SMEs with stock offerings that trade under $5 per share are regarded as penny stocks by the SEC (Securities and Exchange Commission) in the US. In the United Kingdom, penny stocks trade at less than £1. These ‘penny stocks’ companies are characterized by low market capitalizations, and their share offerings are usually associated with low trading volumes. Given that they are usually in their infancy stage of development, they don’t have mass market exposure, and they typically fly under the radar.

Penny stocks are often traded over-the-counter (OTC), or as Pink Sheets. This has important ramifications in terms of credibility. Securities and Exchange Commission (SEC) guidelines, and Financial Conduct Authority (FCA) guidelines have strict rules in place vis-a-vis reporting requirements for listed companies. In the absence of listings on the NASDAQ, S&P 500, NYSE, or LSE, traders have to be careful when picking penny stocks. Fortunately, there are 4 different tiers of penny stocks to choose from, most significantly Tier 1 Stocks and Tier 2 Stocks.

An in-depth education is needed to successfully trade penny stocks online. This guide presents several penny stocks to watch for November 2020.

FindIt Inc (OTCPK: FDIT)

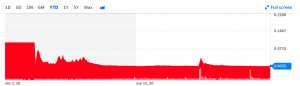

The above chart reflects the current demand/supply, and attendant pricing for Findit Inc (FDIT). The stock is currently regarded as neutral, but recent performance has been strongly bullish heading towards the end of November. The company has a low market cap, as indicated by its $13.581 million figure. The stock is currently trading at $0.1150, almost 4 times higher than it started the year ($0.0318) on January 1, 2020. Tremendous volatility was evident heading into October, and again heading into November. Traders ran up the price of the stock to over $0.20 per share, before taking profit.

The charts and patterns reflect this bullish trading activity, and attendant profit-taking. When traders sold off en masse, the price dropped, allowing for additional price action to buy the dip. That caused the price to rally again. The current pricing for FindIt– an app that has been approved for the Google Play Store – as indicated by the Bollinger Bands is neutral. The stock has a 50-day moving average of $0.11, and a longer term 200-day moving average of $0.06. The current Bollinger Bands have a high band of $0.18, a median band of $0.13, and a low band of $0.09. The price is currently a sliver beneath the median band, indicating that it is possibly slightly oversold and ripe for a reversal.

Bantec Inc (OTCPK: BANT)

Bantec Inc is another penny stock that trades OTC. This products & services company manufactures hand sanitizers, and disinfectants. The stock is currently priced at $0.0025 with negligible overall price movement for the year-to-date. There were several periods of volatility over the past month where the stock rallied tremendously. For example, in the final days of October, Bantec stock hit a price of $0.066, which is 2.5 times its current trading price. While miniscule in nominal terms, this huge price percentage appreciation represents a dramatic opportunity for penny stocks traders.

This underscores the importance of percentage appreciation, versus price appreciation. Penny stocks traders who invested $1000 in BANT on October 27 at a price of $0.0031 would have seen the valuation of that stock increased to $0.066 by October 28, before the sell-off and take profit orders were exercised. The initial purchase was the equivalent of 322,580 shares which could have been sold for $0.0066, for a price of $2,129, netting a profit of $1,129.

Digital Ally Inc (NASDAQ: DGLY)

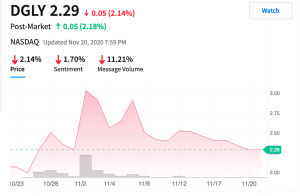

Digital AllyIncorporated manufactures body cameras for the police department, among others. The stock is currently trending bearish, as evidenced by the recent downturn since early November. At its current price point ($2.29) it qualifies as a penny stock, and it is listed on the NASDAQ. This automatically places it as a Tier 1 category penny stock since it is subject to stringent reporting requirements. There has been substantial price movement in the stock over the past month, with lows of $1.95 and highs of $3.120. The company’s market capitalization is $61.309M, and the 1-year target estimate is $5.00 per share.

When trading the stock, several important figures need to be assessed, notably the actual earnings versus the consensus earnings. In Q2 2020, and Q3 2020, DGLY beat expectations. This bodes well for bullish trading movements with the stock. The last major ratings upgrade & downgrade by Aegis Capital recommended a buy for this stock. In terms of long-term propositions, with a Biden administration in place, and greater accountability expected of the police force, we can expect demand for DGLY to increase. By the same token, a diminished police presence may act against the stock’s appreciation. It’s too early to tell which way to trade this penny stock, but a buy and hold for the foreseeable future appears to be the consensus.

Note: It is foolhardy to simply accept expert opinions regarding top listings of penny stocks to trade, without conducting your own due diligence. Recommended stocks may be good at the time of writing, but by the time you have read the article, other stocks may be preferred.