The FTSE 100 was down 0.7% to 7,099.8 in midday trading on Thursday after commodities prices fell and dragged mining groups down.

Anglo American shares declined 3.5% to 2,590p, Antofagasta dropped 1.2% to 1,029p, Endeavor slid 0.7% to 1,643.5p, Fresnillo fell 1.5% to 673.8p, Glencore decreased 1.9% to 410.3p and Rio Tinto sank 3.1% to 4,640.2p.

Meanwhile, the price of Brent Crude fell below the $100 per barrel mark which it had been so tenaciously remaining ahead of, dropping to $97 per barrel.

Shell shares fell 2.1% to 1,959.4p and BP shares dipped 1.8% to 370.3p on the sinking oil prices.

The bad news for commodities marked a slight relief for other companies on the index, as the lowering prices in materials represented a lower cost base for firms which have been struggling to keep their heads above water among surging cost inflation.

“As Morrissey woefully sang, ‘Stop me if you think you’ve heard this one before’. Investors are getting sick of hearing about inflation, interest rates and falling stock markets. While that tune is still playing loudly, some of the pains we’ve seen over the past year are starting to fade,” said AJ Bell financial analyst Danni Hewson.

“Commodity prices are easing back, implying input cost pressure will relax slightly. Shipping rates are also starting to fall, albeit due to softening demand.”

“Although it will take time for these factors to feed through into the system, the end of sky-high inflation could be in sight. It will hopefully soon be time to change the record, but for now, The Smiths’ song looks like it is stuck on repeat for just a bit longer.”

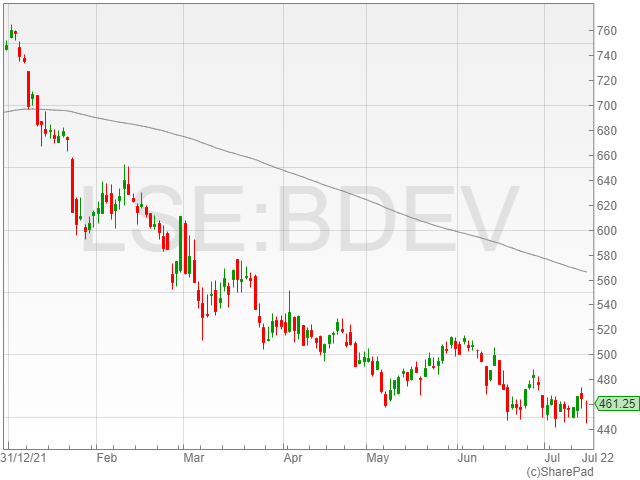

Barratt Developments

Barratt Developments shares were down 0.4% to 463.3p after the housing group announced an expected FY 2022 profit slightly ahead of market expectations between £1.05 to £1.06 billion.

The company further mentioned a return to pre-pandemic levels of completion with 17,908 completions compared to 17,243 the last year.

However, cost inflation took a toll on Barratt’s, with the group confirming a 6% rate of build cost inflation and levels currently at around 9% to 10%.

“Britain’s largest housebuilder, Barratt Development’s latest update is indicative of both the opportunities and challenges facing the sector right now,” said Hewson.”

“House prices may have risen rapidly enough to cover these higher costs so far but Barratt, like its peers, is running just to stand still in terms of profitability and there is a significant risk that raw material and labour costs continue to grow.”

“At least, unlike Persimmon, it is not being forced to downscale its volume targets just yet, suggesting its relationships with suppliers, procurement strategy, simplified build process and attractiveness as an employer are paying off.”