2015 was a slow year for tech IPOs, with many choosing to stick with private investment instead of testing the waters on the market. But with several large tech companies rumoured to be looking to float, what’s the forecast for 2016?

Throughout 2015, the outcomes were mixed for those that did take the plunge; companies such as GoDaddy (up 64 percent from its initial price) and Fitbit (up 48 percent) were the real stars of the season, but others such as Etsy (down 47 percent) and Party City (down 25 percent) made the overall outcome disappointing – which will not have gone unnoticed by those tech companies considering flotation.

Private funding appears to be the word du jour for the big names in tech – Pinterest, for example, have said in a regulatory filing that it has raised an additional $367 million of private funding, bringing the total amount of financing since its 2009 launch to $764 million and the company’s valuation up to around $11 billion. Most unicorn start-ups seem to be thinking along the same lines; why IPO and risk failure when there is plenty of private capital to survive on for the time being?

However, there are rumours abound that several large companies are looking to enter the stock market in 2016, including Dropbox and Spotify.

Possible IPOs for 2016

Snapchat

The smartphone app allowing users to send photos and videos to contacts which then disappear after a given number of seconds has recently reached the big time, boasting 100 million monthly users.

Snapchat has so far undergone eight rounds of equity funding, for a total investment of $1.2 billion. Facebook and Alphabet have made offers above $3 billion for the company, both of which were turned down by Snapchat.

However, there are recent indications that the company is looking to IPO, including hiring Imran Khan, the Credit Suisse banker who led Alibaba’s record-breaking IPO earlier in 2014, as Chief Strategy Officer. Snapchat have also launched paid-for content, including ‘filters’, starting from 79 pence.

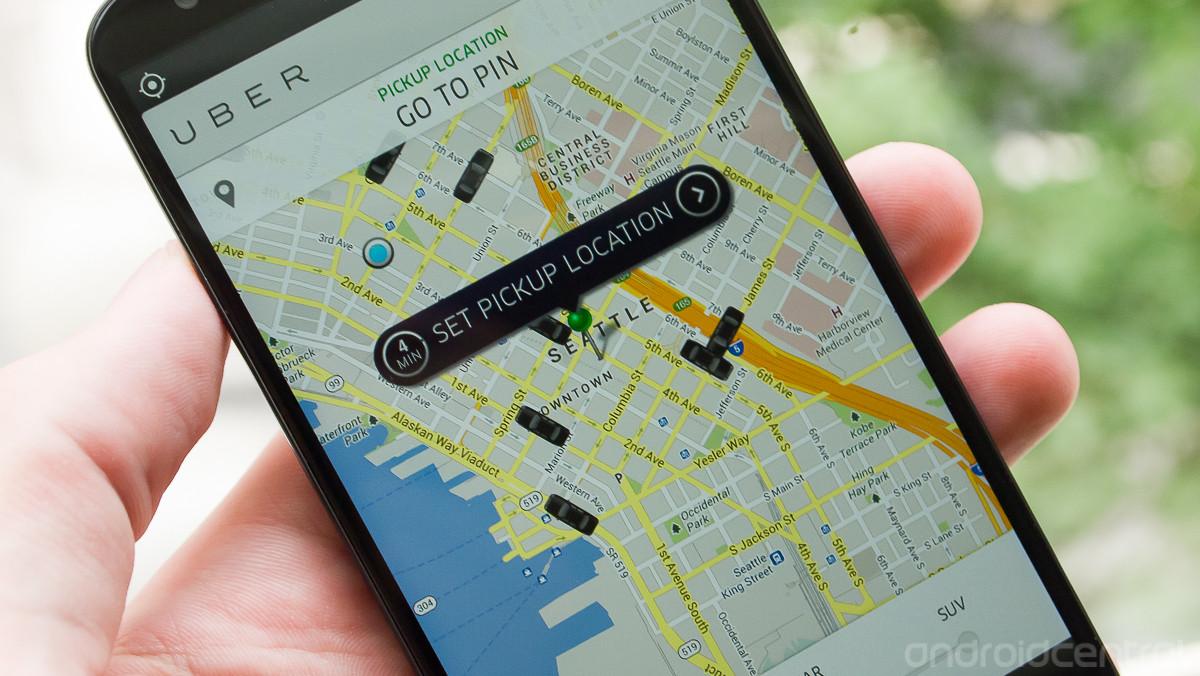

Uber

The controversial taxi app, which has recently been banned in several countries on both safety concerns and claims that they were undercutting traditional cab drivers, is well on its way to becoming the most valuable venture-backed start-up in history; it’s most recent valuation was $50 billion.

Bookings grew from $687.8 million in 2013 to $2.91 billion in 2014, and are expected to reach $26.12 billion by the end of this year. It certainly looks to be a lucrative business, and industry experts are expected the company to go public at some point in 2016.

Airbnb

Airbnb, the online holiday apartment rental platform, is a start-up that has gone from strength to strength since its birth, now displaying over 1.5 million listings in 34,000 cities in 190 countries. Its latest round of funding raised $1.5 billion and valued the company at $25.5 billion.

Rumours of Airbnb’s IPO have been circulating since early 2014, but the company has since undergone a significant rebranding – prompting further speculation that it is finally getting ready to float. Its impressive financials and strong user base would make this company one of the hottest IPOs of 2016.

Miranda Wadham on 04/01/2016