Atlantic Capital Markets have maintained their positive stance on sustainable packaging group, Smurfit Kappa (LON:SKG), following a 7% increase in EBITDA in their full year results.

The rise in profit allowed the board to increase the final dividend by 12% to 80.9 cent per share.

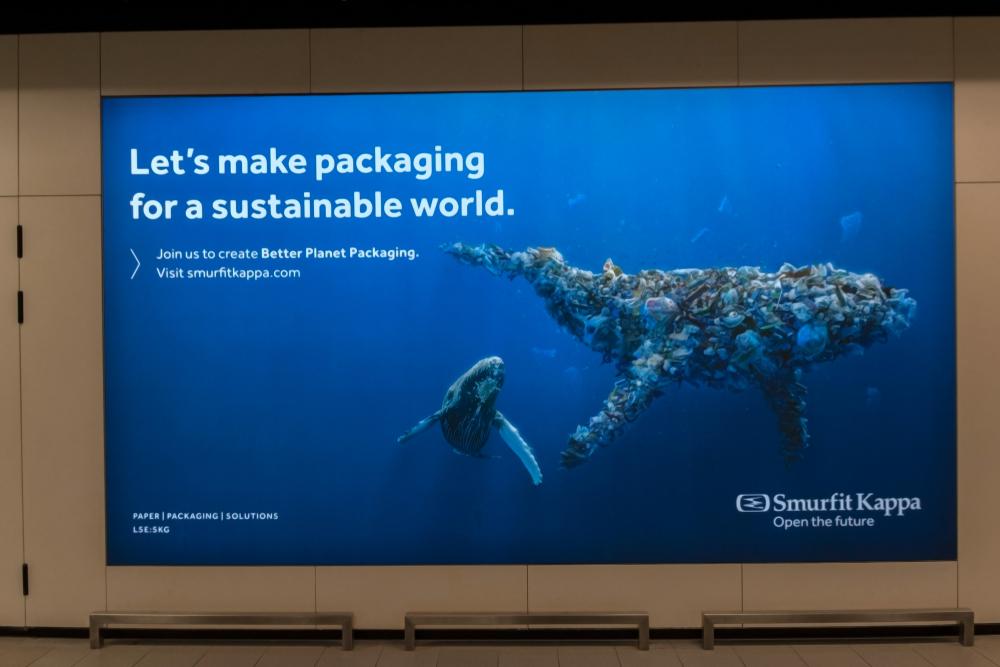

In addition to the strong full year results, Smurfit Kappa shares are an increasingly attractive proposition due to their ESG credentials.

“The figures are great news for all concerned,” said John Woolfitt, Director of Trading, Atlantic Capital Markets.

“Smurfit has always been our top pick in the sector and the news of them returning to profit and increasing the dividend is positive for shareholders and sends a strong message out to the markets regarding the business position and the year ahead.”

“Profit before tax for the year to 31 December was €677m, compared to a loss of €404m the previous year. Last years loss was largely due to the Venezuelan business being seized by President Nicolas Maduro’s regime. This now looks to be behind the firm with them persuing proceedings to seek compensation from the government of Venezuela.”

“Despite a challenging backdrop for the sector Smurfit have yet again proved themselves to be in a strong position with solid performance and a confident

outlook for the year ahead.”

Smurfit Kappa Dividend Hike

John Woolfitt also pointed to the increase in dividend as a reason to be bullish on the stock.

“Smurfit is a business built on quality, from their products through to their management and staff and this is shown in the bullish increase in the dividend,” John said.

Tony Smurfit, Group CEO, summarised the results:

“2019 represents another period of strong delivery and performance for SKG. EBITDA was €1,650 million, a 7% increase on 2018 with an increased EBITDA margin of 18.2%. Our vision is to be a globally admired company, dynamically delivering secure and superior returns for all stakeholders. Our recent performance shows progress towards the realisation of our vision.

“Across 35 countries, we continue to create market leading innovative solutions for over 65,000 customers, delivering sustainable and optimised paper-based packaging. The 2019 outcome also reflects our performance culture, which has, at its core, an unrelenting customer focus.

“During the year, we continued to strengthen our integrated model, following the acquisition of Reparenco in 2018, and our more recent acquisitions in France, Bulgaria and Serbia. These acquisitions significantly enhance our business and further expand our geographic reach. As with previous mergers and acquisitions, the new teams have integrated well and further strengthen the depth and quality of the Group.

“Our European business continued to perform strongly, delivering an EBITDA margin of 19.0%. Demand growth was ahead of the market and in line with our expectations for the year with particularly good performances in Iberia and Eastern Europe.

“The Americas region continued to perform well, delivering an increased EBITDA margin of 17.5% up from 15.7% in 2018. Our three main countries of Colombia, Mexico and the US had strong financial performances with demand in Colombia particularly strong.”