The FTSE 100, London’s blue-chip index, was hit hard on Thursday as it fell by 0.74% just after midday to 6,626.05. The index felt the knock-on impact of a rise in US bond yields which dragged commodity prices down, as well as causing a sell-off on US tech stocks.

FTSE 100 Top Movers

Aviva (2.53%), Sage Group (2.4%) and British Land Group (2.29%) headed up the index at midday on Thursday.

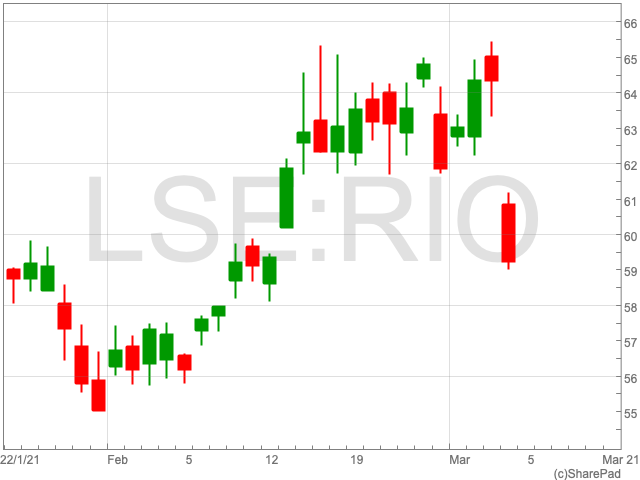

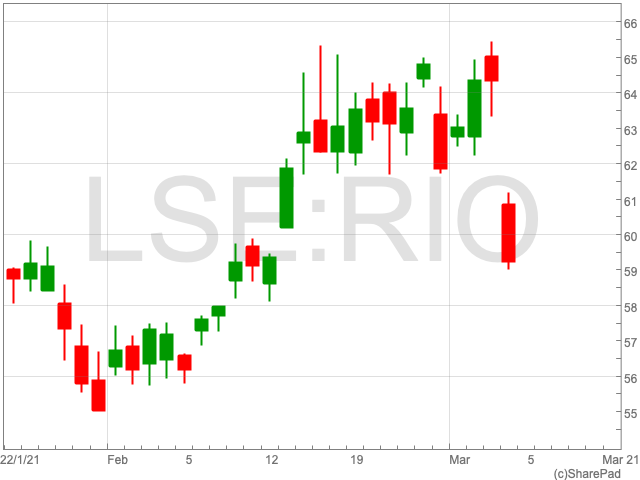

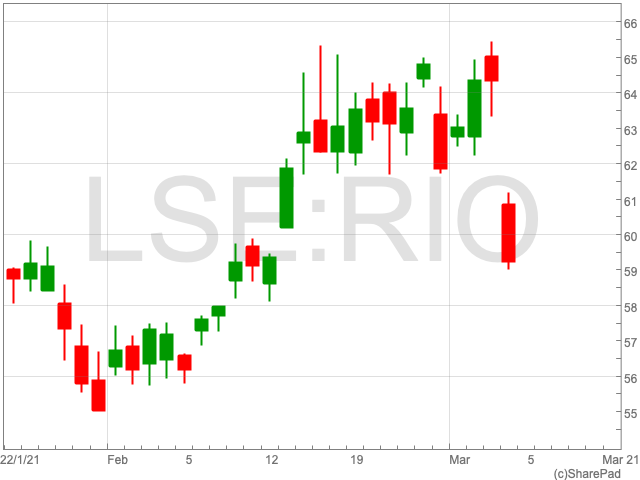

Mining giants Rio Tinto (-7.84%) and BHP (-6.10%) were the top two followers on the FTSE 100 at lunchtime closely followed by the Scottish Mortgage Investment Trust (-5.9%).

FTSE 100 Mining Companies

It was a tough day for oil and mining companies on the index as the price of oil came down. This followed a rally in recent weeks, particularly for mining groups, in anticipation of a commodities supercycle.

After a strong climb since early 2020, Rio Tinto shares plumetted by nearly 8% to 5,933p. Other FTSE 100 mining companies, including BHP, Antofagasta and Glencore also saw significant falls in the value of their shares.

Aviva

Aviva confirmed on Thursday that the company is set to sell its Italian arm in 2021 as it looks to pay down its debt. The insurer also announced a net profit of £2.9bn, up from £2.7bn in 2019.

The FTSE 100 insurer proposed a final dividend of 14p per share, bringing the total dividend for 2020 up to 21p per share. This is up from 15.5p per share in 2019.

Schroders

Schroders confirmed on Thursday that its pre-tax profit fell by 2.3% in 2020, while its assets under management soared to a record high. The asset management company posted a profit before tax of £610.5m in 2020, down from £624.6m in 2019.

The FTSE 100 company now manages assets worth £574.4bn, up from 15% the year before.