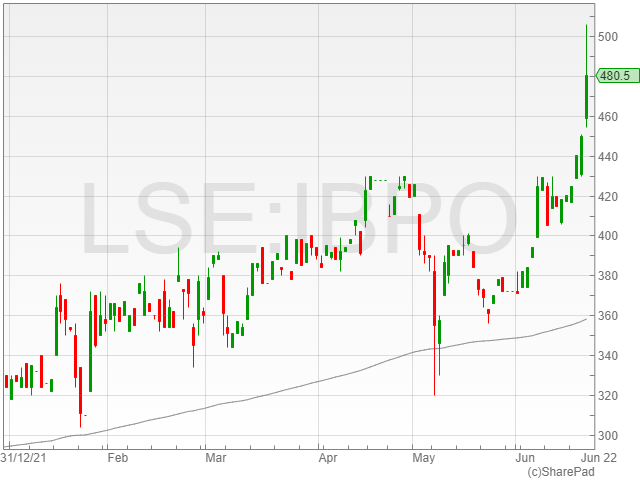

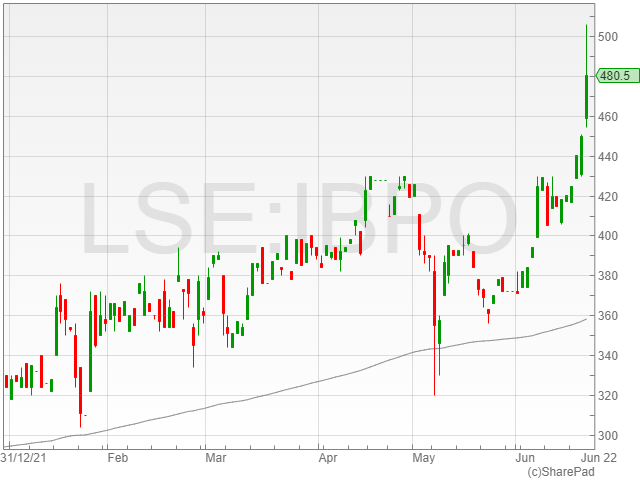

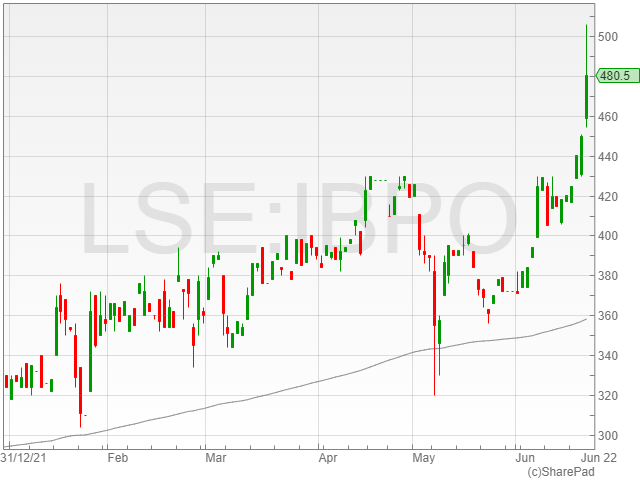

iEngergizer Limited shares rose 8.2% to 487p in early afternoon trading on Thursday after the firm exceeded market expectations with a revenue growth of 32.4% to $265.2 million against £200.3 million in FY 2022.

The digital solutions group confirmed revenue and profitability was driven by significant growth in higher margin International BPO business, and financial reporting and compliance services in its content services division.

Additionally, iEnergizer Limited highlighted increased revenue from the majority of its international clients operating across verticals of media and entertainment, BSFI, publishing services and online training and education.

“We are delighted to report another strong performance by iEnergizer, achieving significant growth in revenue and exceeding market expectations for EBITDA, due to the significant progress made by colleagues across all divisions, focusing on high margin revenue,” said iEnergizer chairman Marc Vassanelli.

The firm also added several new clients to its e-commerce, telecom and e-learning industry sectors.

“Importantly, we have secured several new customers across each of our divisions, as well as maintaining and deepening relationships with our existing key customers,” said Vassanelli.

“The business has maintained a successful focus on recurring revenue streams, by capitalizing on iEnergizer’s advantageous position to service existing and new customers’ needs in the evolving digital technology landscape.”

iEnergizer Limited reported a service revenue increase of 32.8% to $260.3 million compared to $196 million, alongside an EBITDA climb of 51.3% to $97.3 million from $64.3 million, representing an EBITDA margin of 36.8% against 32.1% the last year.

The company announced an operating profit rise of 58.5% to $91.3 million compared to $57.6 million, and a pre-tax profit boost of 55.5% to $83.2 million against $53.5 million.

The firm also mentioned a post-tax profit climb of 52.3% to $74.5 million compared to $48.9 million year-on-year.

The company said its first three months of FY 2023 had started on a positive note, with its growth continued on the back of existing contract extensions.

iEnergizer Limited noted an EPS increase of 50% to 39c against 26c, alongside a total dividend of 21.9p per ordinary share compared to 14.1p for the financial term.

“Reflecting the Group’s strong balance sheet and the cash generative nature of the business, coupled with the Board’s confidence in the business strategy and growth prospects, we are pleased to announce a final dividend of 13.8p for fiscal 2022, in line with our progressive dividend policy adopted in 2019,” said Vassanelli.

“With iEnergizer’s solid foundation, its proven strength in operational execution, new sales initiatives, differentiated offerings, healthy balance sheet, and with substantial opportunities for further growth identified, the Board is confident in the Company’s continued growth path as a unique, end-to-end digital solution enabler.”