Autins Group PLC (LON: AUTG) have updated their trading figures for the year, concluding that it was expecting to produce results in line with 2019 financial expectations.

The Rugby based firm had outlined plans to significantly cut costs and operational efficiency.

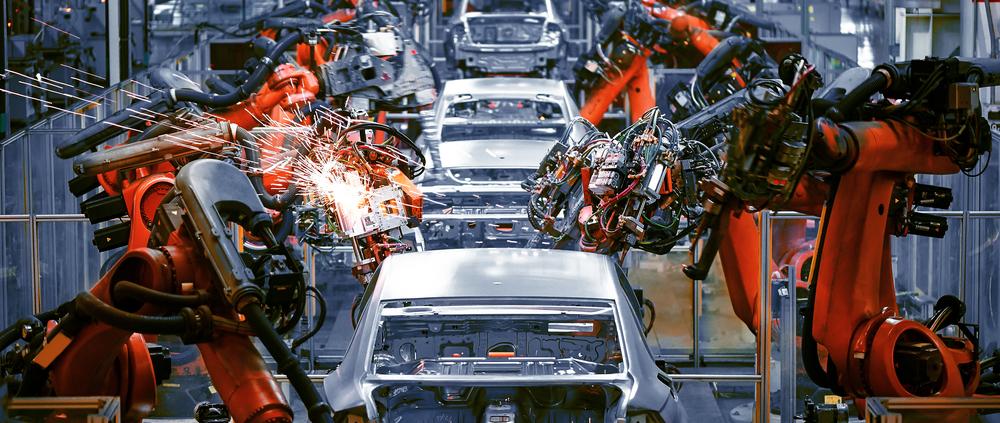

Autins works with the likes of Aston Martin, Bentley, Jaguar Land Rover and Porsche.

The automotive acoustic and thermal insulation company seemed optimistic about 2019 trading despite both political and economic uncertainties.

The AIM listed firm said that “extensive” management actions employed to reduce costs and increase operational efficiency had successfully delivered improved profit margins.

Autins said they were “well-placed” with sufficient capacity to take advantage of the “many opportunities” in its pipeline, to grow and diversify the business.

External sales to customers outside the UK also have grown, and boosted performance from lightweight high-performance material ‘Neptune’ in securing multiple new business client wins, and with production levels ramping up towards the end of the 2019 financial year, which had continued in the new year.

This has been a challenging year for both the industry and the Group, but it has also been a year of repositioning, recovery and new business wins,” said chief executive officer Gareth Kaminski-Cook.

Kaminski-Cook also added ““The positive momentum is encouraging and, combined with a stronger balance sheet following the successful placing in the summer, gives cause for optimism for the year ahead.”

Autins have made an active effort to grow and diversify following strategies to pursue work on new vehicle platforms with new and existing manufacturers.

Autins are set to release their annual results ending in September on December 11th.

After such hopeful predictions it will only be seen whether this optimism can be justified.

Currently, shares of Autins Group Plc are trading at 19p per share. 28/10/19 12:27BST.

In the manufacturing industry there have been updates for the following companies. Nissan (TYO: 7201) have moved Juke operations to the UK, Pipehawk (LON: PIP) had a strong second half trading period and Georgia Capital (LON: CGEO) have experienced their share value slip.