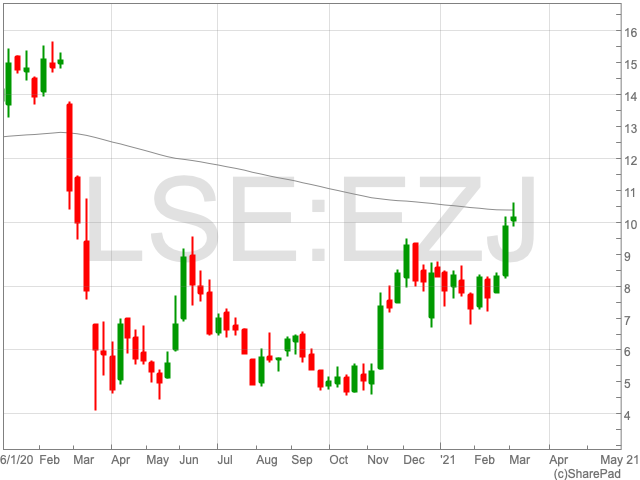

EasyJet Share Price

EasyJet’s share price sat at 1,508.50p in February 2019 before news of global travel restrictions caused a fall to 475p per share at the beginning of April. However, the airline has gained ground since, climbing back up to 1,014.50p per share, particularly in recent weeks, as the government outlined plans to lift restrictions. Since the beginning of 2021 EasyJet’s share price is up by 32%.

Potential for Growth

In February, the Prime Minister announced a four-stage plan for easing lockdown measures in the UK, with a return to international travel proposed for 17 May. The date, just before the beginning of the summer holiday season, unleashed a surge of pent-up demand, as EasyJet reported a dramatic rise in the number of holiday bookings.

Chief executive of easyJet, John Lundgren, commented on the figures: “We have consistently seen that there is pent-up demand for travel and this surge in bookings shows the signal from the government that it plans to reopen travel has been what UK consumers have been waiting for.”

In addition, the UK airline raised €1.2bn worth of seven-year bonds at the end of February at a yield of 1.875%.

“Monday’s announcement was incredibly helpful but, this was opportunistic on the back of recent market conditions irrespective of [the] announcement,” said Mark Lynagh, co-head of Emea debt markets at BNP Paribas, who worked on the deal. He added that this “plays into the optimism around the recovery that we’re going to see and there is a view that low-cost carriers like easyJet are well placed to benefit from that”.

Risks

EasyJet reported a £1.3bn loss towards the end of 2020, down from a £430m profit the year before. Even if the airline industry does recover, it could be a long road back for EasyJet, as many of its costs have remained constant throughout the pandemic.

Otherwise, there is the question of if and when travel can return to normal. Even once most people have received a vaccine jab, if the disease lingers, then international travel could be restricted beyond May 17.

“The challenge is to find a way to live with it without keeping huge restrictions in place,” says Azra Ghani, professor of infectious disease epidemiology at Imperial College London.