United Utilities is set to expect revenue growth of approximately 3% for 2021, however, the company anticipates its underlying operating profit will remain flat as the rising revenue is offset by inflationary pressure.

United Utilities further predicted an increase in underlying net finance expense of £175 million, due to the 30-year record level of inflation applied to the company’s index-linked debt.

The group mentioned that trading is in line with expectations for the current period.

“Utilities tend to be relatively good inflation hedges because they’re able to increase their fees in line with rising prices,” said Hargreaves Landsdown equity analyst Laura Hoy.

“That’s the case for United Utilities, but some of those benefits are being lost because of the group’s index-linked debt, which gets more expensive alongside inflation.”

“This variable rate debt is a concern given the current environment, and we’d like to see the group find ways to pay it down or refinance for more favourable terms.”

“The underlying business case is still intact, but a near doubling of interest expense payments this year is a trend that can’t be repeated in 2022.”

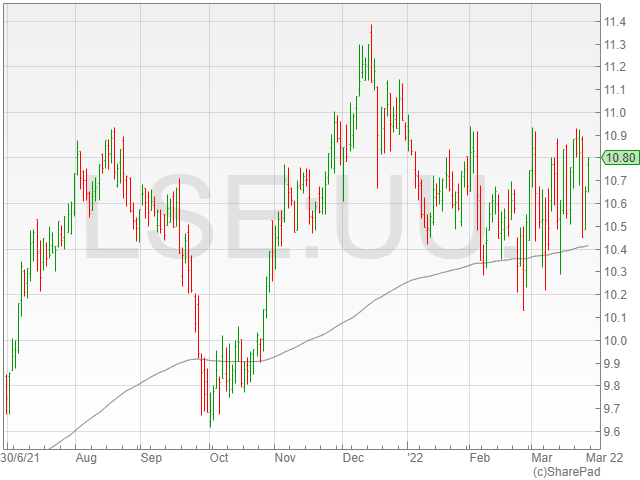

United Utilities saw its share price increase 1.1% to 1,078p in late morning trading on Friday after predicting 3% revenue growth to be seen in 2021.