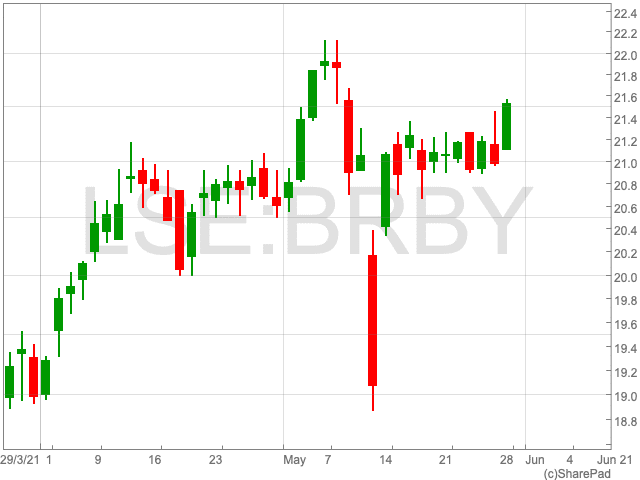

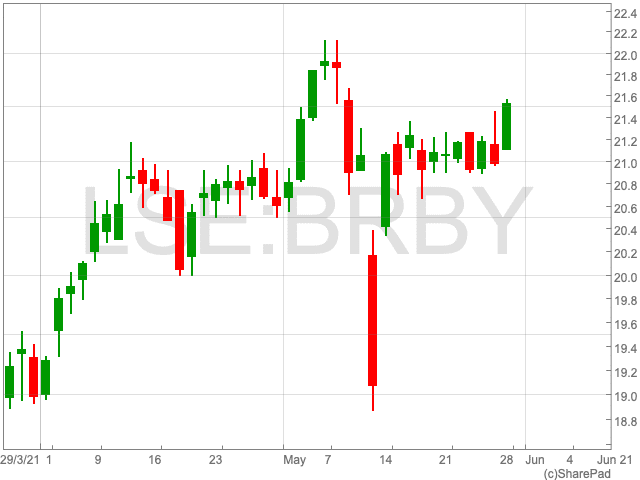

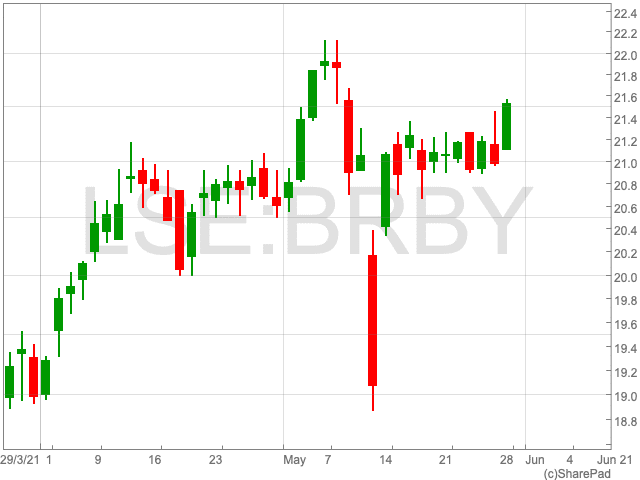

Burberry Share Price

If not for a backlash from China over alleged human rights abuses, the Burberry share price (LON:BRBY) could be a lot closer to its all-time-high of 2,329p, reached in January 2020. Nonetheless, the Burberry share price has rebounded impressively despite the unusual challenges of the past year and beyond. Since 16 March 2020, it is up by 72.6%, while it has gained 19.8% since the beginning of the year. The Burberry share price has moved up by nearly 2% at the time of writing, buoyed by Chinese demand. However, investors will remain curious about its prospects in a key market, as well as its wider performance.

Results

The Burberry share price dived, as seen above, following the release of its financial results. Like any other retailer, Burberry was disrupted as stores were closed down across the world.

Regardless, Burberry reinstated its dividend to its level prior to the pandemic, as the luxury fashion group said its revenues were slowly beginning to recover. The dividend is set to be priced at 42.5p per share, which means the yield stands at just over 2%.

Despite its suggestion that the luxury fashion brand will perform well during the second half of this year, Burberry’s overall sales fell to £2.3bn, a drop of 11%, for the year to March. Furthermore, while Burberry’s Q4 revenues rose by 32%, they were down by 5% compared to the same period in 2019.

On the other hand, rivals, including Hermès and LVMH, posted revenues that returned to pre-pandemic levels.

Burberry warned that its profit margins will take a hit due to planned investment. This does not bode well for investors with a shorter-term outlook, while it could bolster the company’s already solid foundations over the longer-term.

China

The middle class is growing at a rapid rate in China, which means the country is of high importance to Burberry.

Compared to two years ago, Burberry’s Q4 sales were up in China by more than 53%. Having said that, it remains unclear what the future holds for Burberry in the country. Julie Brown, the FTSE 100 fashion brand’s head of operations and finance, omitted details over the brand’s results after March, when it was disrupted by the Chinese boycott of a number of major western brands.

Marco Gobbetti, chief executive, told analysts on call that the impact from the boycott “has been relatively limited”, the Financial Times reported.

As the Burberry share price moved up today, led by the Chinese recovery, the company’s long-term outlook may be bullish. But that could be dependent on the company staying on the right side of the authorities.