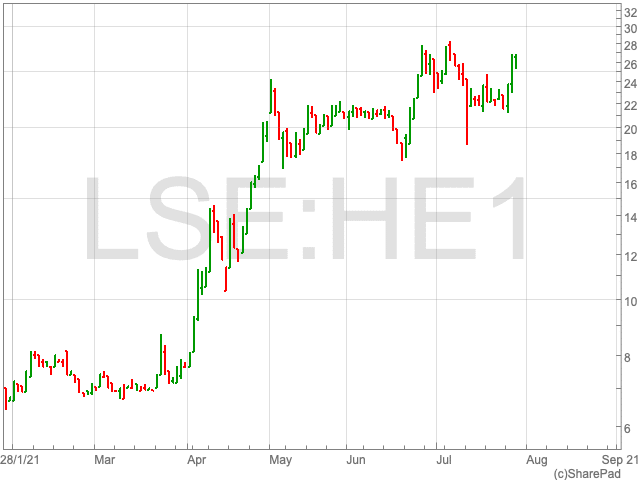

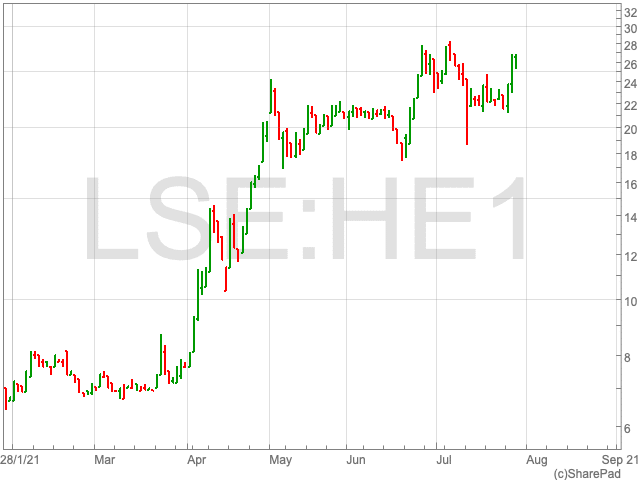

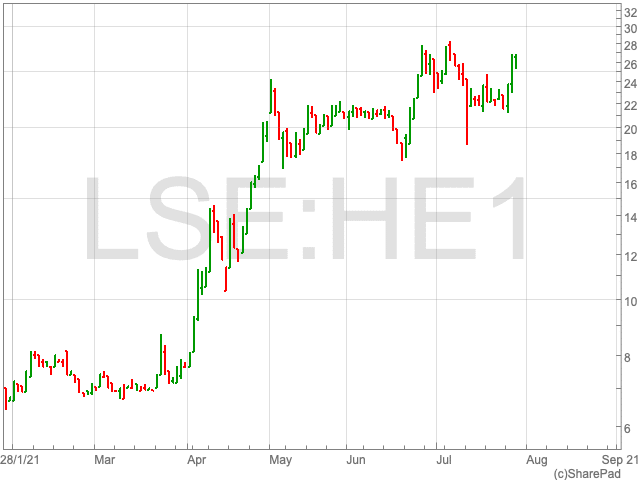

Helium One Share Price

The Helium One share price (LON:HE1) is up by 18.04% over the pst five days as the helium exploration company revealed some positive news regarding drilling results. The Helium One share price has been on an outstanding run since the beginning of the year, adding 223.1% in the period. Following a mini-dip, which started at the end of June and finished at the end of July, investors will be hoping the Helium One share price can kick on. Chief Executive Officer David Minchin certainly has confidence in his company’s strategy.

Drilling Results

Earlier in July, Helium One identified helium gas in the Red Sandstone Group between 552m and 561m. However, there were delays in drilling due to parting of drill pipe in the midst of drilling the gas show.

Two things can be learned from this event which impacted the Helium One share price recently and will continue to do so. Firstly, there is a great deal of potential at the Tai-1 well. Secondly, however, while the company is in its early stages, things do not, and will not always, go smoothly. This will result in an element of volatility in the Helium One share price, which also has the potential for a longer-term upwards trajectory.

On this occasion, the drilling set the company back a few weeks, although it will not hope to make a habit of such delays, which could weigh down on Helium One’s overall development.

“The sidetrack has been a success, so we can now start to push to our target depth, and we’ll be, obviously, keeping the market informed as the drill hole progresses and we move on first exploration drill into our first discovery drill,” said Minchin.

Strategy

Helium One is a helium exploration company, with its main focus being on its flagship project in the Rukwa basin in Tanzania. The AIM-listed firm has so far acquired 4,500 square kms of sought after ‘helium prospective land’.

Crucially for Helium One, helium is a useful commodity in the transition to a greener world economy.

“We’ve got a 100 best estimates un-risked prospective helium resources of 138 billion cubic feet, we’ve measured the gas coming up to surface at 10.6% helium, which positions us well to be a potentially strategic player in provision of this important commodity into the next century,” David Minchin said.

Investors with an eye on the Helium One share price will be well served by understanding the future impact of helium on the world economy, in addition to Helium One’s ability to find and supply the commodity effectively.