US investment management blue chip, BlackRock (NYSE:BLK) posted commentary on Monday afternoon, which stated that Democratic candidate, Joe Biden, currently appears to have an edge in the race to become president.

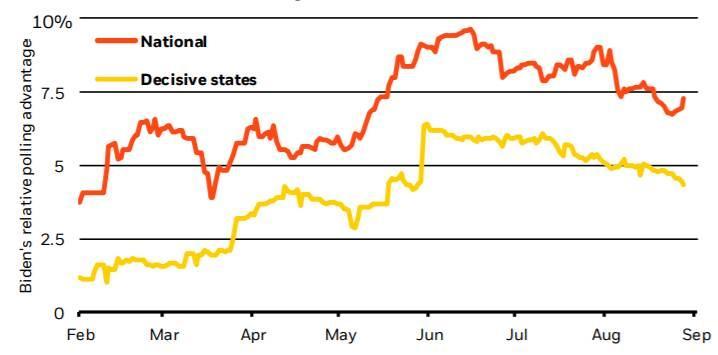

In what the company described as a highly ‘consequential election’, Biden looks to be leading Trump by seven percentage points in the recent national polling data. This lead, as ‘stable’ as it has appeared, is set against a tumultuous backdrop of economic uncertainty and public safety concerns – and therefore anything can still happen.

Indeed, and likely what many predicted, his lead has narrowed in key electoral states. This could well give Trump a path to re-election, with the incumbent president timing his poor handling of the virus well, with enough time for the debate focus to be shifted onto social issues and national security.

Among BlackRock’s three plausible scenarios for the election, they predict: 1) a Democratic sweep of the White House and Congress (with Democrats winning control of the Senate); 2) a Biden win with a divided Congress; and 3) a status quo Trump win. What is interesting, though, is that they also note the challenge that record-high mail-in voting will pose to vote counting, with potential delays and legal challenges on the cards.

Blackrock identifies three policy areas to watch

As far as policy differentiations are concerned, we might see Trump and Biden as diametrically opposed, but BlackRock notes three particular divergences to take note of.

First, and crucially: fiscal policy. The company says that under a Democrat clean sweep, the likelihood would be a new round of fiscal stimulus to spend on clean energy, transport and housing, as well as tax increases for companies and the wealthy. A Biden win with a Republican Senate would see less ambitious fiscal stimulus and infrastructure spending, alongside fewer tax changes.

BlackRock’s commentary adds that: “The net difference in fiscal spending between the two scenarios could be several percentage points of GDP over each of the next few years, we estimate. Fiscal spending under a second Trump term would be somewhere in the middle between those two scenarios.”

On the second policy issue, geopolitics, BlackRock states that under either scenario, a Biden win would likely mark a return back to ‘predictable’ trade and foreign policy, which would support emerging market assets and broader risk sentiment in the short-term. The company also believe that a Biden victory would not greatly impact US-China relations, as there is now bi-partisan support for a competitive stance on China in regard to tech, trade and investment. However, one big change would involve the US spear-heading the green stimulus effort.

BlackRock states that: “The U.S. would likely immediately rejoin the Paris Agreement and increase its emissions reduction goals. Its fiscal plans could help supercharge a globally coordinated green stimulus effort, adding to recent efforts by the European Union. A Trump win, by contrast, would likely lead to a doubling-down of the “America First” stance on trade and immigration.”

Finally, the company disregards the ‘tax-centric’ election logic, which states that a Democratic clean sweep would be seen as a market negative. Instead, in such an instance, BlackRock believes that investors would have to deal with higher taxes and tighter regulation, but that this would be balanced out by predictable foreign policy and greater fiscal support. The main implications, they say, will be in fixed income and leadership in equity markets, with long-term rates being pushed high and leading to a ‘modest steepening’ of the Treasury yield curve.

Also, while additional tax and regulations might pressure high cap companies, domestically-oriented small cap firms might benefit the most. Blackrock finishes by saying that:

“This scenario would add to reasons to prepare for a higher inflation regime and reinforces our strategic underweight of developed market nominal government bonds. The tectonic shift to sustainable investing will likely persist regardless of the result, but could be supercharged under a Democratic sweep scenario.”