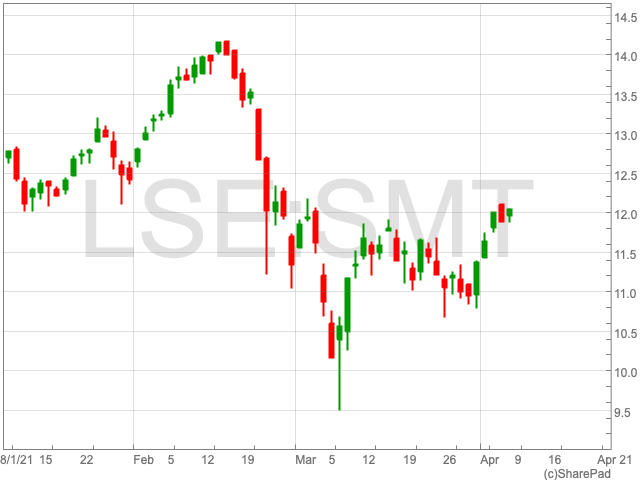

Scottish Mortgage Investment Trust Share Price

In February shares in Baillie Gifford’s flagship investment trust fell sharply due to a US tech sell-off, rising bond yields and a dip in Asia. However, Scottish Mortgage Investment Trust now appears to be at the early stages of a recovery. In just over a month shares in the trust are up by 19%. While since the beginning of the year, its share price remains down by just over 1%.

Change of Leadership

UK Investor Magazine reported in March that James Anderson, who manages the trust alongside Tom Slater, will step down in April 2022 after nearly 40 years at Baillie Gifford. This could raise concerns for investors over the long-term performance of the fund as it changes hands in a year’s time. After all, when one buys into an actively managed trust or fund, it is the manager’s expertise that offers value.

In the case of the Scottish Mortgage Investment Trust, its recent success can certainly be put down to the competence of Anderson, who generated impressive profits through well timed acquisitions of Tesla, Amazon and Alibaba, among others.

Investors are sometimes made nervous by such a change in leadership. Ryan Hughes, head of active portfolios at AJ Bell, discussed investors’ concerns and looked towards the future of the Scottish Mortgage Investment Trust without Anderson.

“News that James Anderson is stepping down as joint portfolio manager on the Scottish Mortgage investment trust will potentially cause some worry to the thousands of investors who have made fantastic returns over many years,” says Hughes.

“However, it’s important to remember how Baillie Gifford work with the investment process being firmly embedded in the team-based approach and experienced investor Tom Slater remaining at the helm. With Anderson not stepping back for over a year, this has been well planned with a clear handover process for Lawrence Burns to become deputy manager on the trust to support Slater.”

The continuation of leadership at the helm, along with the current team culture, could mean that there are no radical changes to the company’s portfolio when Anderson does leave. This could go some way to quelling investors who will be keeping an eye on the Scottish Mortgage Investment Trust share price.