to the same period a year before, up to 71m. While the IPO wasn’t overly successful, the funds raised will go along way to securing its near-term future, as will its recent results and the Waitrose news.

However, the company is expecting a slowdown once lockdowns are gone, while it still expects customer spending on its food delivery app to grow by 30-40% in 2021. Other issues ongoing disputes between the company and its workers over labour rights. The company is facing increasing pressure over its employment practices, which could put investors off.

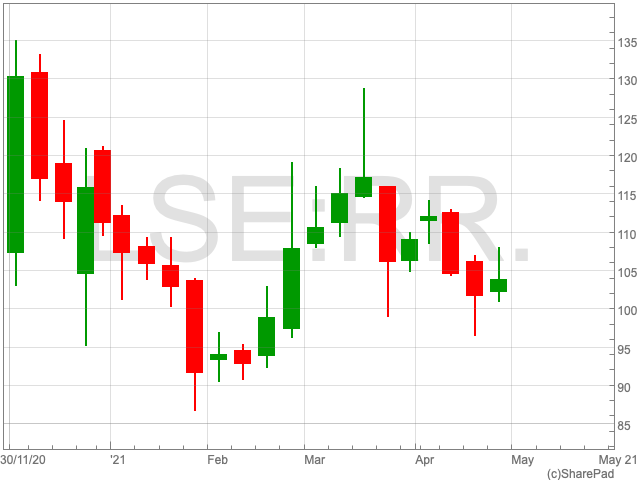

Rolls-Royce Share Price: awaiting government announcement on travel

Rolls-Royce Share Price

The Rolls-Royce share price (LON:RR) is at the same level at which it began 2021, as it remains unclear what the immediate outlook is for the engineering company. Following a strong push from February through to March, shares in the FTSE 100 company have fallen back to 103.72p. As one of the largest aircraft manufacturers in the world, Rolls-Royce has been significantly impacted by the ongoing pandemic. While UK Investor Magazine reported two months ago that its outlook could depend on the airline industry, many questions remain unanswered, as despite a positive roll-out of vaccines in the UK, other parts of the world have not fared so well.

Finances

The Covid-19 pandemic had a severe impact on Rolls-Royce’s performance and near-term outlook. However, the company took solid measures to protect its balance sheet over the longer-term. The company strengthened its liquidity to £9bn and protected its financial position with £7.3bn of new debt and equity, while it launched a programme to raise at least £2bn from disposals.

Rolls-Royce has also made progress on its restructuring programme, removing 7,000 positions during 2020. Looking ahead, Rolls-Royce is aiming for its free cash flow to turn positive during H2 of 2021, and at least £750m during 2022, although these targets depend on the speed of the recovery, as well as the ongoing restructuring plan.

“The impact of the COVID-19 pandemic on the Group was felt most acutely by our Civil Aerospace business. In response, we took immediate actions to address our cost base, launching the largest restructuring in our recent history, consolidating our global manufacturing footprint and delivering significant cost reduction measures. We have taken decisive actions to enhance our financial resilience and permanently improve our operational efficiency, resulting in a regrettable, but unfortunately very necessary, reduction in the size of our workforce,” said chief executive Warren East.

Rolls-Royce has taken decisive action to tighten up its balance sheet to see the company through challenging market conditions, however, it could still do with some positive economic news.

Airline Industry

The slower pace of the vaccine rollout in the EU, a spike in infections in mainland Europe and the emergence of new variants has complicated the picture for Rolls-Royce. There is a real risk that the company will not get the summer it was hoping for, according to AJ Bell investment director Russ Mould.

“The risk, and one being increasingly acknowledged by Government ministers, is this summer is even worse than last for the travel space as the UK keeps restrictions in place to avoid undermining its hard-won success with the vaccine,” Mould said.

Nonetheless, governments across the world are doing their best to give hope into the airline industry. In Britan, proposals to permit travel to certain countries from May 17 received backlash for the caveat that travellers must undergo costly PCR Covid tests. The plans follow another week of uncertainty for a sector that lost $118.5bn in 2020, the worst year in aviation history, with downgraded passenger forecasts for a number of airlines.

Jangada Mines: exponential growth potential in Vanadium, Titanium and Iron Ore

Jangada Mines (LON:JAN) operates in Northern Brazil and is undergoing the development of a number of projects focused on Vanadium, Titanium and Iron Ore.

Brian McMaster, Executive Chairman of Jangada Mines, details the latest progress of the company and outlines what investors can expect from the company for the rest of the year.

Having conducted initial preliminary economic assessments, Jangada is now working towards further tests that could see expansion to their resources.

There is also consideration paid to the roadmap for production and comparisons made to other companies operating in the area.