Mali and Senegal focused mining company Cora Gold (AIM:CORA) announced on Monday that it had been collecting samples from other parts of the licences it owned as part of its Mali operations, and with this news, investors were entirely unsure how to act.

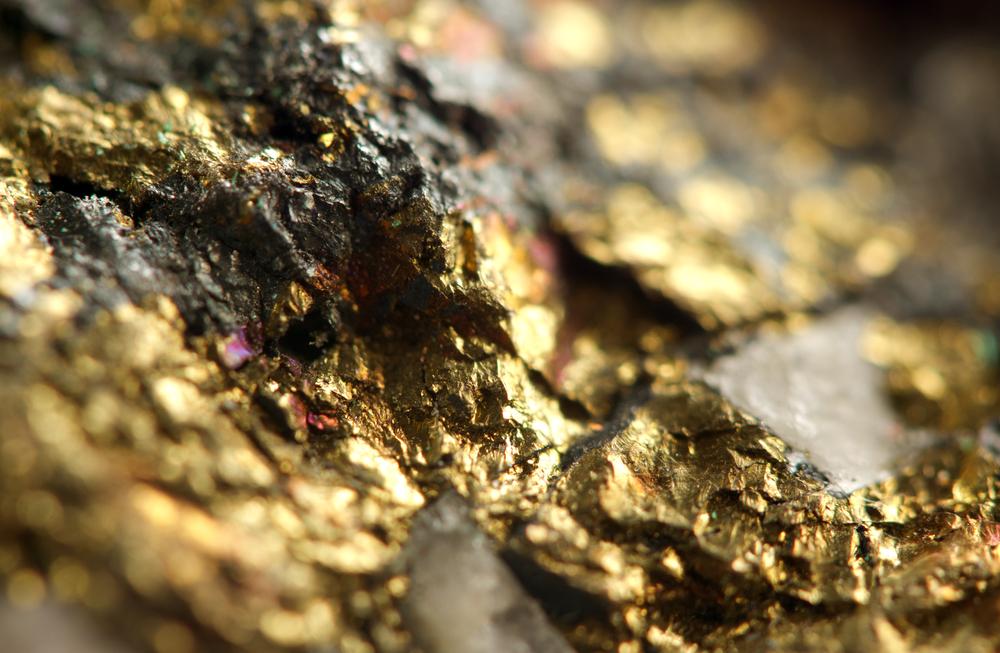

From its projects in West Mali and East Senegal, the company stated that it had identified a new target at its Madina Foulbé Permit, with assay values that included 57.2 g/t, 11.8 g/t, 5.99 g/t and 3.97 g/t of gold. Similarly, it announced two targets at the Diangounte Project Area, with values of 14.1 g/t and 12.1 g/t of gold.

It added that the partially completed reverse circulation drilling programme at Madina Foulbe had identified mineralisation zones of 47m at 0.63 g/t and 36 at 0.53 g/t.

In its Southern Mali Yanfolila Project Area, Cora Gold stated that initial results from rotary air blast drilling at its Tagan Permit had suggested a presence of 1.7 g/t of gold, while a similar drilling programme at its Winza site had a potential strike of over 1,000m with multiple gold zones.

Speaking on its tests and efforts to find the company’s next big project, Cora CEO Bert Monro:

“Given the results generated during H1 2020, we are hopeful that we can discover, in time, another Project like Sanankoro from within our existing highly prospective licence package. Cora has an experienced exploration team that have worked together for well over a decade, based in West Africa, which enables us to operate in an efficient and cost-effective way constantly building up a future pipeline of new drill ready targets.”

“Cora’s main focus remains the Sanankoro Gold project with a very positive Scoping Study, with an 84% Internal rate of return (‘IRR’) at a US$1,400/oz gold price, completed on it and a recent US$21m mandate and term sheet signed for funding to support its future development.”

Following the fairly uneventful update, Cora Gold shares dipped by over 4.50%, before switching back and rallying 2.66%, to 9.08p per share 06/07/20 12:41 BST. This is about equal from the company’s previous year-to-date high in the last week of June, and well above its 4.25p nadir in mid-March.