Frederick & Oliver have given an update on their recent stock tip selection following a period of uncertainty in markets.

The trading house that specialises in a long/short strategy focusing on FTSE 350 provided UK Investor Magazine readers with a selection of tips at the beginning of June which have so far proved to outperform the market.

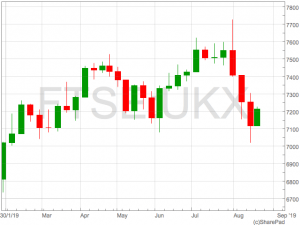

The selection was released prior to period of market unease caused by the heating up of US/China trade tensions, poor economic data suggesting a global recession and changes in US interest rates.

By having a flexible approach to trading large and mid-cap stocks Fredrick & Oliver have been able to harness the volatility in markets to their benefit and produced returns from their selection that would have exceed those holding a representative basket of FTSE 100 shares.

The trading style purses a sector agnostic approach that aims to exploit companies for their individual merit as opposed to following a restrained mandate of stock selection.

The trading style purses a sector agnostic approach that aims to exploit companies for their individual merit as opposed to following a restrained mandate of stock selection.

Marc Kimsey, equity trader at Frederick & Oliver commented on a number of stocks in the selection:

“We’re pleased with the call on Lloyds, especially as many brokers rate the stock as ‘buy’. With October fast approaching and a pro-Brexit government installed, a short at 58p made sense. Currently trading at 48p, clients have 17% profit on the table. From a charting perspective there could be some support incoming, we’re intrigued to see if it holds up, a move south of 45p potentially sets up a revisit of 37p”

“Compass Group was a standout buy. Shares had just notched a record-high on the back of a strong trading statement and yet another dividend increase. The company puts food on tables all over the globe and generates most of its profits in US dollars meaning any Brexit-related weakness in the pound would further boost company profits”

The report in which these selections were included is still available to download.

You can download the report from Frederick & Oliver by clicking here.