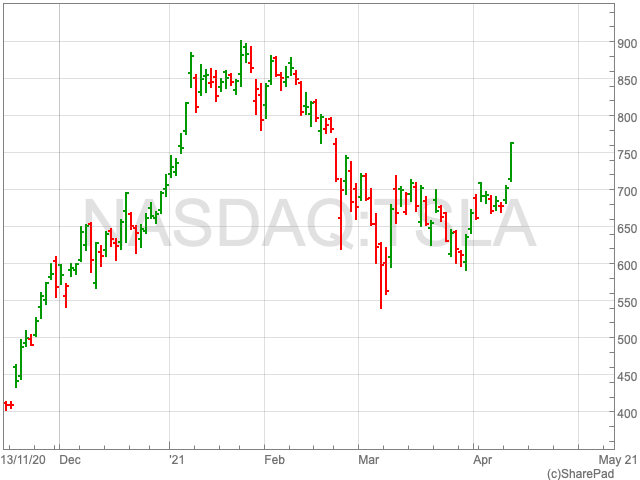

Coinbase trades 50% over its reference price

Coinbase shares (NASDAQ:COIN) traded at $381 on its New York debut, over 50% above its $250 reference price, on a day hailed as a watershed moment for cryptocurrencies on the world financial markets.

The price puts the eminent digital currency exchange’s value at just under $100bn on its first day of trading.

In the lead up to Coinbase’s listing on Wednesday, bitcoin set a new all-time high, surging above $63,000, before retreating slightly.

The company’s high valuation has added another name to the list of the world’s billionaires with Brian Armstrong, Coinbase CEO and co-founder, who has a 20% stake in the company bringing his net worth to $20bn.

Armstrong has said in previous interviews that his overriding goal is to usurp the current financial system with a more efficient model.

“I don’t think crypto is here to solve every problem in the world. But it’s here to solve one very important meta-challenge, which is economic freedom,” he told the Wall Street Journal.

Coinbase was founded in 2012 and become one of the world’s leading digital currency exchanges. The exchange has around 56m users in more than 100 countries. It holds assets valued at $223bn, amounting to over 11% over the total market for crypto-assets.

“What we hope is it just brings a lot more transparency to this industry, and a lot more focus,” said Alesia Haas, chief financial officer of Coinbase. “We’ve seen that with the attention that Coinbase has received during the past few months.”

Coinbase’s listing is specifically not an IPO which would involve the issuance of further shares. It is a direct listing which means existing equity will be sold without further dilution. Coinbase has been operating for close to a decade, and has received vast sums from venture capitalists, negating the necessity for an IPO.