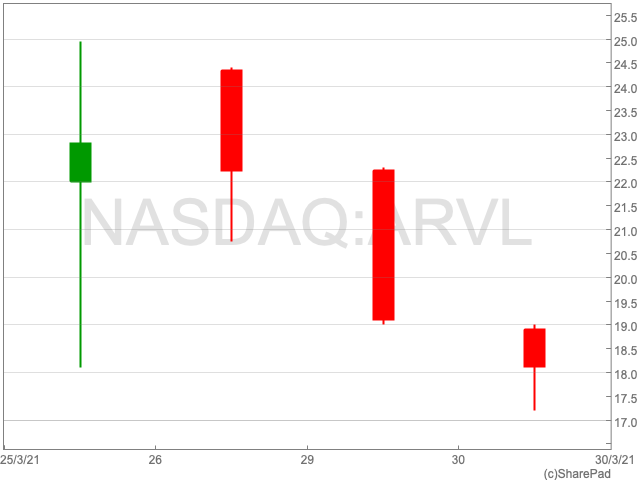

PMI measure soared to 62.5, up from February’s level of 57.9

Manufacturing in the eurozone performed robustly during March, as operating conditions improved by the highest level in 24 years of records.

The PMI figure, a measure of the prevailing direction of economic trends in manufacturing, soared to 62.5, up from February’s level of 57.9, indicating a substantial improvement in the sector’s performance.

The index has now registered above 50.0, the level which reflects no changes in output, for nine months in a row.

| Germany | 66.6 (flash: 66.6) | record high |

| Netherlands | 64.7 | record high |

| Austria | 63.4 | 39-month high |

| Italy | 59.8 | 252-month high |

| France | 59.3 (flash: 58.8) | 246-month high |

| Ireland | 57.1 | 8-month high |

| Spain | 56.9 | 171-month high |

| Greece | 51.8 | 13-month high |

Growth was broad-based across the region, with Germany and the Netherlands leading the way. Both nations recorded their highest ever PMI levels in March.

Greece, in contrast, recorded only modest growth, despite enjoying its best PMI reading for over a year.

The further strengthening of trade, orders and production placed further strain on already stretched supply chains.

According to the latest data, average lead times for the delivery of inputs lengthened at an unprecedented rate as challenges in sourcing inputs due to product shortages, stronger global demand and ongoing logistical challenges linked to COVID-19 continued in March.

According to the latest data, the rate of increase in buying was the strongest ever recorded by the survey, although with continued delays in delivery, firms sought to utilise their existing stocks wherever possible. Whilst falling at a slightly slower rate, input stocks declined in March for a twenty-sixth successive month.

Commenting on the final Manufacturing PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

“Eurozone manufacturing is booming, with production and order books growing at rates unprecedented in nearly 24 years of PMI survey history during March,” Williamson said.

“Although centred on Germany, which saw a particularly strong record expansion during the month, the improving trend is broad based across the region as factories benefit from rising domestic demand and resurgent export growth.”

“Driving the upturn has been a marked improvement in business confidence in recent months, with expectations of growth in the year ahead running at record highs in February and March. This has not only boosted spending but has also led to rising investment and restocking, as firms prepare for even stronger demand following the vaccine roll-out.”