TechFinancials (LON:TECH) are propelling their transformation with the launch of two Blockchain based ventures in CEDEX, a diamond trading platform, and NewCo, a sports venue ticketing solution.

TechFinancials are a Fintech software provider and the recent developments bolster their portfolio of global trading solutions and signals growth into new markets.

CEDEX

The CEDEX platform allows investors to invest and trade in diamonds as they would any other financial asset class.

The platform harnesses Blockchain technology to give investors the power to trade diamonds with the liquidity and transparency not previously seen in the market.

TechFinancials has a 2% interest in CEDEX Holdings, the holding company of the CEDEX exchange. TechFinanicals have an option to acquire a further 90% of CEDEX Holdings.

CEO Asaf Lahav commented on the launch: “We are delighted to have played a pivotal part in the launch of the first blockchain-based diamond exchange in the world. This milestone achievement is testament to the innovative capabilities of both CEDEX and TechFinancials to build a new, ground breaking platform and we look forward to updating the market on its progress in due course.”

Footies

Signalling TechFinancial’s growth into new markets, the group have signed a binding agreement with Footies to create NewCo, a sports ticketing solution to control revenue loss in the secondary ticket market.

The secondary ticketing market has been the subject of scrutiny this year as event organise attempt to reduce over inflated prices of tickets being sold in the secondary market.

NewCo’s solution will provide a Blockchain-based solution to provide greater control over the path of tickets once issued to produce economic benefits from both the issuers and fans.

NewCo will be led up by ex-CEO of Liverpool Football Club, Ian Ayre who has been appointed chairman.

Ian Ayre commented: “I am delighted to be involved in the establishment of such an exciting and innovative company in partnership with TechFinancials. There is huge demand for the secondary ticketing market in the sporting industry to be revolutionised in order to make it fully transparent and to make sure that a fairer deal is ensured for both the venues and the customers. For years, both of these parties have suffered at the hands of ticket touting, and we aim to solve this by making it a more secure and stable market.

“Supported by TechFinancials’, I look forward to developing and growing the business to transform the way organisations handle their events more effectively, for the benefit of all involved in the ticketing process.”

TechFinancials will have a 75% stake in NewCo with Footsies holding 25%.

Half Year Results

Half Year Results

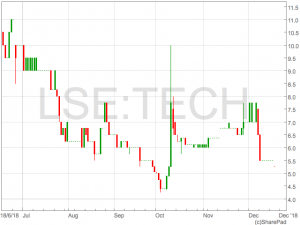

The announcements came after the company released interim results that highlighted the transformational nature of 2018 for TechFinancials.

The group posted revenues fo $3.78m for the first half, down 46% for the same period a year prior.

Despite a disappointing first half, the group is well positioned for further investment with a cash position at the end of the first half of US$2.86m.

New blockchain trading technology business produced revenues of US$1.3m (H1 2017: $0).

TechFinancials (LON:TECH) has recently received a $1.7m dividend pay-out by DragonFinancials, their 51% owned subsidiary operating a trading platform targeting the Asia Pacific Region.