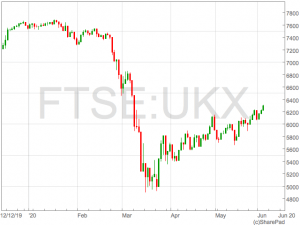

A rally in the FTSE 100 on Wednesday was triggered by promising Asian economic data overnight and was built on by optimism over the reopening of economies and resumption activity in the travel sector.

The FTSE 100 was up 1.1% to 6,290 just after midday on Wednesday.

easyJet was up over 5% whilst International Consolidated Airlines added 8% and was the FTSE 100’s top riser as it touched 272p, the highest level since the sell off in March.

Cyclical sectors such as financials and commodities were also amongst the top risers.

The strong session in Europe followed a rally in Asia over night which was kicked off by the latest raft of global economic data in the form of services data.

The strong session in Europe followed a rally in Asia over night which was kicked off by the latest raft of global economic data in the form of services data.

“Ignorant, oblivious or uncaring about the domestic situation in the USA, investors instead focused on a gangbusters Caixin services PMI out of China, extending the month’s early rebound,” said Connor Campbell, analyst at Spreadex.

“Coming in at 55.0, the PMI was way ahead of the 47.4 forecast AND the previous month’s 44.4, showing a sharp return to growth for the sector across May.”

“That was a huge boost to Europe. The FTSE added another 0.9%, pushing the index to a near 3-month peak of 6275. It would have been higher, however, if the pound weren’t continuing to rebound itself.”

A shift in focus towards Brexit talks has started to play out in currency markets recently as the prospect of hard Brexit hit sentiment, however, today the focus was very much on economic data.

“Though the ongoing Brexit talks seem frosty at best, outright hostile at worst, cable rose 0.4% to $1.2588, its best price in close to 7 weeks,” Campbell said.

“It remains to be seen whether the pound can keep hold of that growth in the face of another weak UK services PMI, one that is expected to see the final reading for May revised marginally higher, from 27.8 to 27.9.”

The Eurozone services sector was also still stuck in contraction, but the Services PMI had nonetheless rebounded strongly to 31.9 from 13 the month before.

“The scale and breadth of the euro zone downturn was highlighted by the PMI data showing all countries enduring another month of sharply falling business activity,” said Chris Williamson, chief business economist at IHS Markit.