With no data of its own to deal with, the FTSE 100 wasn’t up to much, rising 0.1% to 6,970, after failing to hold at 7,000 on Thursday. On the final day of the month the European markets erred on the positive, after stumbling at yesterday’s close.

“News that the German economy contracted faster than forecast – shrinking by 1.7% in Q1 against the expected 1.5% – failed to stop the DAX climbing 0.4%. Though that’s in large part due to the size of yesterday’s pullback,” said Connor Campbell, financial analyst at Spreadex.

“If estimates are accurate, the Eurozone as a whole is set to have contracted by 0.8% in Q1, quickening the pace of its problems when compared to the -0.7% seen in the fourth quarter of 2020,” he added.

“Potentially set to disrupt these fragile gains, the Dow Jones is heading for a 0.2% drop when trading starts Stateside. That’d knock the index back below 34,000 after it clawed its way above that key level last night,” Campbell says.

FTSE 100 Top Movers

Smurfitt Kappa (4.35%), AstraZeneca (4.14%) and British American Tobacco (2.4%) are the top risers on the FTSE 100 two hours into the day.

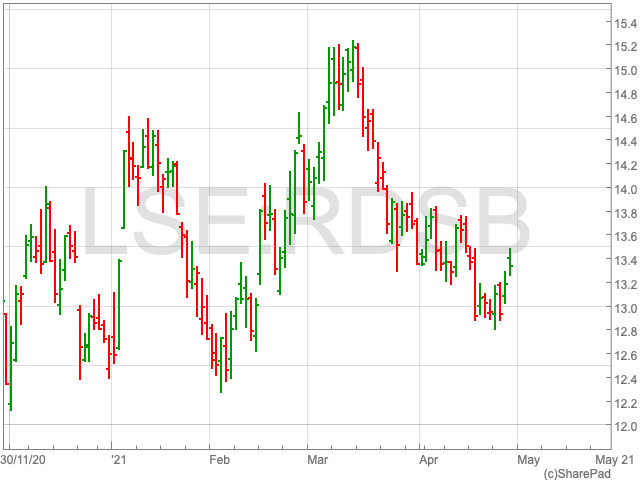

At the bottom on Friday, as the week draws to a close, is Barclays (-5.7%), Anglo American (-2.08%) and Flutter Entertainment (-1.87%).

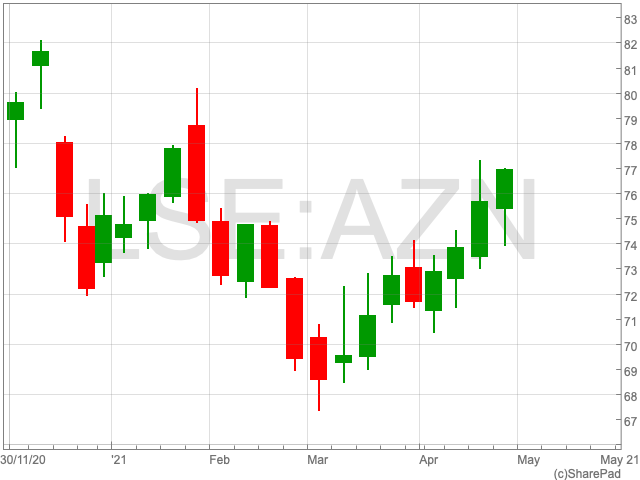

AstraZeneca

AstraZeneca earned $275m in revenue in Q1 from its Covid-19 vaccine, which it is not making a profit from, as sales of its cancer drugs and growth in emerging markets allowed the pharmaceutical company to surpass its expectations.

The FTSE 100 drugmaker confirmed it revenue grew by 15% during the first quarter of 2021, as its post-tax profit climbed from £750m to £1.56bn.

UK House Prices

UK house prices grew in April at the quickest rate in over 15 years, research by Nationwide has revealed. Compared to the month before, the average house price was up by 2.1%, which is the biggest increase since early 2004.

Year-on-year house price growth rose to 7.1% in April compared to 5.7% in March, as property values reached a record high of £238,831.