888 unsuccessfully tried to buy William Hill in 2016

888 Holdings mad a move towards becoming one of the dominant betting companies in the world as it acquired William Hill International for £2.2bn.

It said the deal would allow 888 to make £100m of annual cost synergies following the move which was part-funded by a £500m equity raise.

The FTSE 250 firm described the deal as being “a transformational opportunity for 888 to significantly increase its scale, further diversify its product mix and accelerate the upward shift of its revenue-growth profile”.

The 888 Holdings share price (LON:888) is down by 2.54% just before lunchtime on Thursday.

“William Hill himself used to take bets over the phone from the famously nocturnal racehorse owner Dorothy Paget after the races had been run, because he knew she was a wild gambler and had no chance of finding out which horses had already won, at a time when there were no licenced betting shops, let alone live radio or television broadcasts or mobile phones. 888 will be hoping it is on to a similar sure-fire winner with its acquisition of the European assets of the betting empire built by Mr Hill,” says AJ Bell Investment Director Russ Mould.

888 unsuccessfully tried to buy William Hill in 2016, as part of a complex three-way, £3 billion deal with Rank, when it nearly turned the tables on Hills, which had failed in a lunge for 888 the year before.

“888 will feel that patience has paid off, not least as the total bill this time is £2.2 billion. Moreover, the deal will hugely enhance 888’s size, share and competitive position, especially in the all-important online betting arena in regulated markets,” Mould said.

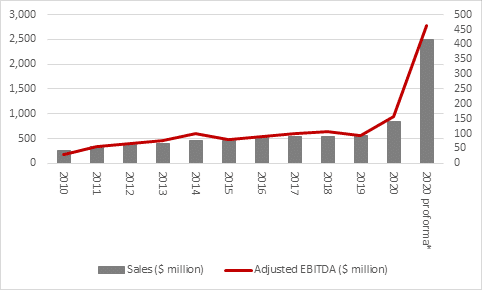

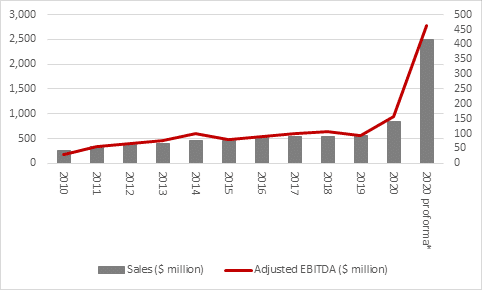

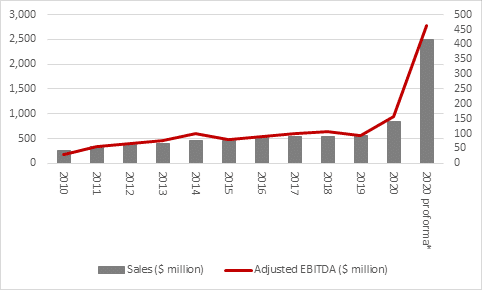

“In 2020, 888 recorded sales of $814 million and earnings before interest, taxes, depreciation and amortisation (EBITDA) of $156 million. Including William Hill International’s assets takes those historic figures to $2.5 billion and $464 million.”

“On top of that, 888 expects to generate $100 million in cost benefits and will doubtless also be looking to drive revenues higher through cross-selling games and services to existing and new customers,” said Mould.

888’s business mix is more heavily slanted toward games and casinos, William Hill’s more toward betting on horse racing and sports.

Some investors may be wondering whether 2020’s pandemic-and-lockdown online betting boom can be sustained, given the greater range of leisure and spending opportunities that are once more open to consumers.

“Tighter regulation also remains a potential concern, notably in the UK, where the Government continues to review the 2005 Gambling Act.”