The FTSE 100 closed 1.5% higher at 7,151.2 on Friday as investors piled into defensive sectors providing reliable dividends.

“On the UK market, the FTSE 100 was propped up by oil, tobacco, pharmaceutical and banking stocks. All four of those sectors are known for generous dividends, suggesting that investors may be looking for safety in income stocks once again,” said AJ Bell financial analyst Danni Hewson.

British American Tobacco shares climbed 3.3% to 3,477.5p, Barclays increased 3.5% to 150.7p and NatWest rose 2.7% to 216.5p.

Meanwhile, AstraZeneca shares rose 2.6% to 11,060p, GSK gained 1.8% to 1,711.4p, Hikma increased 1.4% to 1,687.5p and Smith & Nephew climbed 2.3% to 1,153.5p.

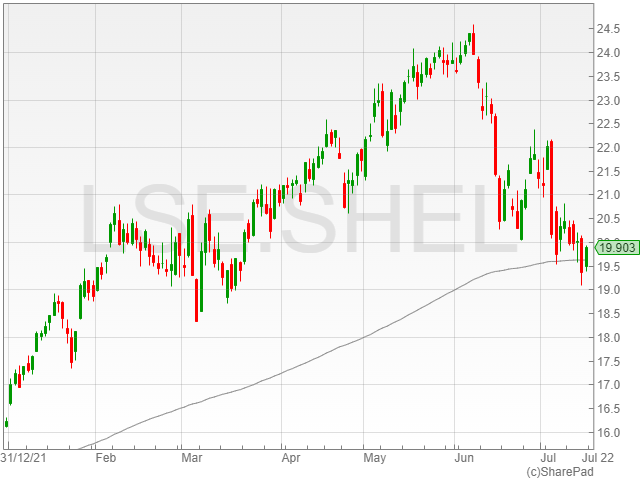

Shell shares gained 3.3% to 2,000.5p and BP shares rose 3%% to 375p as the price of benchmark Brent Crude oil climbed above the $100 per barrel mark to $101 after its fall below the level earlier this week.

However, reports that China’s economy fell dramatically below analyst estimates in Q2 gave commodities groups reason for concern, as fears of falling demand in the largest global consumer sent investors scrambling.

Chinese GDP grew 0.4%, coming in far below expectations of 1.2% growth in previous economic forecasts as the country’s continued series of lockdowns sent economic activity plummeting as a result of the region’s “zero-Covid” policy.

Asian markets sank, with the Shanghai SSE falling 1.6% and the Hang Seng sliding 2.4% in Friday trading.

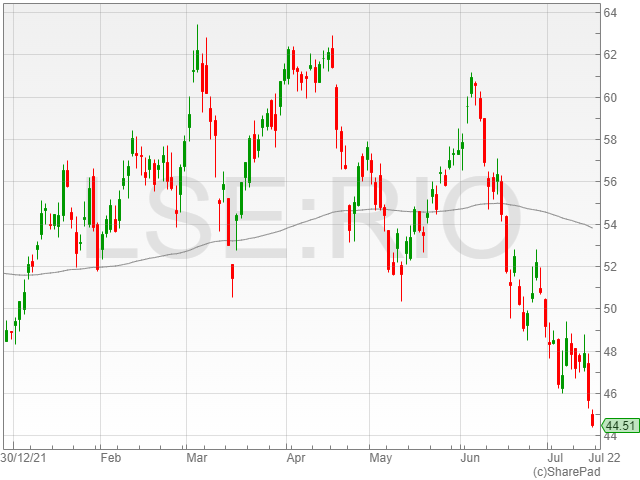

Rio Tinto warns of weakened economic outlook

Rio Tinto shares gained 0.2% to 4,579, rebounding from its slide earlier in trading after the mining company reported a weakened economic outlook partially due to reduced demand from China, with the news of China’s economic slowdown serving to confirm its fears and send shares falling.

“This doesn’t bode well as recession fears grow in many parts of the world, and it could fuel speculation that China’s commodities appetite may wane if economic activity is stalling,” said Hewson.

“It’s no coincidence that Rio Tinto has given a warning about China in its latest production update, flagging uncertainties for this important commodities market.”

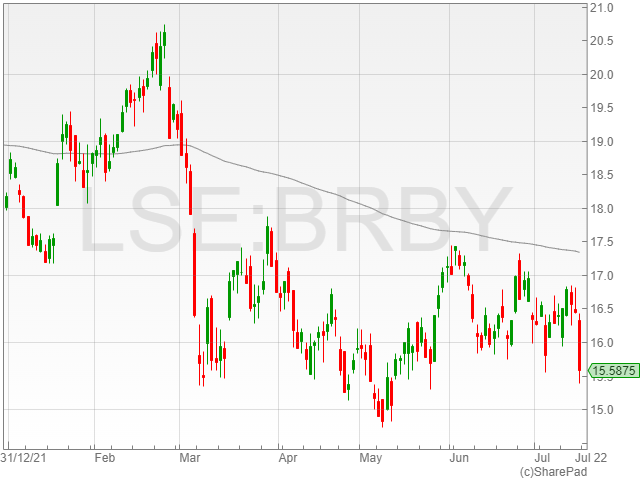

Burberry sales stumble on Chinese lockdowns

Burberry shares tumbled 4.4% to 1,575.5p on a meagre 1% growth in sales over Q1 2023 against a 90% climb in Q1 2022 as a result of lockdowns in mainland China dragging its revenues down.

“Burberry’s first quarter performance has sorely disappointed the market, with concerns around lacklustre growth rates,” said Hargreaves Lansdown analyst Sophie Lund-Yates.

The fashion group reported a retail revenue of £505 million compared to £497 million the last year, and mentioned its £400 million share buyback scheme launched over the financial period, which is scheduled for completion by the end of FY 2023.

“Burberry said in its latest update that trading had been impacted by lockdowns in China,” said Hewson.

“While the country’s latest GDP figures included news that retail sales had picked up in June, there is a feeling that boost may only reflect pent-up demand from people who couldn’t get out during lockdowns, meaning the month’s sales recovery might be unsustainable.”