Tesco (LON:TSCO) are to continue to pay their dividend after it experienced a jump in sales due to coronavirus panic buying. However, this uplift may be short-lived as the group expects to suffer up to £925 million in additional costs through the pandemic.

In a trading update and preliminary results for 2020 the retailer said it had seen a circa 30% increase in sales during the onset of the coronavirus pandemic which had cleared the supply chain of certain lines. This is now said to be stabilising and they see stores well stocked.

The group said they had been on a hiring spree to meet demand, leading to higher overall costs as it supported employees unable to work due to illness or isolation.

Despite the expectation of higher costs, Tesco said they plan to pay their full year dividend of 9.15p.

The full year dividend would be in addition to a proposed special dividend from the sale of the Thai and Malaysian business.

In early March, Tesco announced it was selling the Thai and Malaysian business unit for a consideration of £8.2 billion, to help focus the business.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

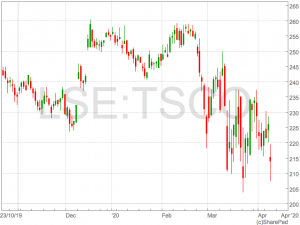

Shares is Tesco were down over 4% following the announcement.