The outlook for the UK economy is improving as the so far successful vaccine roll-out has led the governor of the Bank of England to hint at stronger than anticipated growth in the coming months. While Andrew Bailey warned against complacency, he suggested that the United Kingdom could return to its pre-pandemic level before the end of the year.

With the Brexit deal completed and the end of lockdown in sight, Britain’s economy could be worth another look for investors who largely turned their backs on UK companies.

David Smith, the manager of Henderson High Income Trust, said: “Now that effective vaccines are being rolled out there is a credible path to life returning to some form of normality sooner rather than later.”

“With strong global economic growth expected as the recovery from the pandemic comes through, and continued monetary and fiscal support from governments, the backdrop is positive for equities.”

Aberdeen Standard Sicav UK Equity and Allianz UK Mid-Cap are two funds which could reap benefits from a resurgent UK economy.

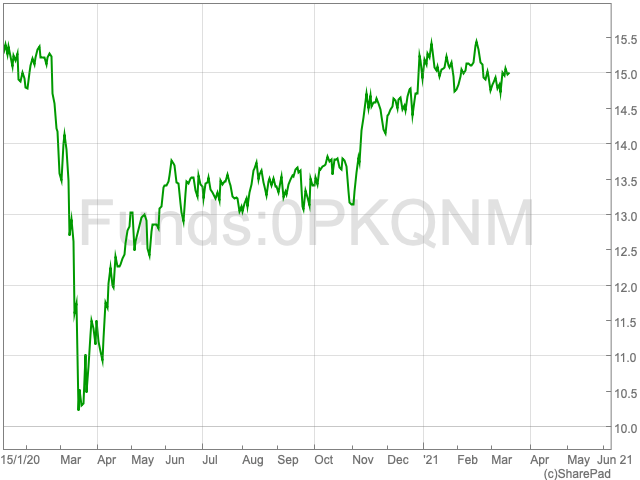

Aberdeen Standard Sicav UK Equity

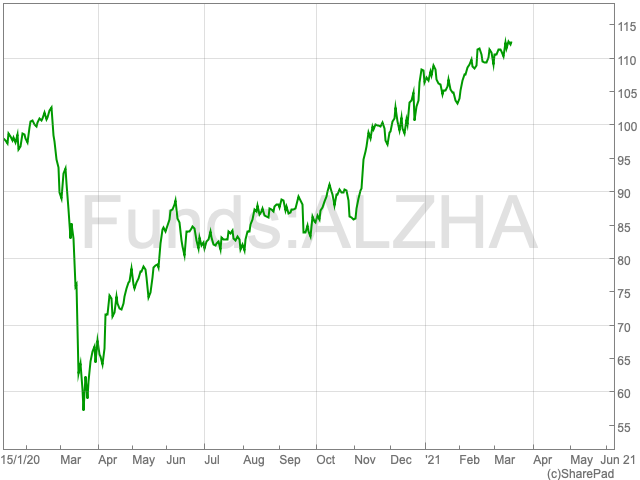

The fund’s aim is to outperform the FTSE All-Share Index, achieving a combination of growth and income by investing in British companies.

As the economy crashed as news of the impact of the pandemic became known, the Aberdeen Standard Sicav UK Equity avoided negative growth. It remained above its benchmark index and quickly recovered toward its pre-pandemic level.

Over a five-year period the fund saw a yearly rise of 8.22%, exceeding its performance target of 5.87%. While over a three-year period the UK-based fund outperformed its target by 4.67%.

The company’s top holdings are AstraZeneca (6.95%), Prudential (4.7%) and Close Brothers Group (3.9%), while it is defensively weighted towards the financials (21.8%), healthcare (17.2%) and consumer goods (15.7%) sectors in response to current market conditions.

The fund’s dividend yield is historically around 0.8%.

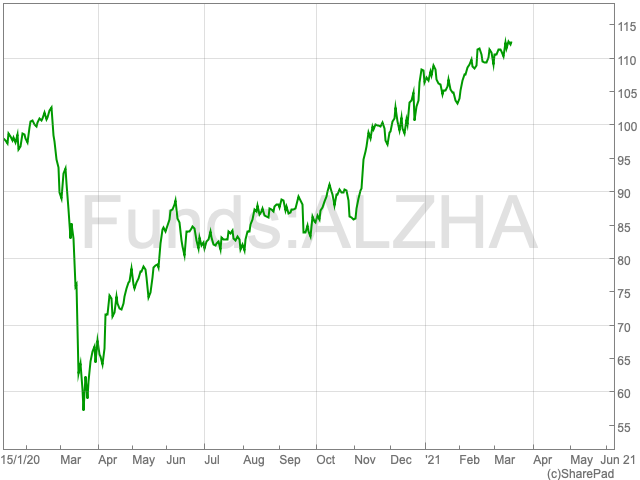

Allianz UK Mid-Cap

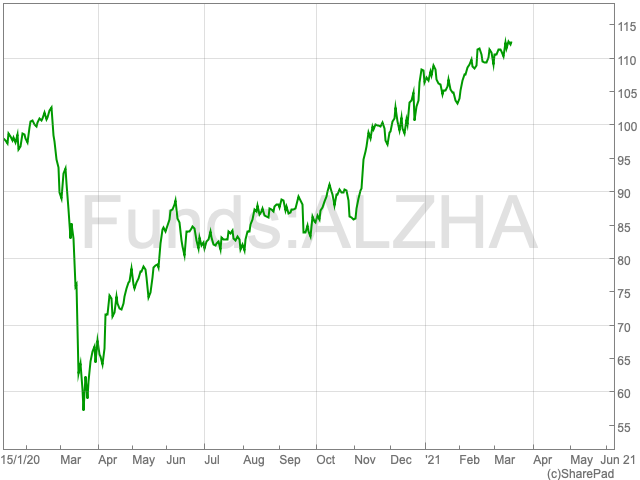

The fund aims to achieve capital growth by generally investing in UK mid-cap stocks listed on the London Stock Exchange.

The Allianz UK Mid-Cap has outperformed its benchmark, the FTSE 250 Mid ex-ITs, over the last two years, 30.38% to 16.15%, as well over the course of the past year, 47.89% to 40.64%. In addition, the fund’s share price has climbed by 79.4% over the past year.

Allianz Uk Mid-Cap’s top holdings are in Howden Joinery Group (5.52%), Travis Parkins (5.36%) and Wizz Air Holdings (5.26%). While it is most weighted towards consumer services (31.54%), industrials (24.52%) and consumer goods (16.03%).

The fund’s yield is 1.02% which is reinvested annually.