Kromek Group PLC (LON: KMK) have seen their shares bounce on Wednesday morning following an impressive update.

Kromek Group plc is an international technology group (global HQ in the UK) and a leading developer and supplier of high-performance radiation detection products based on cadmium zinc telluride (CZT) and other advanced technologies. Using its technology platforms,

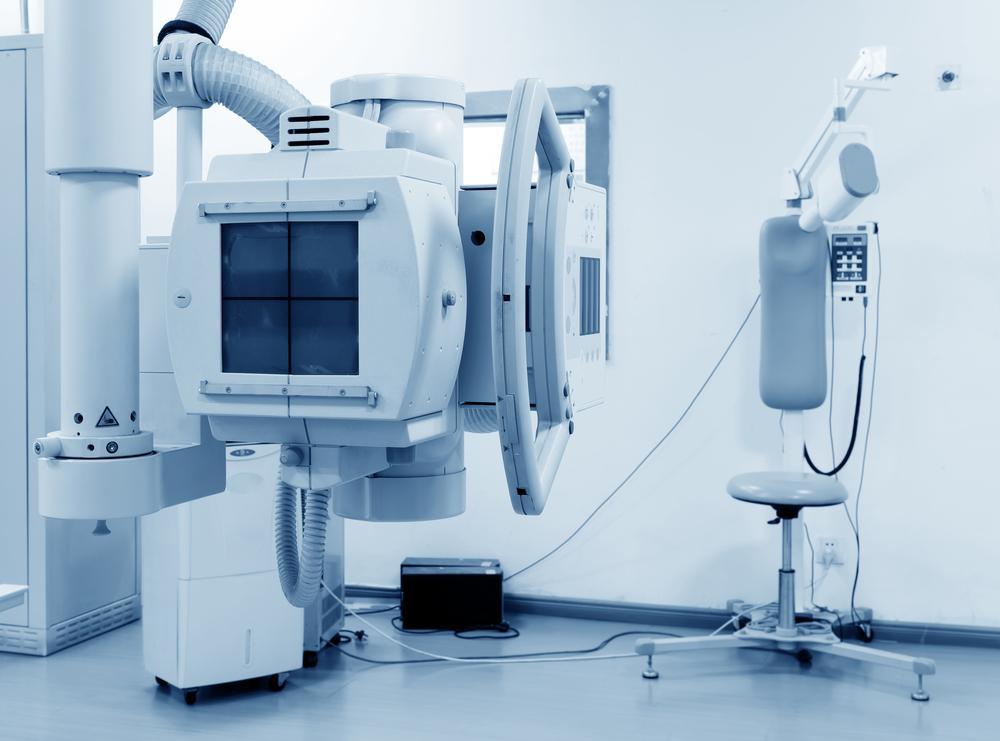

Kromek designs and develops and produces x-ray and gamma-ray imaging and radiation detection products for the medical, CBRNe security, Homeland Security and civil nuclear radiation detection markets.

Shares in Kromek bounced 14.06% to 19p on the announcement. 11/12/19 11:10BST.

Kromek said that they had reached ‘record’ revenue figures for the interim period.

Revenue in the six months to October 31 was £5.3 million, 43% higher than a year before.

The pretax loss widened to £2.7 million from £2.1 million, however, due to increased finance and operation costs.

Looking forward, Kromek has “increasing commercial momentum”, with revenue and earnings before interest, tax, depreciation and amortisation for its financial year to April on track to meet the market’s expectations.

“This year has seen a focus on executing on the previously-signed agreements and commencing delivery on the multi-year contracts won in recent years. This has resulted in record first-half revenues,” said Chief Executive Arnab Basu.

“Kromek entered the second half well-positioned to report its highest ever full-year revenue as delivery of high value, multi-year contracts continues to ramp up. We are delivering on contracts worth nearly GBP100 million won over the past three fiscal years in our target markets of medical imaging, nuclear detection and security screening as customers commercially deploy their next-generation CZT-based products,” Basu continued.

“Additionally, we continue to experience growing demand for our flagship products, which is expected to convert to further orders.”

The update from Kromek today is one that will impress shareholders, in a technology industry which has seen saturation and increased competitiveness.

In the market firms have seen mixed results, and updates can be found below.

ULS Technology booked a setback to its financial progress with challenging market conditions during the first half.

The Company’s revenues contracted 8% during a year-on-year comparison for the first half, down to £14.55 million.

At the start of November, Castleton Technology PLC saw theirs shares crash over 40% after a poor trading update.

The company reported revenues of not less that £11.6 million in six months to September 30th, significantly less than sales of £12.9 million in the same period in 2018.

Adjusted EBITDA of not less than £2.9 million and cash generation of of not less than 79% EBITDA.

Additionally, Managed IT services provider AdEPT Technology Group PLC saw its share price drop despite a sharp hike in the Company’s financial performance fundamentals during the half year to September 30th.

The Company’s revenues bounced 26% to £30.8 million year-on-year. The majority of revenue came from managed services, which jumped 39% to £25.1 million and now make up 82% of total Company revenues.

Certainly, shareholders of Kromek should remain optimistic and shareholders will hope that the firm can expand and develop across 2020 to produce impressive results as the ones shown this morning.